People wait to cross a street in front of a Shell filling station with the electric indicator showing a liter of regular gas price, top, at 148 yen, or $1.25, per liter (554 yen, or $4.69 per gallon) in Tokyo Friday, Nov. 28, 2014. A renewed plunge in oil prices is a worrying sign of weakness in the global economy that could shake governments dependent on oil revenues. It is also a panacea as pump prices fall, giving individuals more disposable income and lowering costs for many businesses. Partly because of the shale oil boom in the U.S., the world is awash in oil but demand from major economies is weak so prices are falling. The latest slide was triggered by OPEC’s decision Thursday to leave its production target at 30 million barrels a day. Member nations of the cartel are worried they’ll lose market share if they lower production. (AP Photo/Koji Sasahara)

Featured Photo Galleries

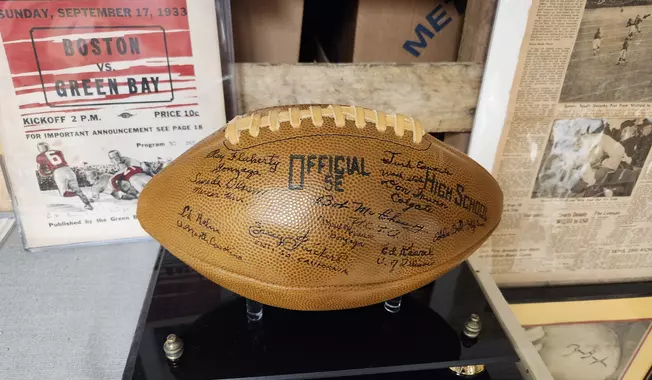

Inside the expansive collection of Washington football memorabilia

When Samu Qureshi sits down in the middle of his 4,100-square-foot “museum” in Bethesda, the longtime Washington football fan is surrounded by his life’s work.

Trump Transition: Here are the people Trump has picked for key positions so far

President-elect Donald Trump has announced a flurry of picks for his incoming administration. Get full coverage of the Trump transition from The Washingon Times.

Trump dances onstage, takes post-election nation by storm

President-elect Trump dances onstage