A version of this article appeared in the daily Threat Status newsletter from The Washington Times. Click here to receive Threat Status delivered directly to your inbox each weekday.

BlackRock, a major Wall Street firm, is investing millions of dollars in an estimated 30 Chinese military-linked companies sanctioned by the U.S. government, according to a think tank report prepared for Congress.

Additionally, BlackRock, which manages retirement assets for millions of Americans, has invested in companies working on China’s large-scale nuclear weapons buildup, said the Coalition for a Prosperous America.

Although BlackRock has adopted a corporate policy supporting responsible “environmental, social and governance” (ESG) policies, the report said, it has invested nearly $50 million in Chinese companies sanctioned under the 2022 Uyghur Forced Labor Prevention Act. The act became law in response to what the State Department called Beijing’s policy of genocide against minority Uyghurs in western China.

“China’s political leadership wants to redirect capital to emerging technologies with military application in preparation for a potential war with the United States,” the report said. “Beijing also wants to continue its campaign of oppression against the Uyghurs and other minority groups in northwestern China.”

Noting that BlackRock has said it does not do business with companies in China producing nuclear arms, the report concludes: “The reality is that BlackRock holds stock in Chinese companies pursuing an aggressive buildup of nuclear warheads meant to hold United States territory at risk.”

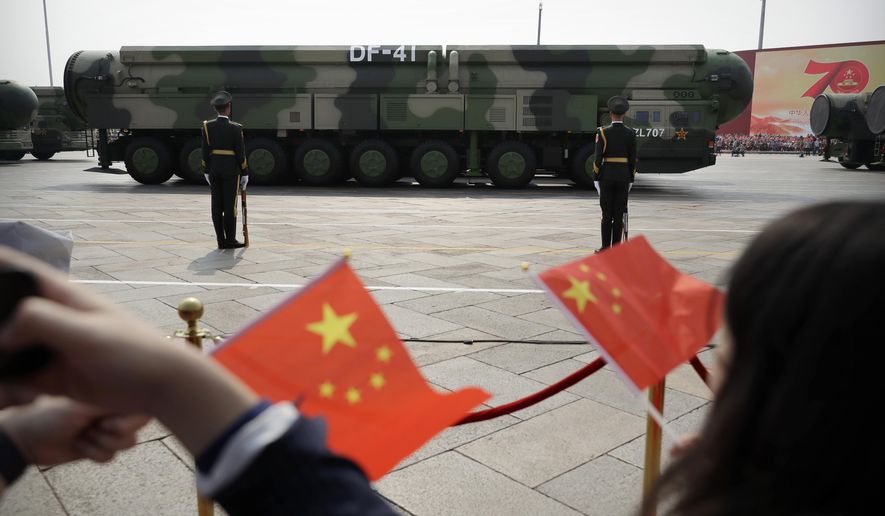

China’s nuclear expansion has been called a “breakout” and the largest buildup of nuclear weapons since the Cold War.

The report singled out MSCI Inc., a leading provider of support tools for global investors known as indexes, for its role in BlackRock’s investments in banned military-linked companies in China.

Christopher Berger, a spokesman for BlackRock, which reports managing $10 trillion in assets, had no immediate comment on the report. MSCI officials did not immediately respond to requests for comment.

BlackRock is regarded as among the most powerful companies, and its giant asset fund “gives BlackRock influence over thousands of companies worldwide,” said the report by the Coalition for a Prosperous America, which states on its webpage that it is a bipartisan coalition of domestic manufacturers, workers, farmers and ranchers.

“Most of this influence comes from the proxy voting rights of its passive index funds registered around the world,” the report states.

BlackRock became the first global asset manager allowed to operate a wholly owned mutual fund business in China in 2021. Chief Executive Larry Fink was among the senior American business leaders who reportedly paid $40,000 for a seat at a dinner table with Chinese President Xi Jinping during his visit to California in November. The company said on its website that one of its principles is “we are committed to a better future.”

“We are long-term thinkers, focused on helping people build a better tomorrow,” the website said. “At the companies we invest in for our clients, we advocate for sustainable and responsible business practices that drive long-term value.”

The report identified MSCI as BlackRock’s main index provider, with more than $15 trillion in assets.

“As MSCI’s most important customer and second largest shareholder, BlackRock could demand the exclusion of Chinese military companies and human rights violators from its indexes,” the report said. “Instead, BlackRock fails to acknowledge that its exposure to U.S.-sanctioned entities is a problem, claiming that it ‘complies with all applicable U.S. government laws.’”

Although BlackRock and MSCI say they promote ESG agendas, the companies “willfully undermine congressional intent to protect defenseless Uyghurs by investing in companies involved in the ongoing oppression,” the report said.

On the nuclear weapons links, the report cited two companies described as integral to China’s nuclear weapons complex: China National Nuclear Power Corp. and CGN Power. BlackRock holds stock in both companies, including a $46 million stake in CNNP, the report said.

“These holdings contradict BlackRock’s public assertion that 0.00% of companies in its flagship emerging markets fund are involved in the manufacture of nuclear weapons and their delivery systems,” the report said.

CNNP is building fast-breeder reactors that are key elements for producing plutonium for warheads. The Nuclear Regulatory Commission blocked CGN Power from gaining access to U.S. radioactive materials used to boost nuclear weapons, the report said.

