OPINION:

One of the all-time marketing flops was the Ford Edsel, which was heralded as the hot new car of the late 1950s. All the automotive experts and Ford executives said it was a can’t-miss. Henry Ford (the car was named after his son) guaranteed hundreds of thousands of sales.

But one big thing went wrong: Nobody ever bothered to ask car buyers what they thought of the new car. As it turned out, they hated it. So instead of sales of 400,000, Americans bought 10,000, and the model was embarrassingly discontinued.

The obvious lesson for the industry: You can’t bribe Americans to buy cars they don’t want. Given the all-in approach to electric vehicles at Ford and General Motors, it’s clear that Detroit never got the message.

Last week, Honda and GM announced an end to their two-year collaboration in building a platform for lower-cost EVs. Honda executives said it was “too hard.”

Amazingly, only 10% of all new cars sold over the last two years were EVs. This is despite the fact that the U.S. government is writing a $7,500 check to people for buying an EV, and some states are kicking in $5,000 more. The Texas Public Policy Foundation calculates that all-in EV subsidies can reach $40,000 per vehicle. It would practically be cheaper for the government to purchase a new gasoline-powered vehicle for every American car buyer.

Energy expert Robert Bryce estimates that Ford has lost $62,000 for each EV it has rolled off the assembly line. That’s hardly a road to profitability.

Meanwhile, the news is even worse for wind and solar power. The Wall Street Journal reported last week that “clean energy” investment funds are tanking, with some down as much as 70% in recent months. Solar has been one of the worst-performing industry stocks this year.

This collapse is happening right when Exxon and Chevron have engineered $110 billion blockbuster acquisitions to expand oil and gas drilling in the Permian Basin in Texas, one of the biggest oil fields in the world.

They are looking at the real-world data. In 2023, the world is guzzling oil and gas like never before. Global consumption of fossil fuels was higher in 2022 than at any time in human history, even as the developed countries spend hundreds of billions of dollars trying to stop oil, gas and coal.

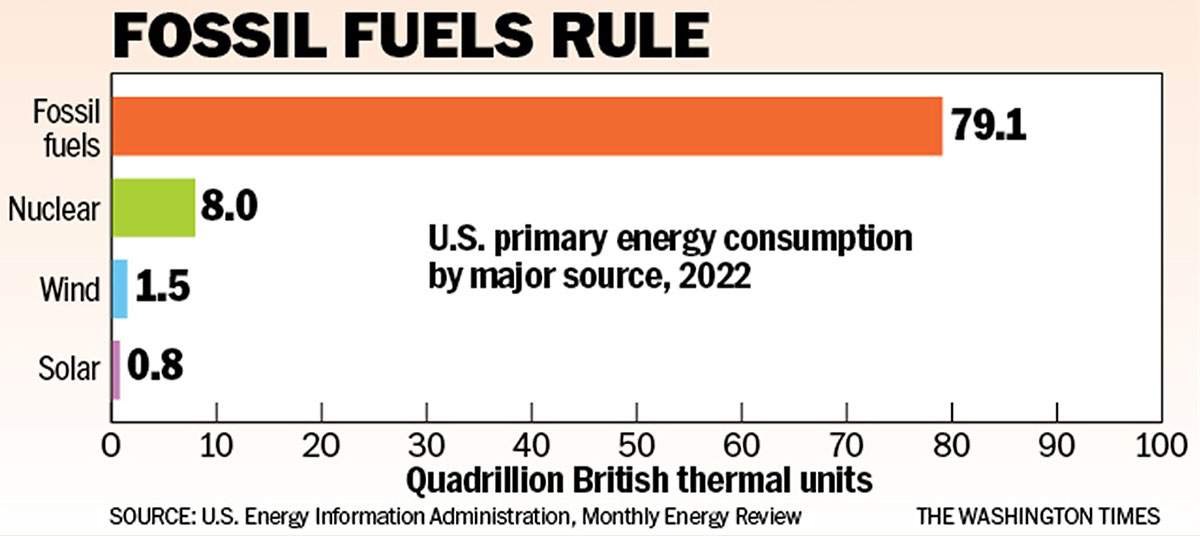

The chart shows that despite the $370 billion green energy slush fund stashed in the federal budget, almost 80% of our energy still comes from old-fashioned fossil fuels. We’re a long, long way from “net zero.” And remember: Unlike green energy, fossil fuels get almost no subsidies. In fact, they pay taxes.

All of this is to say that there is no “global energy transition” going on. If there is one, it’s away from green energy, not toward it.

• Stephen Moore is a senior fellow at The Heritage Foundation and chief economist at FreedomWorks.

Please read our comment policy before commenting.