OPINION:

The Wall Street Journal noted last week that if several EU sham lawsuits prevail, American shareholders will lose tens of billions of dollars in investment income from their stock holdings in Silicon Valley companies like Google and Apple.

These are generally suits alleging that America’s dominant tech companies act like monopolists. Or, to borrow a term, our tech companies are “price gouging.” Many of these companies are now above $2 trillion in their market cap. Every pension fund in America expands in size, and benefits are paid out to workers when these companies expand.

The EU’s courts outrageously ruled this week that Apple shareholders owe Europe $13.5 billion in back taxes because the company took advantage of Ireland’s low 12.5% tax rate. The EU “competition chief” declared that this sham court decision “is a big win for European citizens and tax justice.” No, it’s a big win for big government.

Meanwhile, Google shareholders are now forced to pay the EU $2.4 billion because its search engine has become dominant in the European market. The European search engines are so inferior that nobody wants to use them. So sue American companies.

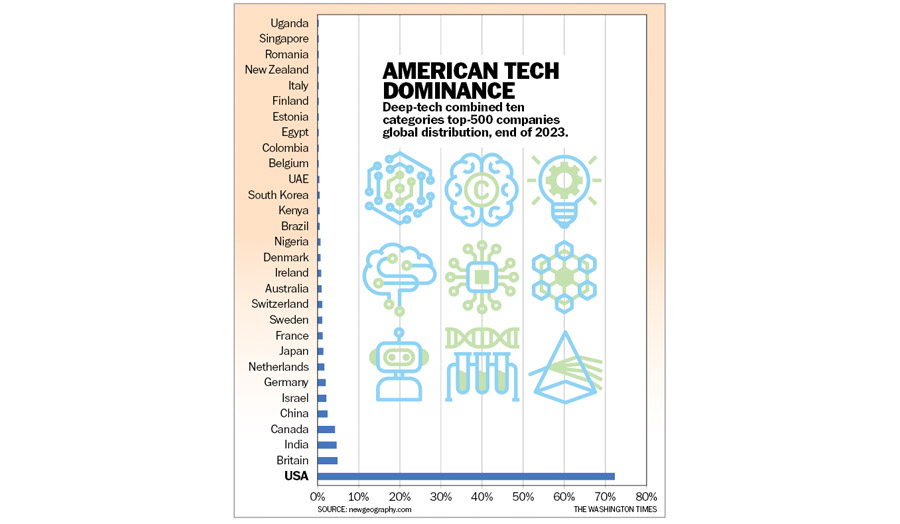

Let’s be clear here: The EU laggards are simply green with envy. American tech dominance has crushed the Eurozone. No company in socialist Europe has found a way to compete with American innovation at Google, Apple, Microsoft, Amazon, Nvidia, Meta, and so on. See the chart below. Since they can’t compete, they invent sore-loser lawsuits.

That’s what the losers in sports from junior high school always pout: The other side didn’t play fair.

The bigger issue is why the Biden administration isn’t defending American companies from European extortion. These tech lawsuits are a tax on American know-how and innovation.

Instead of defending American shareholders from the EU predators, the Biden regulators encourage and give legitimacy to the foreign courts.

How can the U.S. government complain against specious antitrust attacks (tech prices are falling dramatically) against Google and Apple when our FTC and the Justice Department regulators are bringing copycat lawsuits against our tech giants in U.S. courts? Lina Khan of the Federal Trade Commission has spent nearly four years peppering our tech industry leaders with nuisance lawsuits of her own.

The capricious fine against Google results from an American company shopping around the globe to find the lowest tax climate (Ireland) for doing business. Is this illegal? Thanks to the Trump tax cut, our corporate tax rate is now 21%, down from 35% under former President Barack Obama. However, President Biden and Vice President Kamala Harris want to raise it back to 28% or more. That only encourages more jobs and investments offshore. Did I mention that Ireland’s rate is just 12.5%?

Instead of lowering the rates here, Treasury Secretary Janet Yellen wants to force Ireland and other low-tax countries to raise their rates with a Global Minimum Tax of 15% or more. This sounds a lot like collusion and cartel policy. It’s like telling Kellogg’s they can’t charge less than $3 a box for Special K as a way to compete with Cocoa Crispies.

Similarly, the antitrust lawsuits from Europe and Washington aimed at American tech companies are spurious because nearly every price for tech services - from cell phones to drone deliveries to internet searches to fiber optic hookups - has been falling. How are consumers getting gouged, if they keep paying less for new technologies?

There’s an old saying in sports: No harm, no foul.

I often dislike the politics of Big Tech. But Washington’s plan to penalize American tech giants for building a better mousetrap will ultimately move the world’s high-tech hubs—from Silicon Valley to Austin to Boston to Miami—to competitor nations. That’s a good way to lose jobs and put America last.

• Stephen Moore is co-author of the new book “The Trump Economic Miracle” and is a Trump Economic advisor.

Please read our comment policy before commenting.