OPINION:

Shortly before his death in 2006, I had the privilege of interviewing Milton Friedman over dinner in San Francisco. The last question I asked him was, what are the three things we have to do to make America more prosperous?

I have never forgotten his answer: “First, allow universal school choice; second, expand free trade; third and most importantly, cut government spending.” That was long before Presidents Barack Obama and Joe Biden came along.

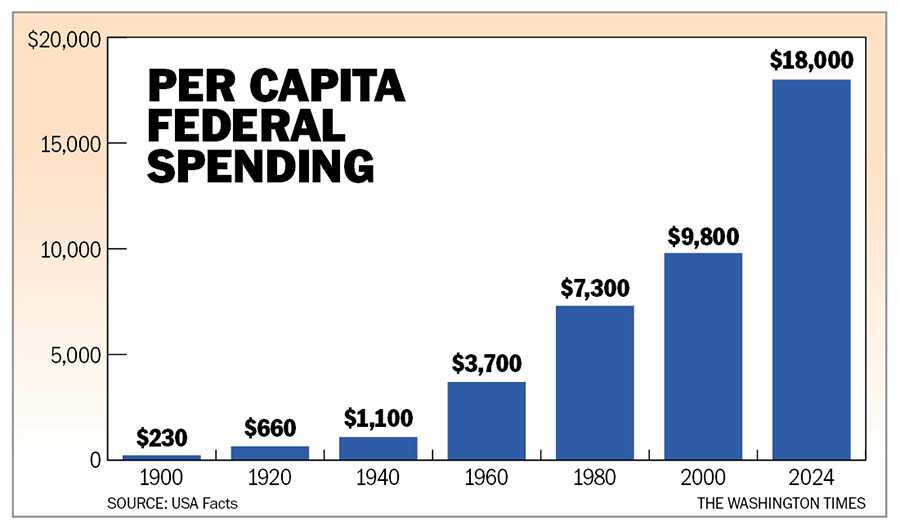

There aren’t many problems in America that can’t be traced back to the growth of a big and incompetent government. This chart shows the meteoric rise of government spending per person after adjusting for inflation.

Notably, the two big bursts of inflation in modern times occurred when government spending exploded. The first was the gigantic expansion of President Lyndon Johnson’s “war on poverty” welfare state in the 1970s, with prices nearly doubling, and then the pandemic-era spending blitz in the last year of Donald Trump’s presidency and then Mr. Biden’s $6 trillion spending spree, with the consumer price index sprinting from 1.5% to 9.1%.

Coincidence? Maybe, but I doubt it.

The connection between government flab and the decline in the dollar’s purchasing power is obvious. In both cases, the Washington spending blitz was funded by the Federal Reserve’s money printing. The helicopter money caused prices to surge. (I still find it laughable that 11 Nobel-winning economists wrote in The New York Times in 2021 that the Biden multitrillion-dollar spending spree won’t cause inflation. Were they on hallucinogenic drugs?)

The avalanche of federal spending hasn’t stopped even though COVID-19 ended more than three years ago. We are three months into fiscal 2025 and on pace to spend an all-time high of $7 trillion and borrow $2 trillion. If we stay on this course, the federal budget could reach $10 trillion over the next decade.

This road to financial perdition cannot stand. It risks blowing up the Trump presidency.

Upon entering office, Mr. Trump should call for a package of up to $500 billion of rescissions — money that the last Congress appropriated but has not been spent yet. Canceling the green energy subsidies alone could save nearly $100 billion. Why are we still spending money on COVID-19?

We could save tens of billions by ending corporate welfare programs — such as the wheelbarrows of tax dollars thrown at companies such as Intel in the CHIPS Act. The informal Department of Government Efficiency has already identified low-hanging fruit that needs to be cut from the tree.

Along with extending the Trump tax cut of 2017, this erasure of bloated federal spending is critical for economic revival and reversing the income losses to the middle class under Mr. Biden.

This is especially urgent because the curse of inflation is not over. Since the Fed started cutting interest rates in October, commodity prices are up nearly 5%, and mortgage rates have again hit 7% — in part because the combination of cheap money and government expansion is a toxic economic brew — as history teaches us.

Nothing could suck the oxygen and excitement out of the new Trump presidency than a resumption of inflation at the grocery store and the gas pump. Mr. Trump’s record-high approval rating will sink overnight if the cost of everything starts rising again.

Cutting spending won’t be easy. The resistance won’t just come from Sen. Bernie Sanders and progressive Democrats. He will have to convince lawmakers in his own party — many of whom are already defending Green New Deal pork projects in their districts.

This is why Mr. Trump should make the case in his inaugural address that downsizing government is the moral equivalent of war. To borrow a line from Nancy Reagan: Just say no to runaway government spending. Say yes to what Friedman titled his famous book: “Capitalism and Freedom.”

• Stephen Moore is a senior fellow at The Heritage Foundation and a co-founder of the Committee to Unleash Prosperity. He is co-author of the new book “The Trump Economic Miracle.”

Please read our comment policy before commenting.