Politicians often bet big on promising tax cuts to get elected. President Biden is letting it ride on tax increases.

He has called for Congress to kill Trump-era tax cuts. “If I’m reelected, it’s going to stay expired,” he said.

The president also has announced plans to impose a spate of new levies, including higher income taxes, taxes on unrealized capital gains and a billionaire minimum income tax.

The catch, Mr. Biden says, is that they will touch only the wealthy and taxpayers earning less than $400,000 annually will be spared.

He is tapping into an us-versus-them sentiment growing in U.S. politics.

“It is a popular message,” said David Paleologos, director of the Suffolk University Political Research Center. “Given that the income inequalities are widening, it seems like the only dynamic that levels that playing field is a stock market crash, and no one wishes on that, but in terms of policy, being an ally of those people … who make under $400,000 is a good side to be on.”

Mr. Biden makes no bones about his goal of punishing the rich. He figures the government can use the money to expand the social safety net.

What was once a losing argument started to change about 15 years ago when Americans became more open to redistributing wealth vis-a-vis heavier taxes on the rich, Gallup tracking polls show.

The Pew Research Center found in its most recent polling that 6 in 10 adults “are bothered a lot by the feeling that some corporations and wealthy people don’t pay their fair share.”

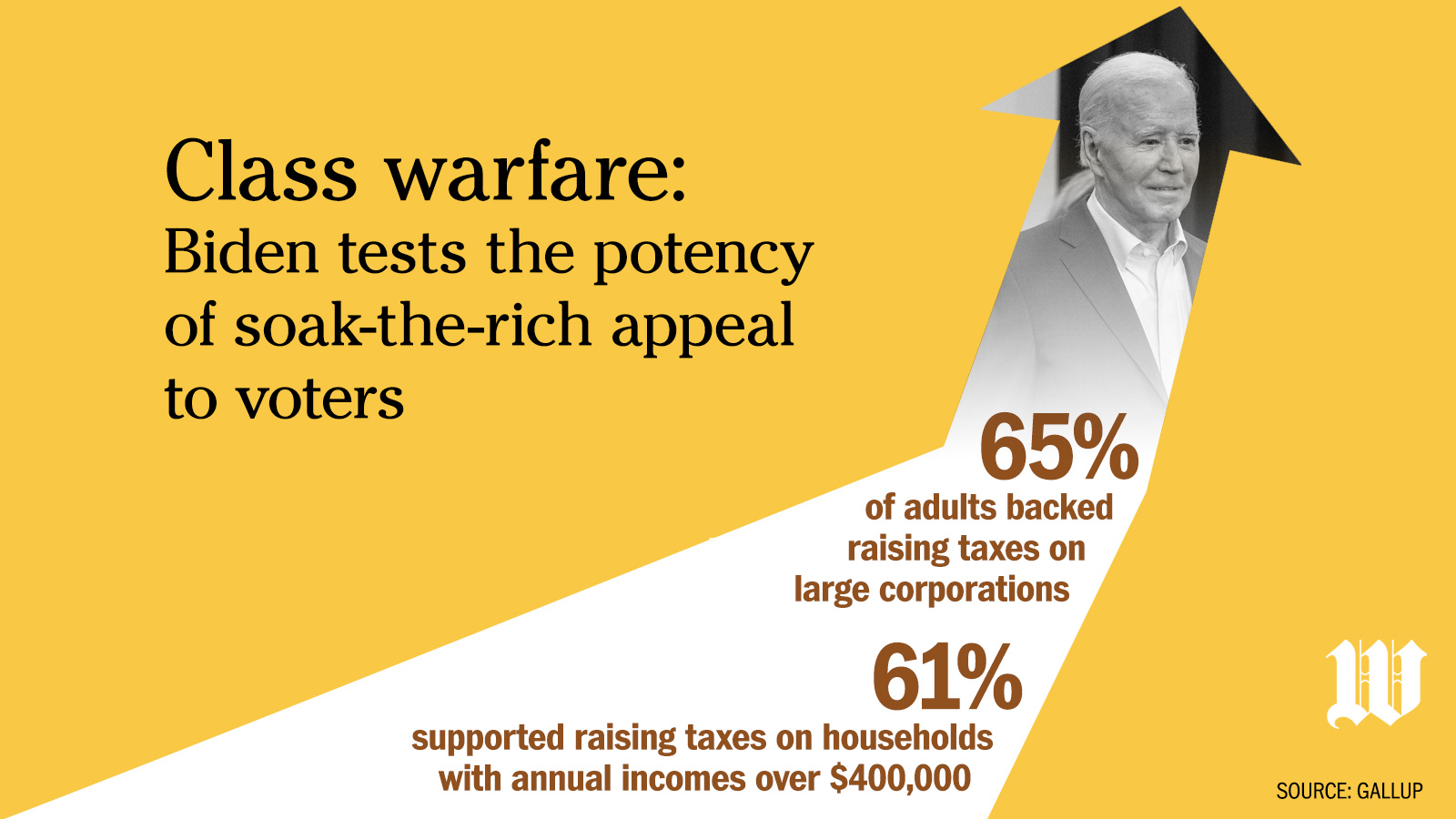

Some 65% approved of higher taxes on large corporations, and 61% supported higher taxes on households with annual incomes of more than $400,000.

Mr. Paleologos said Mr. Biden’s message is particularly attractive to independent voters, who say the economy and inflation are their chief concerns. Democrats are focused on threats to democracy, and Republicans’ chief concern is illegal immigration.

“That is really what this is all about,” he said. “With 26 weeks left before the election, you want to play to the groups that matter, and when you look at the data, it is pretty convincing that if you are Biden or if you are Trump and you need independent voters, that is your issue.”

Mr. Biden’s menu of tax proposals includes:

• Increasing the income tax bracket from 37% to 39.6% for individuals with incomes of more than $400,000 and families earning more than $450,000 annually.

• Establishing a billionaire minimum income tax requiring the wealthiest American households to pay a minimum of 20% on all their income.

• Raising the corporate tax rate from 21% to 28%.

• Raising the long-term capital gains tax for top earners from 20% to 39.6% and establishing a 25% tax on unrealized gains of those with wealth greater than $100 million.

