Consumers hoping for relief from three years of fast-rising Christmas tree prices will have to shop around a bit this year.

The costs of fresh-cut pine and pink plastic trees are up at about the same pace as the past three years, industry insiders told The Washington Times.

At the same time, they insisted fewer wholesalers and retailers will pass those increases onto consumers as a late-falling Thanksgiving leaves them with one less week this year to unload inventory before Dec. 25.

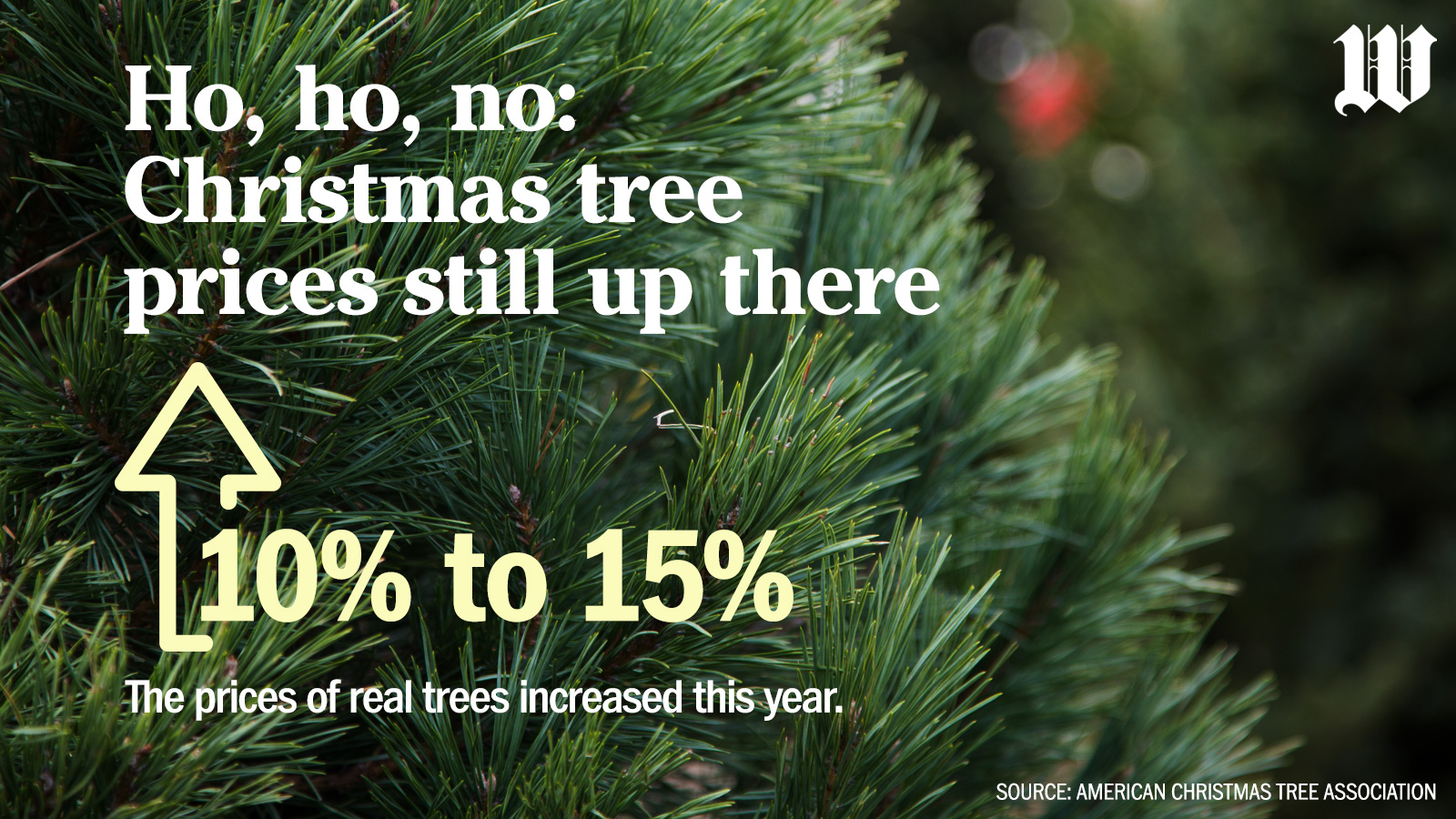

Inflation and droughts have jacked up the prices of real trees by 10% to 15% this year, the American Christmas Tree Association estimates. Trees now average $80 to $100 for a live sapling and a minimum of $100 for an artificial imitation, according to the association, which represents U.S. producers and retailers.

