Colleges nationwide have received a wave of complaints that they have misled applicants financially as the Biden administration fights to expand regulations for federal student loan forgiveness.

The Education Department said Tuesday that it would fine the nation’s largest Christian university a record $37.7 million and encourage more than 7,500 former students to file federal borrower defense to repayment, or BDR, claims to cancel their loan debts.

The department said for-profit Grand Canyon University falsely advertised the cost and coursework required to complete some doctoral degrees. The Phoenix-based school strenuously denies the accusation.

With a BDR claim, a borrower can ask to have his federal student loan discharged if he can show that the college misled him or engaged in other misconduct in violation of state law.

The Education Department has sent thousands of BDR notices to nearly every college and university over the past three months to clear a massive backlog in claims filed from 2016 through 2022 by financially strapped dropouts and graduates. The Trump administration ignored complaints about their inability to repay loans.

As part of a class-action settlement last year, a federal court ordered the department to process $6 billion in claims by July 2025.

“To say it’s messy is an understatement, and it’s scary for people,” Sarah Flanagan, vice president for government relations and policy development at the National Association of Independent Colleges and Universities, a network of nonprofit private schools, told The Washington Times. “They’re getting copies of complaints that are silly, and they don’t know how to respond.”

According to the latest progress report from the Education Department’s Federal Student Aid office, officials forgave the debts of 11,779 claimants from May 1 through July 29, denied none of the applicants and asked 2,041 others to “revise and resubmit” paperwork. Another 60,429 claims sent to campuses were still pending.

Rarely used before the Obama administration established regulations in 2016, the BDR program has largely helped former students cancel loan debts after attending for-profit universities with questionable advertising practices or colleges that closed suddenly.

Several higher education insiders interviewed by The Times said Education Department claims in recent months to large public research universities, community colleges and nonprofit private schools have created confusion.

The insiders said the number of claims sent to nonprofit schools since July includes 90 at one public university, 100 to 200 at several private campuses and at least one at nearly every other campus. It remains unclear how many have been filed recently and how many are older.

“We’ve received unsigned complaints with nothing in them, just former students wanting money,” said David Armstrong, president of St. Thomas University in Florida. “I think it’s a vote grab by the Biden administration, using the BDR process to forgive loans.”

Mr. Armstrong said the Catholic liberal arts campus in Miami Gardens received 29 complaints in a single day, the first BDR claims in its 62-year history. He noted that the private school averages $20,000 per former student in federal student loan debts.

In a statement to The Times, an Education Department spokesperson insisted that the colleges will have an additional chance to defend themselves if the government fines them to recoup the balances of discharged loans.

“The mere transmission of a claim to the school is not an indicator of the claim’s merits or its likelihood of approval or denial,” the spokesperson said. “Whether to respond is up to the school. Furthermore, all claims must meet the applicable regulatory standard regardless of whether the school chooses to respond to notice of the claim.”

The department has a “legal obligation” to take seriously the rights of former students to accuse colleges of deceiving them financially, the statement added.

“That right and the department’s corresponding work are two other steps this administration has taken to make student loan debt and repayment fairer and more manageable,” the spokesperson said.

In July, the Biden administration finalized a set of BDR standards that the spokesperson said would help the Education Department screen out frivolous complaints before sending them to colleges.

A federal appeals court has temporarily blocked the administration from enforcing those regulations, pending the outcome of a legal challenge that a trade group of for-profit colleges filed in Texas.

Critics say the standards would make it easier for loan forgiveness activists to make frivolous bulk claims look legitimate by coaching former students to “check the right boxes,” setting up schools to pay for the losses without due process.

“It could put everybody out of business,” said Arthur Keiser, founder of Keiser University, a nonprofit career preparation institution in Fort Lauderdale, Florida, that has challenged the rules in court. “It’s like buying a car, deciding you don’t like it and then getting the manufacturer to force the dealership to refund all of the money,” he said.

Efforts to cancel federal student loan debts have intensified under President Biden, who promised it during his 2020 election campaign.

