OPINION:

A version of this story appeared in the Threat Status newsletter from The Washington Times. Click here to receive Threat Status delivered directly to your inbox each Wednesday.

After spending $6 trillion on social welfare and a Green New Deal spending spree and running our national debt up to $33 trillion, President Biden is asking to whip out the federal credit card yet again for $100 billion more in military assistance for Ukraine and Israel and “humanitarian” aid.

Yes, it certainly is a dangerous world, and more so every day. But Mr. Biden has a lot of nerve proclaiming that he’s 100% committed to the defense of Ukraine and Israel when his own policies have contributed directly to the hostilities.

The most impactful way to repel our enemies — China, Russia, Middle East terrorists — is to defund them by producing every ounce of oil, gas and coal here at home. Mr. Biden’s war on American energy has cost the U.S. economy more than $200 billion in lost domestic energy output from the Trump pro-drilling trend. At least $40 billion of that has gone to the Iranians. You can buy a lot of rockets with that kind of money.

Meanwhile, the Russian war machine is almost entirely funded with petrodollars. They love that the heart of the Biden climate policy is to produce 3 million barrels a day less than we could and should be.

Mr. Biden misses a larger point about our national security. Right now, our debt is the nation’s most urgent, clear and present danger — not just to our economic prosperity but to our national security. Presidents Ronald Reagan and Donald Trump believed rightly that when America is strong at home with an economy firing on all cylinders, we are strong, respected and feared abroad.

It’s painful to say, but right now, America is far weaker militarily and economically than we were four years ago. The most important geopolitical power today is economic and technological superiority.

You don’t achieve and retain that status by becoming the world’s premier debtor nation.

Americans are starting to feel in the pocketbook the corrosive effect of a hemorrhaging $6 trillion budget. Everything we buy is 17% more expensive as the government effectively prints and borrows money to pay its bills. Mortgage rates are surging, with a 30-year mortgage interest rate at 8%, up from 3% when since Mr. Trump left office.

This means that on an average-priced house with a 30-year mortgage, buyers will pay $1,500 a month more in payments. This will put homeownership out of reach for millions of Americans.

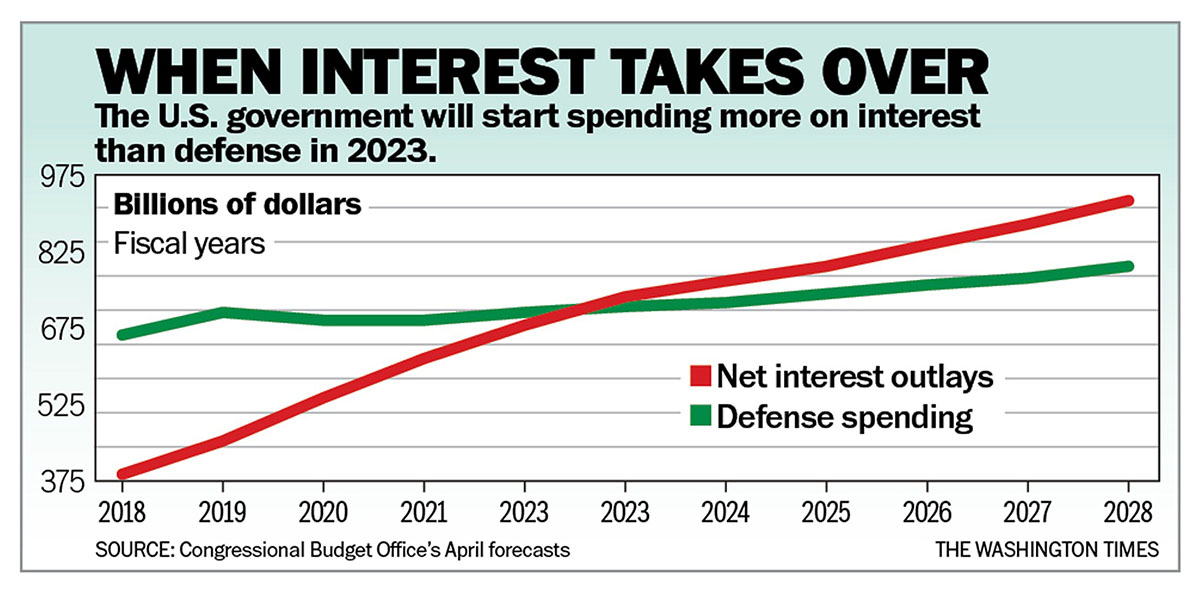

Then, there is the impact of skyrocketing federal interest payments on the debt. This year, for the first time, federal interest expenses exceed our entire national defense budget. With lower interest rate debt now turning over every day and having to be refinanced by issuing 5% and 6% Treasury bills, we’re facing a death spiral of red ink.

Borrowing more money now would make all these problems much worse and make America less of a superpower going forward. Republicans should be insisting on three conditions for any more debt spending packages.

First, it has to be much smaller — cut at least by half — than $100 billion. This isn’t Monopoly money we are talking about.

Second, any release of new funds must be accompanied by a pro-drilling strategy here at home to divert money away from our enemies.

And third, every penny must be paid for dollar for dollar with other spending cuts. This isn’t a heavy lift. We simply slash the $380 billion green energy slush fund and other wasteful programs.

If Mr. Biden and Congress don’t believe they can find and eliminate tens of billions of dollars of waste in the federal budget (about 1% of total spending), this is prima facie evidence that we need a new president and a new Congress.

• Stephen Moore is a senior fellow at The Heritage Foundation and an economist with FreedomWorks. His latest book is “Govzilla: How the Relentless Growth of Government Is Devouring Our Economy.”

Please read our comment policy before commenting.