CGN Power’s parent, China General Nuclear Power Group, is a military-controlled company that was sanctioned by the U.S. government in 2019 for allegedly trying to steal nuclear technology and materials, the report said. BlackRock funds invested $142 million in CGN Power, according to the report.

The House Select Committee on the Chinese Communist Party first identified questionable BlackRock and MSCI investments in July. The committee investigated Wall Street investments in blacklisted Chinese military firms and published its findings in March.

‘Unwitting funders’

Chairman Mike Gallagher, Wisconsin Republican, and Rep. Raja Krishnamoorthi of Illinois, the top Democrat on the panel, wrote to BlackRock and MSCI on July 31.

The two lawmakers said an initial review indicated that because of decisions by BlackRock and MSCI, “Americans are now unwittingly funding PRC companies that develop and build weapons for the People’s Liberation Army (PLA) — the PRC’s military — and advance the [Chinese Communist Party’s] stated mission of technological supremacy.”

The committee report concluded that American financial institutions are investing billions of dollars in Chinese companies “that advance the PRC’s military ambitions and perpetrate the Chinese Communist Party’s human rights abuses.”

It said MSCI, described as the world’s leading index provider, and BlackRock, dubbed the world’s largest asset manager, funneled $3.7 billion and $1.9 billion, respectively, into banned Chinese companies.

In total, major financial institutions provided $6.5 billion to 63 companies linked to Chinese military enterprises or those involved in human rights abuses, the congressional report said.

The 23-page report was produced as a “case study” for Congress and came with several recommendations for legislation to restrict U.S. investment that assists the Chinese military, including new curbs on investment in Chinese companies and a ban on joint ventures with Chinese-based partners.

The report is based on publicly available information that compared BlackRock’s financial holdings in China with sanctions lists published by the Treasury and Commerce departments and the congressionally mandated list of Chinese military companies produced by the Pentagon.

Mr. Xi recently launched a program to mobilize capital markets to build up the People’s Liberation Army through advanced technology, the report said.

“This means that the CCP will manipulate Chinese capital markets — including stock exchanges and initial public offerings — to put government priorities ahead of shareholder value,” the report said. “One such priority is modernizing the Chinese military in preparation for a potential conflict with the United States.”

Justin Bernier, an adviser to the Coalition for a Prosperous America and co-founder of the National Security Index, a fund company to help Americans invest in emerging markets in ways that don’t hurt U.S. national security and human rights interests, said the report highlights how American financial services firms are working with banks controlled by the Chinese Communist Party to sell investments to the Chinese.

“This symbiotic relationship allows Wall Street to pull management fees out of China’s multitrillion-dollar investment market while Beijing channels billions of dollars to companies that support the PLA,” Mr. Bernier said.

BlackRock is unlikely to divest from China’s military-industrial complex because doing so could undermine its lucrative business ties to the government, he said.

Additionally, BlackRock’s joint venture with the state-owned China Construction Bank will distribute mutual funds online and through thousands of branch offices in China. The activity will support human rights violators and defense companies with billions of dollars at the expense of U.S. national security interests, Mr. Bernier said.

A call for action

Roger W. Robinson, a former chairman of the congressional U.S.-China Economic and Security Review Commission, said the report should prompt Congress to take action.

“The callous disregard for national security and human rights-related risk — much less the abuses of these Chinese corporate bad actors — together with the lack of fiduciary responsibility and diligence on display in this report is very troubling,” Mr. Robinson said. “It’s clear that Congress now has no alternative but to make these kinds of reckless investments by American asset managers illegal to protect our country, fundamental values and retail U.S. investors.”

The report contended that BlackRock has been able to circumvent U.S. sanctions law by offering investment products through foreign subsidiaries, including Hong Kong-based BlackRock Asset Management North Asia Ltd. In mainland China, BlackRock is represented by BlackRock Fund Management Co., a wholly owned mutual fund company in Shanghai.

“These subsidiaries together own stock in 14 companies on the Treasury Department’s Chinese Military-Industrial Complex List that U.S. individuals and corporations are not permitted to trade,” the report said.

BlackRock has invested about $36 million in four subsidiaries of the Aviation Industry Corp. of China (AVIC), China’s largest defense contractor building warplanes, including the J-20 and FC-31. The aircraft “would be on the frontline of a regional conflict with the United States,” the report said.

BlackRock also has invested more than $50 million in affiliates of the China Shipbuilding Industry Co. (CSIC), which is building warships and submarines, including aircraft carriers and JIN-class ballistic missile submarines.

The Commerce Department blacklisted 25 subsidiaries of CSIC in 2020, saying the company’s vessels had engaged in asserting unlawful maritime claims in the South China Sea. China’s military is seeking to control the waterway.

The report said BlackRock has invested $45.12 million in companies sanctioned by the Forced Labor Enforcement Task Force, an interagency body under the forced labor act.

“Companies found in violation of the [Uyghur Forced Labor Prevention Act] are prohibited from exporting goods to the United States,” the report said. “These same companies, however, are not denied U.S. investor dollars from BlackRock funds.”

The report concluded that joint ventures in China by BlackRock and other Wall Street firms represent a “convergence” of U.S. corporations and the Chinese government.

“The expanding Wall Street-Beijing nexus further undermines U.S. national security and human rights interests,” the report said. “The PRC government can punish Wall Street firms that oppose its agenda in any way, just as it rewards companies that support its policies.”

• Bill Gertz can be reached at bgertz@washingtontimes.com.

Please read our comment policy before commenting.