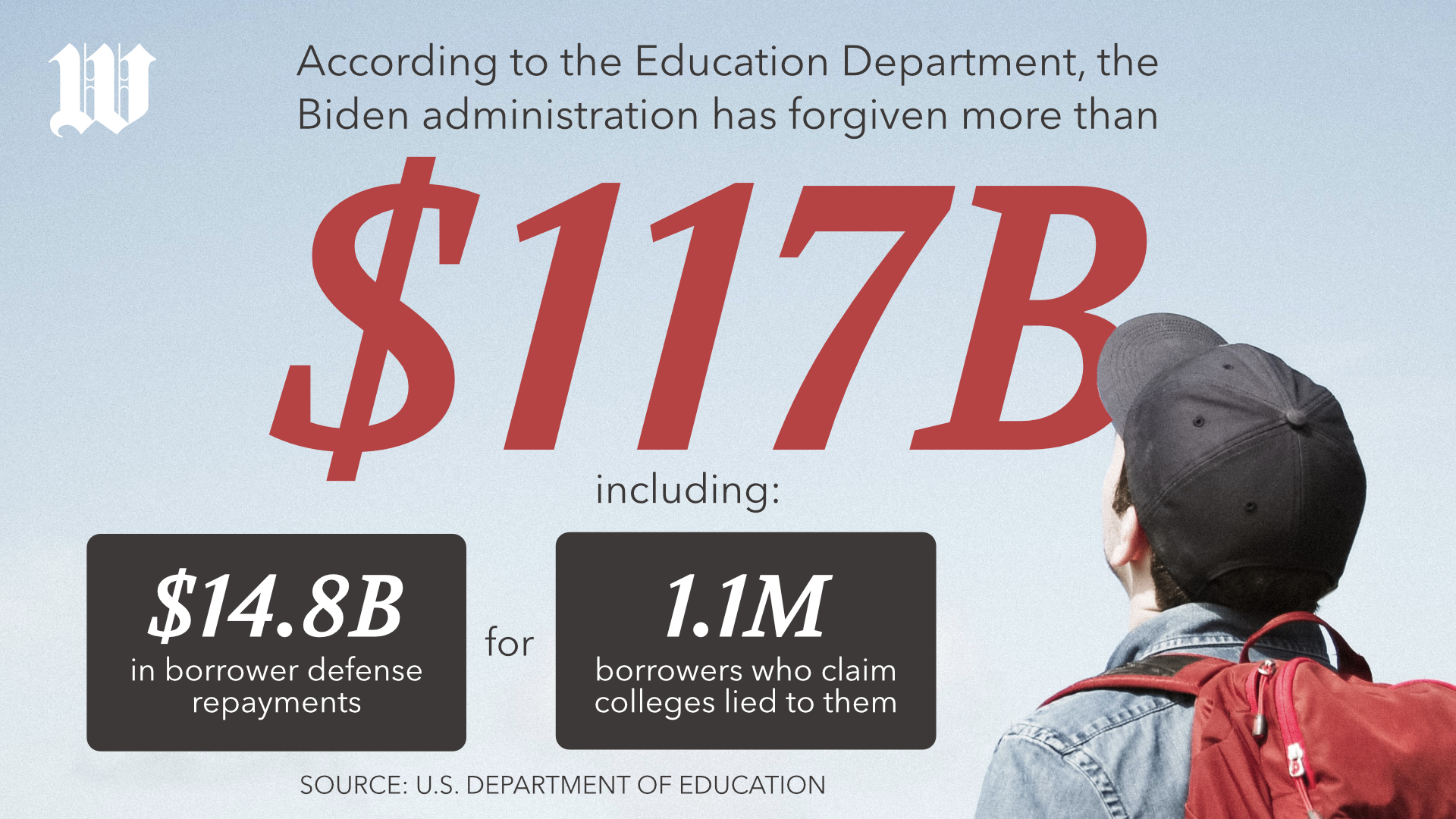

According to the Education Department, the Biden administration has forgiven more than $117 billion in student loan debts, including $14.8 billion in BDR claims for 1.1 million borrowers who say their colleges lied to them.

That’s just a drop in the bucket of the $1.77 trillion in federal student loan debt that the Federal Reserve estimates Americans owe in 2023, a 66% increase over the past decade, but the sum of canceled debts could grow as the department ramps up BDR actions at nonprofit schools.

As of Jan. 31, the Department of Education listed 464,724 out of 779,785 BDR applications as “pending,” according to a monthly report that the agency has since stopped publishing without explanation.

Karen McCarthy, vice president of public policy and federal relations at the National Association of Student Financial Aid Administrators, said mounting college debt loads in recent decades have given former students more incentive to claim colleges defrauded them.

She has urged nonprofit colleges and universities to consult their attorneys in deciding whether to respond to the surge in BDR claims.

“The Department of Education still has not released any general guidance to schools letting them know what is happening,” Ms. McCarthy said. “Whether you respond or not has no bearing on whether they grant the claim or seek to recoup the losses from the schools, but most schools don’t know that.”

• Sean Salai can be reached at ssalai@washingtontimes.com.

Please read our comment policy before commenting.