That’s up from $70 to $90 last year and shows little change from annual increases since the COVID-19 pandemic juiced production costs, said Jami Warner, the association’s executive director.

“I think it’s an indefinite trend,” she said on the phone. “Do we see inflation changing anytime soon?”

She attributed this year’s increases to the effects of “extreme weather, supply and demand imbalances and rising production-related costs” in recent years.

The association estimates that 99% of consumers will display a tree this year, with 78% putting up an artificial tree and 22% hoisting a real one.

Ms. Warner said artificial tree prices are up 10%.

“As is the case with all consumer goods, Christmas trees are not immune to inflation, and consumers should still anticipate slightly higher prices for both real and artificial Christmas trees this holiday season,” she added.

Chris Butler, CEO of the New Jersey-based National Tree Co., which imports artificial trees from China, insisted most families will pay about the same for them this year.

According to market researcher Pattern, the price of artificial trees sold online has dropped 2% since last year, making them the best bet for a bargain this year.

“This is consistent with fluctuations we see concerning other holiday decorations like tree skirts, ornaments and lights,” said Hamilton Noel, Pattern’s data scientist.

According to industry research, nearly 100 million households display a real or artificial Christmas tree.

The National Christmas Tree Association, a trade group of live tree growers, estimated that Americans bought 21.5 million farm-cut trees last year at a median price of $80. The buyers were down from 22.3 million in 2022. The most popular farm-grown trees were firs.

Jill Sidebottom, the group’s North Carolina-based seasonal spokeswoman, said an annual survey found 60% of wholesalers didn’t plan to raise prices this year. Among consumers, 27% of those surveyed planned to buy a real tree for the first time, up from 20% last year.

“Storms in different parts of the country can really affect Christmas tree sales,” Ms. Sidebottom said. “But traditionally, trees have been considered inflation-proof because families with children want a centerpiece for the holidays. It brings the family together to decorate; it’s where the whole family gathers Christmas morning, so most people don’t want to skimp on a tree.”

She said Hurricane Helene didn’t damage most Fraser firs in North Carolina, the nation’s leading producer of the popular species. However, drought conditions have persisted on the East Coast the past year, further reducing the national supply of seedlings and transplants.

Hugh Rodell, the owner of North Star Christmas Trees in Beltsville and Chevy Chase, Maryland, said prices have risen between 1.5% and 2% for the several thousand real trees on his lot compared with an average increase of 3% to 5% last year and 8% in 2022.

He said that before the pandemic, prices changed less, increasing from 0% to 1.5% most years.

On average, North Star’s trees will cost up to $3 more this year, with most of the increases hitting premium firs rather than budget trees.

“We probably should have raised prices a little higher, but with the state of the economy we erred on the side of not doing that,” Mr. Rodell said. “A lot of people are struggling. Half the country says their stocks are up and the other half can’t buy milk.”

Other factors in rising Christmas tree production costs since the pandemic include ballooning invoices for wages, fertilizer, equipment and trucking.

On the positive side, fuel prices have decreased in the past year, helping transportation costs.

With Christmas trees taking seven to 10 years to grow, late frosts in North Carolina in recent years and a 2021 record heat wave in Oregon have also reduced the nation’s tree supply.

“This has left farmers with fewer trees to sell this year,” said Angelica Gianchandani, a marketing instructor at New York University.

Christine McDaniel, a senior research fellow at George Mason University’s free-market Mercatus Center, said it’s only a matter of time before retail prices catch up with the reality that tree production costs are not going back down.

She pointed out that consumer prices have risen by an average of about 3% in the past year, well above the Federal Reserve Bank’s inflation target of 2%.

“Cooling inflation just means that prices are still rising but at a slower pace,” said Ms. McDaniel, a former deputy assistant treasury secretary. “Prices are still relatively high, and the dollar does not go as far as it used to.”

• Sean Salai can be reached at ssalai@washingtontimes.com.

Please read our comment policy before commenting.