OPINION:

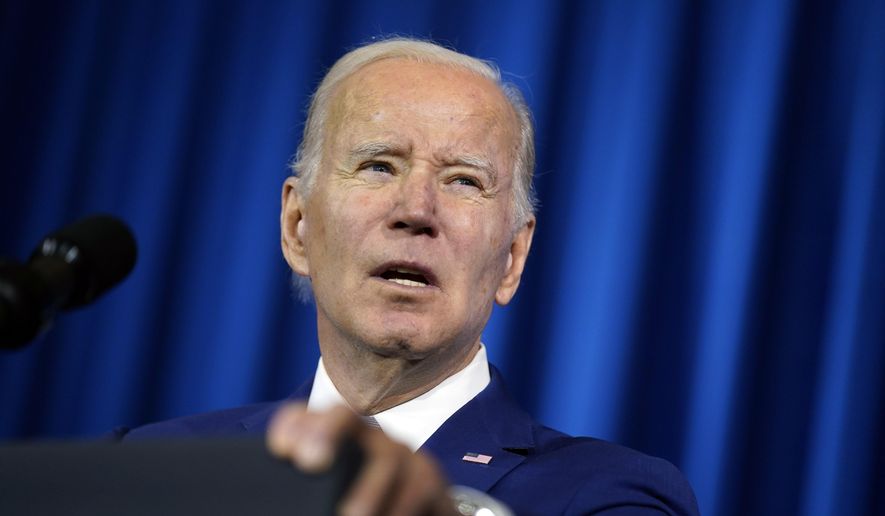

This week, President Biden issued his first veto, rebuffing HJ Res 30, the bipartisan effort to roll back a Department of Labor (DOL) rule that politicizes retirement savings.

This problematic rule allows woke money managers to use other people’s money to realize political objectives and sacrifice the financial returns of everyday investors — who are often left in the dark about these decisions — in the process. Though the administration regularly labels its political opponents as threats to American democracy, it is, in fact, the Environmental, Social, and Governance (ESG) agenda that damages democracy by transferring power away from the American people and into the hands of Wall Street barons.

The Left recognizes that the results of imposing woke capitalism do not have broad support from the American people. Crippling energy prices, racial quotas, weakened national security, and declining retirement savings tend to poll poorly, particularly when Americans have been suffering from decades-high inflation. Consequently, policies that lead to these outcomes do not achieve the legislative majorities necessary to pass them into law through our constitutional system.

To achieve this ideological agenda over the public’s opposition, the Biden Administration is rewriting regulations to empower its allies. Their latest effort was a DOL rule that changed the way money managers allocate the retirement savings of their clients under the Employment Retirement Income Security Act of 1974, overturning protections put in place by the Trump Administration. In particular, the Trump Administration’s DOL clarified that when managing the savings of others, fund managers must “select investments and investment courses of action based solely on financial considerations relevant to the risk-adjusted economic value of a particular investment or investment course of action.”

Unfortunately, the Biden Administration started undoing the Trump era rule when it entered office. The Labor Department recently finalized the Biden Administration’s updated rule, prompting opposition by both the House of Representatives and the Senate. Congress voted in a bipartisan fashion to repeal the new rule under the Congressional Review Act, leading to the veto.

However, harmful ESG efforts are not limited to the Department of Labor. The Securities and Exchange Commission is finalizing reporting of corporate ESG information in an effort to shame companies into pursuing the Left’s goals, which are not limited to achieving a radical climate agenda. Money managers such as Blackrock coerce companies to implement racial and gender quotas in their hiring processes to achieve “equity” outcomes that dispense with equality of opportunity in favor of equality of outcomes. If accomplished by the government, such policies would be unconstitutional. Yet, private money managers can use large pools of capital under their control to force companies to discriminate against White and Asian Americans systematically.

One might argue that in a free society, people should be able to allocate their money based on their preferences — what is wrong with that? However, money managers like Blackrock and State Street are not voting with their own money. Instead, they are voting shares owned by their investors, most of whom have not agreed to these radical policies. Regardless of whether Congress wants the U.S. to join the Paris Climate Accord or mandate transgender bathrooms, Wall Street elites will dramatically curtail capital availability to corporations that don’t “voluntarily” abide by the terms the liberal elite want to be implemented. The result is that a tiny number of unelected giant asset managers have become the pivotal decision-makers in our Nation on such issues, not our elected representatives. This centralization of voting in the hands of elite money managers is the greatest threat to democracy in our Nation.

Despite the Biden Administration’s professed concern for democracy, it is doing little to confront this disenfranchisement of the American people from self-governance. Until recently, the administration’s National Economic Council was led by the former head of ESG for BlackRock, and its Deputy Treasury Secretary also worked on ESG issues at BlackRock. Placing such authority in the hands of these officials signals that rather than staying focused on protecting American savers, the Biden Administration is facilitating an anti-democratic power grab.

The Biden Administration’s policies are failing and are causing serious economic problems for the American people. While attempting to distract the American people with enflamed rhetoric regarding alleged “threats to democracy,” the administration continues to use rule-writing to implement a radical liberal agenda.

The American people are not a threat to democracy. The true threat comes from power being transferred to special interests who have placed their agents into senior positions in the administration. The ESG titans who are trying to use your money to impose their extreme woke capitalism plan on America are more dangerous than any protester or activist. This week’s veto does nothing to protect the American people but instead signals support for ESG policies that will continue to weaken American democracy.

- Michael Faulkender is chief economist at the America First Policy Institute and professor of finance at the University of Maryland. Previously, he served as assistant Treasury Secretary for economic policy (2019–21).

Please read our comment policy before commenting.