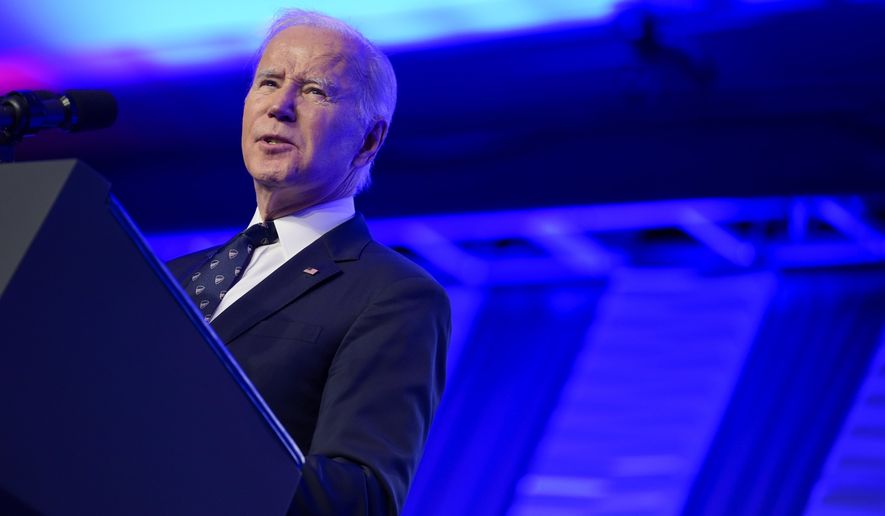

In a preview of his budget plan to be released this week, President Biden on Tuesday rolled out a proposed tax hike on high earners as part of his complicated plan to raise money to keep Medicare solvent.

Under Mr. Biden’s blueprint, Americans earning $400,000 would pay higher taxes on their investments, pharmaceutical companies would be required to pay into Medicare for certain price hikes, and a cap would be imposed on what Medicare Part D pays for many popular drugs.

The White House says the plan would protect Medicare — a program that more than 60 million seniors depend on for health insurance — into the 2050s without cutting benefits.

A key Medicare trust fund is expected to run out in 2028 under current tax and spending levels because it’s shelling out money at a much greater rate than it’s bringing in. That means it faces automatic federal cuts in 2028, creating the possibility that Medicare providers will deny care to the elderly unless Congress and the White House come up with a plan.

Mr. Biden’s proposal would increase the net investment income tax on capital gains and investment income from 3.8% to 5% for all Americans earning more than $400,000 per year. The plan would also impose new taxes on certain businesses that are not subject to the corporate income tax.

“High-income people are supposed to pay a 3.8% Medicare tax on all of their income, but some high-paid professionals and other wealthy business owners have managed to shield some of their income from tax by claiming it is neither earned income nor investment income,” the White House said in a statement.

The proposal would also require pharmaceutical companies to pay into Medicare when they increase prices faster than inflation. The White House says this rule change could add roughly $200 billion to Medicare’s coffers over the next decade.

It would also cap the out-of-pocket cost of certain generic drugs at $2 per prescription a month, which would include popular hypertension and high cholesterol drugs.

The plan would also require Medicare to cover three mental or behavioral health visits per year.

Mr. Biden unveiled the plan as part of his broader 2024 budget proposal, which is set to be released Thursday. The president’s budget faces a difficult path to approval through a GOP-controlled House.

The nonpartisan Committee for a Responsible Federal Budget applauded Mr. Biden’s proposal and estimated the plan would “generate hundreds of billions of dollars — perhaps even approaching a trillion dollars — to strengthen Medicare.”

Still, CRFB President Maya MacGuineas raised key reservations with certain details.

“It would be better for the plan to keep the drug savings in Medicare Part D, where costs remain too high and are rising too quickly,” she said. “Far more concerning, the administration’s plan to redirect the NIIT revenue amounts to a large general revenue transfer that would strengthen Medicare on paper without truly improving its financing.”

She added, “Absent offsetting measures, this part of their plan simply robs Peter to pay Paul and, in the process, would worsen the budget outlook outside of the trust fund.”

Republicans will surely oppose all new proposed tax hikes in the administration’s plan, and some GOP lawmakers are pressing the White House to cut spending.

Rep. Bryan Steil, Wisconsin Republican and chairman of the Committee on House Administration, snapped back at Democrats soon after Mr. Biden unveiled his plan.

“To protect Social Security and Medicare, we need to stop the wasteful spending in Washington,” he wrote on Twitter.

House Speaker Kevin McCarthy, California Republican, retweeted Mr. Steil’s post.

Mr. Biden’s budget and tax-hike plan will be dead on arrival in Congress, but his proposal to shore up Medicare serves as an opening bid if Washington gets serious about confronting the soon-to-be broke Social Security and Medicare programs.

The White House and GOP lawmakers are battling over unchecked federal spending and soaring national debt as the country hits its $31 trillion borrowing cap, requiring Congress to raise the limit.

Mr. Biden and his Democrats have accused Republicans of vying for draconian cuts to Medicare and Social Security, though Congress’ GOP leaders have taken those programs off the table for the budget talks.

The pharmaceutical industry is also expected to rebuke Mr. Biden’s Medicare plan. Drug companies have argued that price capping and increasing their contribution to the program takes dollars away from research and innovation.

As Mr. Biden scrambles to address the Medicare shortfall, he faces a similar crisis with another entitlement program. Funding for Social Security could be depleted by 2033.

Mr. Biden pledged in his State of the Union remarks that he would roll out a plan to protect Medicare for the next two decades but did not make a similar promise for Social Security.

Democrats have urged Mr. Biden to increase payroll taxes on high earners to keep Social Security solvent, but the president has not pursued that idea.

• Joseph Clark contributed to this story.

• Jeff Mordock can be reached at jmordock@washingtontimes.com.

Please read our comment policy before commenting.