The proposed tax on unrealized capital gains has sparked intense debate on Capitol Hill. Democrats say the ultra-wealthy should not be allowed to borrow against their assets and then wipe the slate clean when they pass on their estate using a stepped-up basis.

Opponents say such a tax could be unconstitutional and quickly affect the unrealized gains of those with lower incomes.

They point to the advent of the income tax in 1913, intended to force the wealthy to pay. It applied to only a tiny percentage of Americans and started with marginal rates starting at 1% of income. Less than 1% of the population paid income taxes.

By 1919, the top tax rate was 77%.

Republicans warn that Mr. Biden wouldn’t constrain higher taxes to the wealthy. They point to a social media post where Mr. Biden complains about Congress’ approval of President Trump’s tax cut package in 2017.

“That tax cut is going to expire,” Mr. Biden said. “If I’m reelected, it’s going to stay expired.”

His aides say he was speaking about the part of the package that lowered the corporate income tax rate and cut rates for individuals at the high end. Mr. Biden says he will stand by his $400,000 annual income dividing line between the wealthy and everyone else.

Mr. Trump warned supporters at a campaign event that Mr. Biden plans to “drench the middle class” in higher taxes.

“It will mean you have the biggest tax increase in the history of the nation,” Mr. Trump said.

Grover Norquist, president of Americans for Tax Reform, a conservative think tank, said Mr. Biden is selling voters on a “fantasy world” where only rich people and corporations are forced to pay more to the government.

“He is talking to an audience that thinks of themselves as tax consumers — not taxpayers,” Mr. Norquist said. “The applause is not coming from people who pay taxes.”

Mr. Norquist said workers, consumers and retirees would bear the brunt of higher taxes on corporations.

“Some people will cheer because they listen to NPR when they say this will not affect you,” Mr. Norquist said. “I think Biden hopes to use the old lies that have worked in the past: ‘I am not taxing you, I am just taxing the rich.’”

That fight has already played out with Mr. Biden’s battle to have the IRS collect $80 billion more as part of his 2022 budget-climate bill. He vowed to use the money to increase audits for the wealthy but not for those earning less than $400,000 annually.

The IRS says it has maintained that divide, with more pressure on millionaires to pay taxes and historically low audit rates for those with lower incomes.

• Seth McLaughlin can be reached at smclaughlin@washingtontimes.com.

Please read our comment policy before commenting.