Tax season is in full swing, and many Americans who have filed early may find their refund checks much lighter this year.

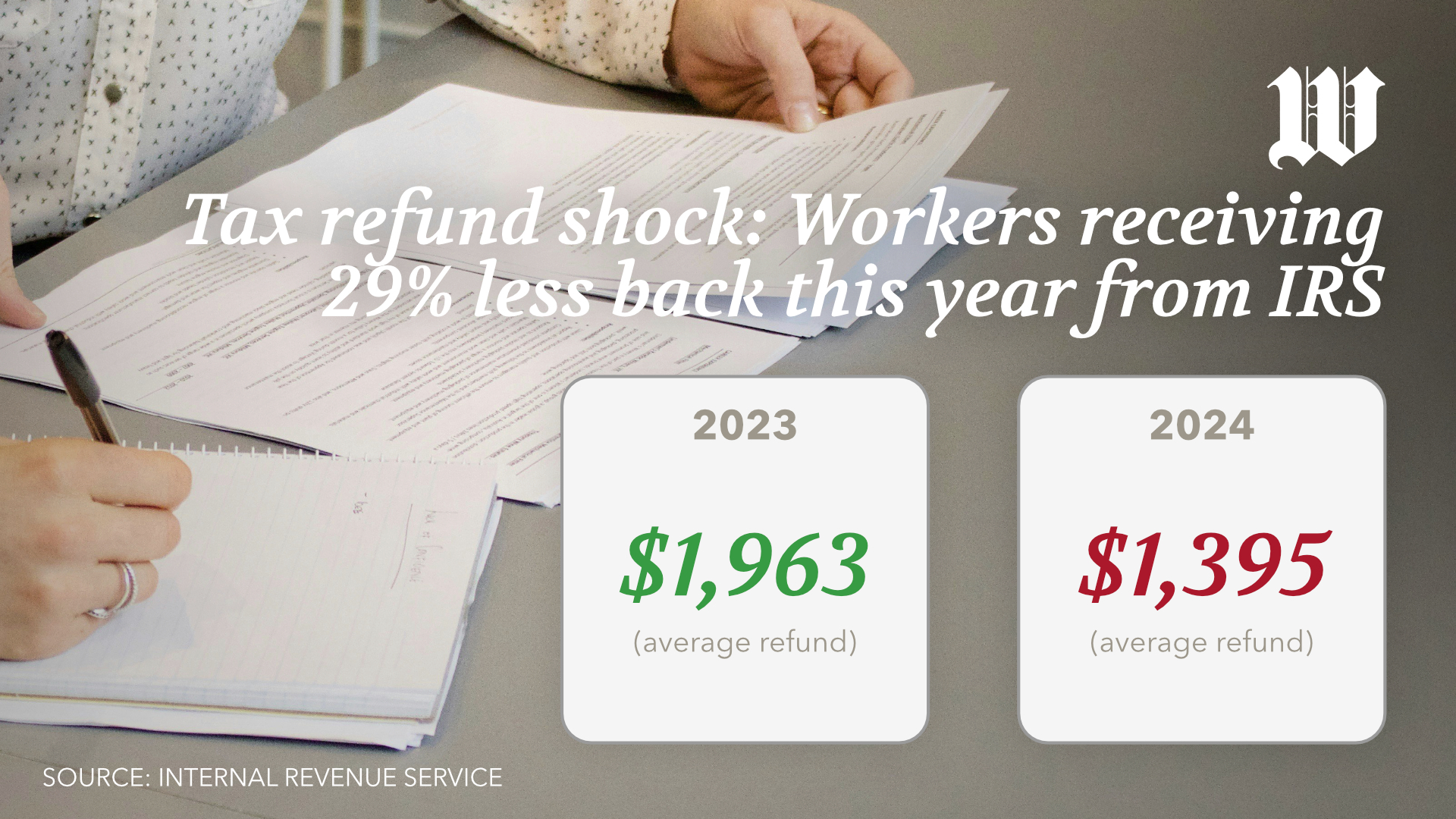

As reported by the Internal Revenue Service, a decrease of 29% in the average refund has been issued compared with last year.

As per the IRS’ published statistics until Feb. 2, the average refund stood at $1,395 — a big drop from the average payout of $1,963 recorded at the same point in 2023.

Despite these early figures reflecting a reduction, the IRS suggests there isn’t cause for concern yet. The average amount of tax refunds typically fluctuates and is expected to adjust as the tax season progresses. During the same period last year, the IRS had an extra week to process returns due to an earlier start to the tax season, which could partially explain the discrepancy in refund amounts.

Some experts anticipate that refunds might surpass last year’s amounts. Mark Steber, chief tax information officer at Jackson Hewitt, explained to FOX Business that those whose incomes have not exceeded inflation rates stand to fare better in terms of refunds. He said the predicted increase is “not even voodoo or marketing spin; it’s pretty much just science.”

According to IRS records, the trend of Americans receiving larger rebates has continued annually. Tax refunds represent the return of any excess amount paid to the IRS via paycheck withholdings throughout the year.

Experts warn that, while a refund may seem like a windfall, overpaying taxes means missing out on using the money during the year. “We have to change our mentality about tax refunds and remind ourselves that it is our money to begin with,” Rebecca Chen, a reporter and CPA, told Yahoo Finance. “And when you have too much withholding with the government, it is essentially like giving them an interest-free loan throughout the year.”

• Staff can be reached at 202-636-3000.

Please read our comment policy before commenting.