OPINION:

Why has Sen. Dick Durbin, Illinois Democrat, declared war on credit cards?

Americans are in love with paying with plastic. Perhaps too much so, given that credit card debt now exceeds $1 trillion.

Paying with plastic has become a sort of American pastime — so popular and convenient (especially with reward programs that offer cash-back payments, frequent flyer miles and other perks) that there are now an estimated 500 million to 1 billion credit cards in circulation and close to another 1 billion debit cards.

This means there are more credit and debit cards than there are adults in the U.S.

That’s a big change from 20 to 30 years ago, when only upper-income Americans had access to plastic cards for swiping (and now tapping), while middle- and especially lower-income Americans had to carry around wads of cash for transactions or go to a loan shark for emergency money.

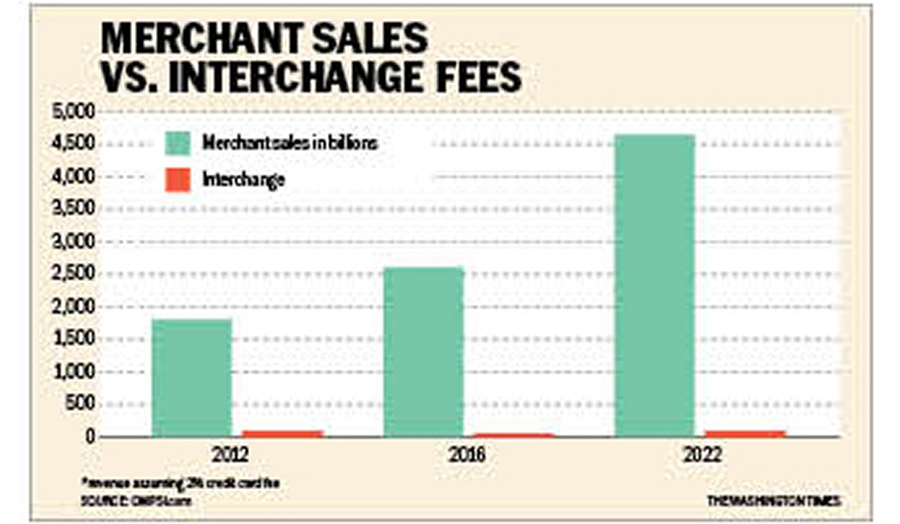

But you know who else loves the convenience of credit cards? Store, restaurants, merchants, online services. They have vastly expanded retailers’ transactions and sales. This year, there will be nearly $5 billion of plastic card (or on cellphone) financial transactions, two to three times the amount in 2012. The chart shows that the fees have gone up more slowly than the amount of sales.

Some smaller businesses don’t accept credit cards, but those numbers are dwindling. Even corner shoe shiners are accepting plastic these days. Taking Visa, MasterCard, American Express, or any of the dozens of other credit cards also reduces the burden of handling cash, it reduces theft at the register, and in most cases, the credit card companies assume the risk of nonpayment. They do all this for an “interchange fee” charged to merchants that average around 2%.

What retailers don’t like is paying that fee.

They’ve run to Congress for help, and Mr. Durbin has obliged with his so-called Credit Card Competition Act. Given that there are dozens of cards to choose from and that retailers are free to create their own credit cards for customers (as used to be the case with Sears, and J.C. Penney cards), the argument that Visa and MasterCard lack competition is a bit far-fetched.

Mr. Durbin’s bill would impose implicit price controls on credit cards by requiring that every Visa and MasterCard also carry the logo of a cut-rate competitor’s network. This is like requiring McDonald’s to show its customers the Burger King and Wendy’s menus and prices.

What’s demoralizing is that many Senate Republicans have signed on to this bill to regulate an industry that works for everyone.

Last week, the senators released a study asserting that this bill would save the average consumer $1,000 a year. But this was the same claim Mr. Durbin made about his debit card price controls. The consumers didn’t save money: The merchants pocketed nearly all the money, and it nearly ended “free checking” services by banks.

To the extent that cash savings are passed on to consumers, The Wall Street Journal has noted that this would likely come at the expense of fewer reward points for credit card holders.

And if swiping fees are such a financial burden on retailers, let’s see them go a few weeks without them.

The credit card market isn’t broken; it’s flourishing as America moves rapidly to becoming a nation where nearly everyone has access to the convenience of cheap credit. The last thing consumers and sellers need is for Congress to “fix it.”

• Stephen Moore is a senior fellow at The Heritage Foundation and an economic analyst at FreedomWorks. His latest book is “Govizilla: How the Relentless Growth of Government Is Devouring Our Economy.”

Please read our comment policy before commenting.