Richard W. Rahn

Articles by Richard W. Rahn

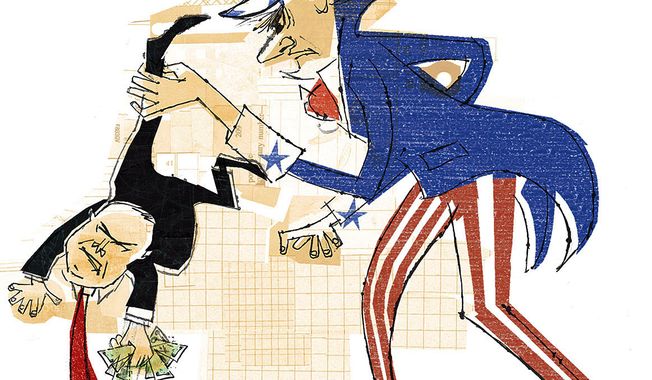

RAHN: Uncle Sam won’t stop overspending

Tax revenue in 2013 will be lower (despite the just passed tax increase), and government spending will be higher than forecast. It's an easy prediction -- and this is why. Published January 7, 2013

RAHN: One piece of the coming disaster

You may have been reading how the Federal Reserve has been buying huge quantities -- almost a trillion dollars' worth -- of "mortgage-backed securities" (MBS). Published December 31, 2012

RAHN: Obama’s hidden-tax heist

How is it possible that the government can spend almost twice as much as it takes in without having high inflation? Published December 24, 2012

RAHN: Obama’s money misunderstanding

In times past, political leaders would lay out their domestic and foreign policies in clear, coherent terms. President Obama talks about getting our fiscal house in order but fails to propose any meaningful spending cuts. Published December 17, 2012

RAHN: Penalized for success

Last week, Christine Jacobs, the CEO of Theragenics Corp., a public company listed on the New York Stock Exchange that makes medical devices and is involved in cutting-edge cancer cures, wrote a letter to President Obama explaining why it was necessary to "begin moving our U.S. manufacturing to Costa Rica." Published December 10, 2012

RAHN: Vote higher taxes now, regret it later

If you are a member of Congress and you wish to be re-elected, do you increase your chances of winning by voting for or against raising taxes on the "rich"? Published December 3, 2012

RAHN: In defense of ‘vulture funds’

If you lend money at 5 percent interest for 10 years and then suddenly the borrower announces that he is only going to repay you at 30 cents on the dollar, would you think you have been cheated? Published November 26, 2012

RAHN: Liberal leaders flunk math

Dennis Van Roekel, president of the largest teachers union, the National Education Association, failed fifth-grade math last week. The question he failed is: If X (government spending) is growing faster than A (government tax revenue) plus B (new revenue from higher tax rates on "the rich"), when will A plus B equal X? Published November 19, 2012

RAHN: Misdiagnosing the stagnation

Last Friday, President Obama said, "We can't just cut our way to prosperity. If we are serious about reducing the deficit, we have to combine spending cuts with revenue -- and that means asking the wealthiest Americans to pay a little more in taxes." Published November 12, 2012

RAHN: Congressional control as important as White House

The media focus has been on the presidential campaign, but the makeup of the U.S. Congress is likely to have an equal or perhaps even greater impact on your future economic well-being. Published November 5, 2012

RAHN: The coming regulatory tsunami

Knowledgeable officials are expecting a regulatory tsunami after the election. By law, the Office of Management and Budget (OMB) is required to publish a report each April and October about new regulations that government agencies are considering. OMB failed to publish the April report. The question is why -- what is it hiding? Published October 29, 2012

RAHN: Political bullies and faith

One of the most delicious moments in last week's presidential debates was when President Obama attacked Mitt Romney for having some of his money invested in Chinese and Cayman Islands companies. Published October 22, 2012

RAHN: Tax-raisers lack compassion

If you were unemployed, would you prefer a job or a handout? Most people would say a job because of the self-respect that comes with being productively employed. Published October 15, 2012

RAHN: A world without income taxes

Why should the federal government bother to impose taxes when it can use the Federal Reserve to "print" all the money it needs to pay its bills? Last year, the Fed bought 77 percent of all of the government's new debt, which is the equivalent of printing money. Published October 8, 2012

RAHN: A vote for Obama is a vote for recession

Many in the mainstream media appear to be in the bag for the re-election of President Obama. They also appear to not have thought through the consequences of their wishes, both to the nation and their own careers. Published October 1, 2012

RAHN: U.S. should ax destructive tax

It's difficult to say definitively which tax is the most destructive. The corporate income tax is a leading candidate for causing higher prices to consumers, lower wages to workers and lower returns to investors. Published September 24, 2012

RAHN: America in free-fall

The annual Economic Freedom of the World report, including an index of country rankings, has just been released, and it should be a wake-up call. Published September 17, 2012

RAHN: The wrong doctors

Central banks are being pressured by their political masters to solve a problem they cannot solve. Published September 11, 2012

RAHN: Former satellites take on Europe

Prague, Czech Republic Published September 4, 2012

RAHN: Democrats’ hypocrisy with the rich

Did you know that President Obama is responsible for the loss of more U.S. jobs than any other person? Did you know that Sen. John F. Kerry and his wife are three to four times as rich as Mitt and Ann Romney, according to the New York Times, yet paid a lower tax rate than the Romneys in 2003, the year before Mr. Kerry ran for president? Published August 27, 2012