OPINION:

The Biden administration regulators see a monopoly boogeyman behind the curtain of nearly every business merger and acquisition — from airlines to cellphones to chicken producers.

Now, the White House is trying to stop Capital One from acquiring the credit card company Discover.

That’s a bizarre cease-and-desist order because this acquisition by Capital One would increase rather than inhibit competition in an industry that processes two-thirds of retail store and online transactions worth $5 trillion annually. Americans love swiping and tapping for their shopping.

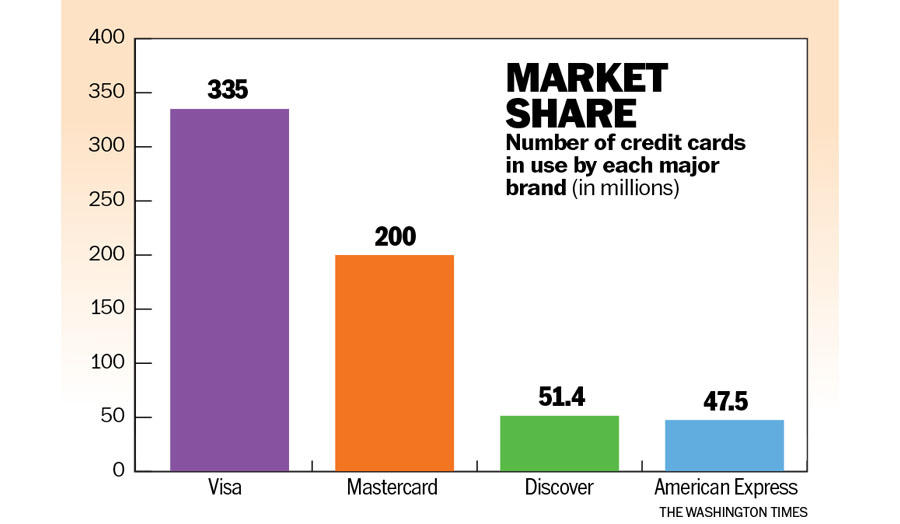

To suggest that the acquisition of a company that controls less than 10% of the market is anti-competitive is a proposition that borders on the absurd.

For years, the Federal Trade Commission and retailers have argued falsely that there isn’t competition in the credit card market. Yet banks and retailers issue dozens of credit cards — and Americans have the freedom to choose the best deal.

Visa, Mastercard and American Express have grabbed more than 90% of the market — not because of a lack of competition but mainly because consumers like the convenience that almost all stores accept these cards, and millions of shoppers like the reward points toward flights, vacation deals and cash-back options.

If Discover and Capital One combine forces, we could see the emergence of a fourth major player on the scene. Someone needs to tell the Biden regulators: If three major rivals compete, that’s good. If four do, that’s even better for consumers.

The merger will likely mean fiercer competition, which means lower fees and interest charges. Ironically, in other lawsuits against the credit card industry, the FTC alleges credit card companies like Visa and Mastercard collude to keep fees high. In this one, the regulators are blocking a merger to help nudge the interchange fees and the interest payments down.

This isn’t just conjecture. Discover already charges lower credit card processing fees than Visa, Mastercard and American Express. With financial support from Capital One, it could make the investments needed to expand its market share, which would mean merchants would have opportunities to negotiate down interchange fees with card providers. Similarly, the rivalry will impel card issuers to offer consumers new and better benefits. Why would anyone oppose that?

Alas, it’s not just the Biden hyper-regulators that are trying to block this marriage. Sens. Josh Hawley (a conservative Republican) and Elizabeth Warren (a liberal Democrat who hates “big business”) are loud skeptics as well.

They should listen to Jamie Dimon, CEO of JPMorgan Chase and a direct rival of Capital One, who says: “Companies should be allowed to innovate and grow and merge. … If that’s how they think they can best compete with JP Morgan — let the market decide.”

Amen. Government regulation never reduces prices. The free enterprise system does.

• Stephen Moore is a senior fellow at The Heritage Foundation and a co-founder of the Committee to Unleash Prosperity.

Please read our comment policy before commenting.