OPINION:

Nothing defines the diametrically opposite economic philosophies of President Biden and former President Donald Trump better than their positions on the Trump tax cuts.

Mr. Trump wants to make those tax cuts permanent, and Mr. Biden has repeatedly promised to tax America back to prosperity by repealing the Tax Cuts and Jobs Act. But there are so many factual errors regarding the Trump tax cuts that it’s a wonder that the “truth screeners” on the internet haven’t flagged this all as “disinformation.”

So, as a public service, I will help them do their job and review the facts using official government data on how the tax cuts have affected jobs, the economy, tax fairness, and the simplicity of the tax code after five years.

• The Trump tax law was one of the biggest middle-class tax cuts in U.S. history. The Trump Treasury Department calculated that the average family of four saves roughly $2,000 a year. This means that repealing the bill would raise taxes for most families making less than $400,000 a year. The House Budget Committee has estimated that the typical family will pay $1,500 more in taxes annually if Mr. Biden repeals the Trump tax cuts.

• The Trump tax cuts vastly simplified the tax code for most Americans. A major feature of the bill was to double the standard deduction from $12,500 to $25,000. Before the Trump tax cuts, about one-third of tax filers had to itemize their deductions and keep track of receipts and other transactions related to mortgage payments, charitable deductions, interest payments and so on for their tax returns. Now, as a result of the tax cuts, nearly 90% of Americans — and almost all middle- and lower-income taxpayers — just check a box and take the standard deduction.

• The Trump tax bill forces millionaires and billionaires in blue states to pay their fair share of taxes. One of the smartest features of the Trump bill was to cap the deduction of state and local taxes for the superrich. This allowed millionaires and billionaires in blue states such as New York and California to pay billions of dollars less in taxes than an equally wealthy tax filer in low-tax states like Florida and Texas. The old law encouraged states and localities to raise their taxes because it shifted the federal tax burden to residents of other states.

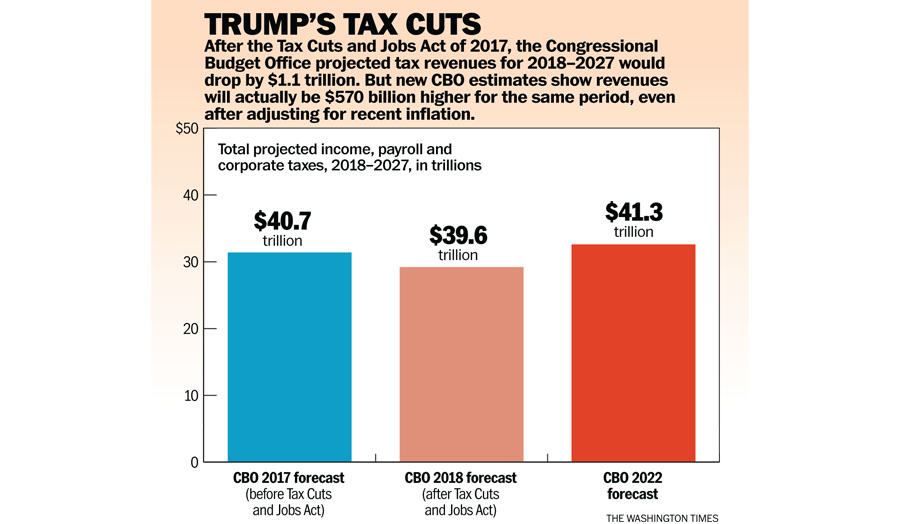

• The Trump tax cut expanded the economy and business activity, resulting in increased tax revenue. A study by Heritage Foundation fiscal analyst Preston Brashers examined the impact of the Trump tax cuts after four years and found that the policy changes actually raised more revenue in their first four years than the Congressional Budget Office predicted without the tax cut. The House Budget Committee similarly concluded in an analysis last month that the Trump tax cuts “resulted in economic growth that was a full percentage point above CBO’s forecast.” Revenue was $200 billion a year more than predicted before the tax cuts.

• After the Trump tax cut, the rich paid more, not less, in taxes. Mr. Biden continually says that the major reason the deficit has exploded is that Mr. Trump cut taxes on the rich. Wrong. Five years after the Trump tax cuts, the IRS’ own figures show that the top 1% of earners in America saw their percentage of total income taxes collected rise from 40% to 46% in 2022. This was the largest share of taxes paid by the rich ever.

The truth is that almost all of the negative claims that Democrats made in opposing the Trump tax cuts in 2017 were proved fallacious. Rather than admit that they were wrong, they’ve doubled down in their commitment to policies that would raise taxes on virtually every American corporation, small business, family and investor.

Perhaps the theme for the Biden campaign should be “Putting America Last.”

• Stephen Moore is a visiting fellow at The Heritage Foundation and a co-founder of the Committee to Unleash Prosperity.

Please read our comment policy before commenting.