OPINION:

Beginning next year, the Federal Deposit Insurance Corp. will levy a “special assessment” on banks to recover the losses from bailing out wealthy depositors at Silicon Valley Bank, or SVB.

Those fees will be passed on to you as the Biden administration takes its war on merit to the battlefield of banking, with your wallet in the crosshairs.

Normally, every depositor is insured up to $250,000 at each bank, a fact that is legally required to be advertised at every institution in the country with FDIC coverage. For nearly everyone, that limit is more than enough to cover their entire deposit in that bank.

But SVB’s depositors were disproportionately venture capitalists and tech startups with deposits far above the $250,000 insured limit.

Those people knew the risk of keeping so much money in a single bank, instead of spreading their deposits to multiple banks.

When SVB collapsed, large depositors stood to lose some of their money in the subsequent fire sale of SVB’s assets. But that never happened because the federal government took the unprecedented step of changing FDIC rules on the fly and guaranteeing all of SVB’s deposits, including uninsured ones.

This cost the FDIC about $15.8 billion, and now depositors at more prudent banks are stuck with the bill. We are paying for someone else’s mistakes in a game where the rules seem to change by the day.

To recoup the loss to the FDIC’s Deposit Insurance Fund, the special assessment will charge 0.125% of each bank’s uninsured deposits over $5 billion.

The FDIC’s rationale for the structure of this assessment is that banks with uninsured deposits were protected by the intervention taken with SVB. If everyone thought their uninsured deposits were guaranteed, then there would be no reason to withdraw those deposits. The SVB intervention supposedly prevented bank runs at other institutions with large uninsured deposits.

But that’s doubtful because of the Biden administration’s contradictory messages regarding deposit insurance. Not only did administration officials repeatedly say that uninsured deposits did not have blanket coverage, but data from the Federal Reserve show that deposit outflows have continued in the wake of SVB’s collapse.

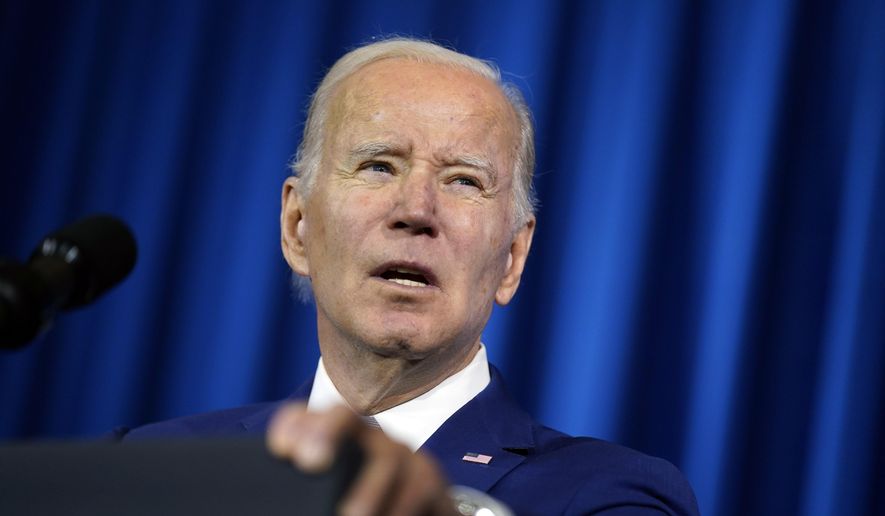

Both the bailout by the FDIC and the resultant charges to recoup the losses are just another example of the Biden administration’s war on merit and creation of moral hazards.

Coincidentally, President Biden’s bailouts also seem to disproportionately help his voters and donors.

Did you take out too much in student loans for a degree that didn’t qualify you for a job with sufficient income to repay those loans? Mr. Biden will “forgive” those debts.

Do you have a history of poor financial decisions that resulted in a lower credit score and no money for a down payment on a house? Mr. Biden will “adjust” the fees on your mortgage so that you pay less.

And did you keep too much of your money in a mismanaged bank when you knew your deposits were only insured up to $250,000? Mr. Biden will bail you out.

The message from this administration is clear: If you make mistakes, fret not. Everyone else will pay for them.

It’s difficult to imagine a better incentive for reckless personal financial decisions than knowing that the seemingly unlimited federal purse is at your disposal — provided you have the right politics.

——————

E.J. Antoni is a research fellow for regional economics at The Heritage Foundation’s Center for Data Analysis.

Please read our comment policy before commenting.