OPINION:

A version of this story appeared in the On Background newsletter from The Washington Times. Click here to receive On Background delivered directly to your inbox each Friday.

In his State of the Union speech, President Biden proposed yet another government subsidy program to promote homeownership.

Through dozens of government programs such as Fannie Mae, Freddie Mac, the Federal Housing Administration and the mortgage interest deduction, Uncle Sam already spends tens of billions of dollars to get Americans to purchase a home.

This latest government giveaway program will offer first-time homebuyers a $5,000 annual subsidy for two years. That’s equivalent to a $416 monthly taxpayer subsidy on their mortgage payment. If many more such programs are implemented, the government might as well buy the houses for families. Perhaps Mr. Biden will.

The president could propose mortgage loan forgiveness — as he has done for millions of young people who aren’t repaying their student loans — and make the taxpayers pay off the debt.

None of these solutions, however, really addresses the root cause of the housing affordability crisis. What Mr. Biden fails to understand is that two factors drive homeownership: the interest rate and real income growth. Both are working against first-time homebuyers.

Thanks to the Biden spending spree, the average home mortgage rate on a 30-year bond is now up to 7.1% — well over double the 2.9% rate that prevailed when former President Donald Trump left office. Consequently, the average monthly mortgage payment on a 30-year mortgage for a median-value home has risen from about $1,500 a month to above $2,600 today.

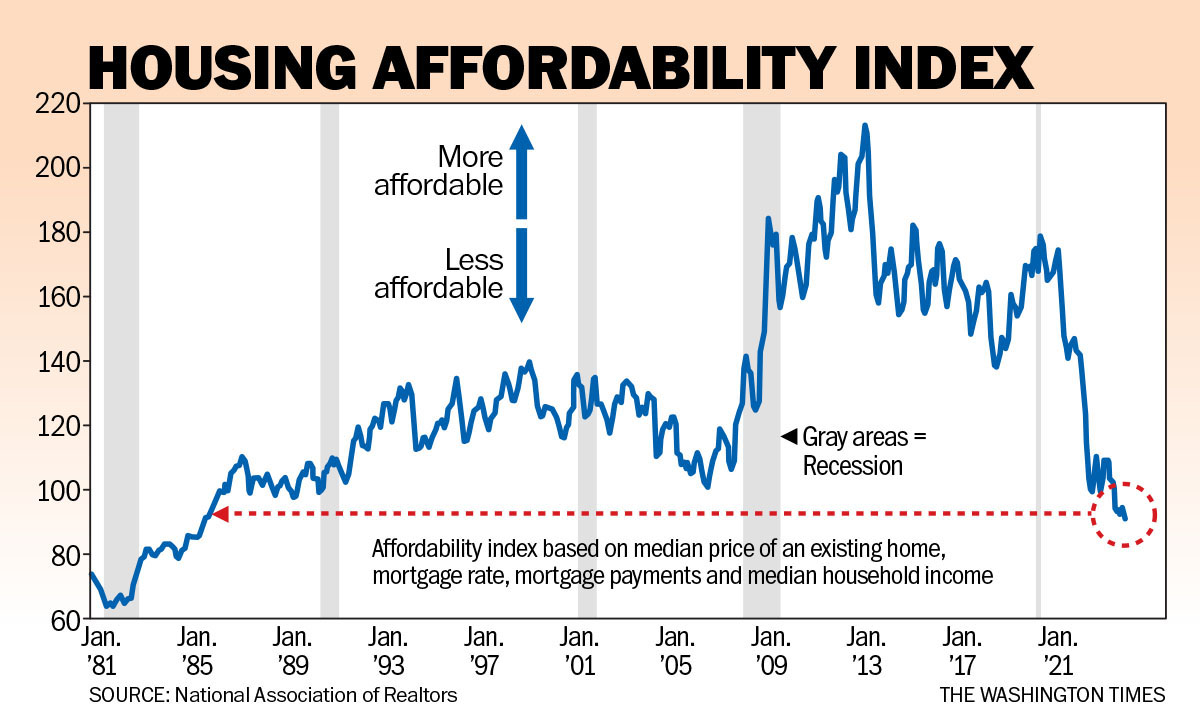

Meanwhile, housing affordability has hit a 40-year low under Mr. Biden after affordability surged under Mr. Trump.

This means that even with Mr. Biden’s $400 monthly subsidy by the federal government, these payments are like putting a Band-Aid on a patient in cardiac arrest. Americans will still be running a deficit of about $700 a month.

Why? Bidenomics and record federal debt-funded spending have run up interest rates through higher inflation.

The best solution to this housing affordability crisis is to cut federal spending. Yet his new budget calls for a record high of $7.3 trillion in spending next year.

The American dream of homeownership is yet another casualty of Bidenflation.

• Stephen Moore is a senior fellow at The Heritage Foundation and a co-founder of the Committee to Unleash Prosperity.

Please read our comment policy before commenting.