OPINION:

No one in the media is reporting this: Vice President Kamala Harris continues to dance and duck like Muhammad Ali in the ring to avoid any questions about her economic plan.

The American Family Business Defense Foundation reports that under her tax plan, the number of Americans subject to the hated estate tax would double to triple. This would happen because Ms. Harris has declared that she will let the Trump tax cut expire next year if she becomes president.

Thanks to the tax cut, the amount of an estate that is exempt from tax is roughly $13.6 million.

But the IRS says: “Under the tax reform law, the increase is only temporary. Thus, in 2026, the exemption is due to revert to its pre-2018 level of $5 million, as adjusted for inflation.”

Ms. Harris wants this to happen. She wants to soak millionaires and billionaires. But under her plan, thousands more families will be clobbered by this tax when a parent dies. This brings new meaning to the expression “Grim Reaper.”

We aren’t talking about the very rich — people such as Warren Buffett and Bill Gates, who are already subject to the unfair tax, though these super billionaires have built massive family foundation tax shelters to escape it.

Now many farms, ranches and family-owned businesses will have to be sold after a funeral just to pay the taxes. These are mostly owners and operators of small businesses that have been built up over a lifetime from nothing to $1 million-plus enterprises. The owners have already paid Uncle Sam millions of dollars in income, property, payroll, energy, business and other taxes and annual levies.

Now, they will have to pay a 40% estate tax rate, plus 5% to 15% more, depending on what state they die in. In other words, up to half a family inheritance must be paid to the government. The IRS gets almost as much as the kids and grandkids. The agents should at least pay their respects at the funeral.

How is that fair?

It gets worse.

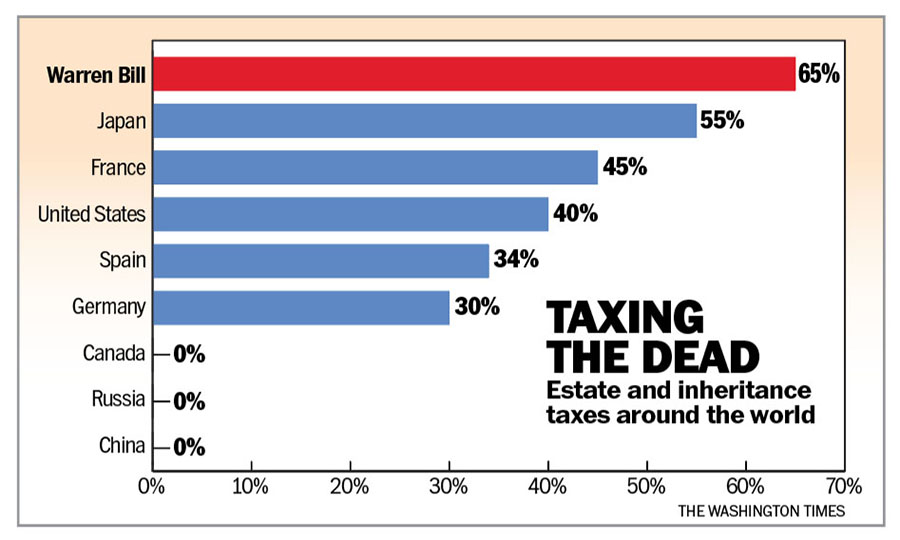

Sen. Elizabeth Warren of Massachusetts has introduced a bill to make the estate tax even more onerous. Under her bill, the estate tax rate would rise to as high as 55% to 65% and reduce the exemption to about $3.5 million. This means that the government could seize as much as two-thirds of an estate.

This isn’t taxation. It’s the confiscation of family property. Is the IRS going to seize Grandma’s jewelry, Grandpa’s stable of horses and the mansion he built himself?

Will family businesses have to undergo the indignity of a fire sale to vulture companies just to pay the taxes owed?

Guess who supports Ms. Warren’s tax plan? Yes, Kamala Harris thinks this is a swell idea.

Incredibly, if the Warren tax came to pass, the United States — the land of the free — would have the highest estate tax in the world. Higher than Russia. Higher than China. Higher than the socialist nations of Europe.

The real-world impact of estate taxes this high is that older people will avoid them by lavishly spending down the family estate so that there is no money left to tax. The incentive is to die broke. Family businesses won’t be able to pass from one generation to the next. This is how the tax destroys jobs and investment.

The chart below shows that the U.S. already has some of the highest estate and inheritance taxes in the world, and we would have the highest under the Warren bill.

By contrast, Mr. Trump would make his tax relief permanent. Family businesses and estates would remain vibrantly intact.

This is one of many vital tax issues voters should consider on Election Day.

• Stephen Moore is a visiting senior fellow at The Heritage Foundation. His latest book with Arthur Laffer is “The Trump Economic Miracle.”

Please read our comment policy before commenting.