FILE - In this Aug. 12, 2016, file photo, United States' Katie Ledecky shows off her gold medal in the women's 800-meter freestyle medals ceremony during the swimming competitions at the 2016 Summer Olympics in Rio de Janeiro, Brazil. A bill moving forward in Congress would block the IRS from taxing most medals or other prizes awarded to U.S. Olympians. The U.S. Olympic Committee awards cash prizes to Olympic medal winners: $25,000 for gold, $15,000 for silver and $10,000 for bronze. Because the money is considered earned income, it is taxed — a practice some lawmakers refer to the "victory tax." (AP Photo/Michael Sohn)

Featured Photo Galleries

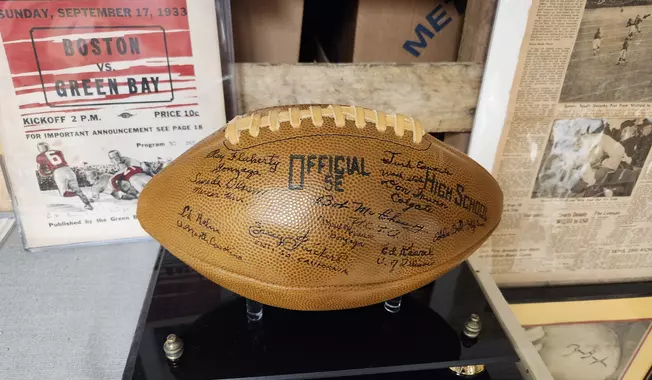

Inside the expansive collection of Washington football memorabilia

When Samu Qureshi sits down in the middle of his 4,100-square-foot “museum” in Bethesda, the longtime Washington football fan is surrounded by his life’s work.

Trump Transition: Here are the people Trump has picked for key positions so far

President-elect Donald Trump has announced a flurry of picks for his incoming administration. Get full coverage of the Trump transition from The Washingon Times.

Trump dances onstage, takes post-election nation by storm

President-elect Trump dances onstage