Congressional Democrats warned on Thursday that a refusal by Republicans to raise the debt limit would imperil retirement benefits for millions of Americans, while raising interest rates even higher.

Democrats on the Joint Economic Committee unveiled a report estimating the fiscal impact of Congress refusing to raise the cap on how much the federal government can borrow to meet its expenses.

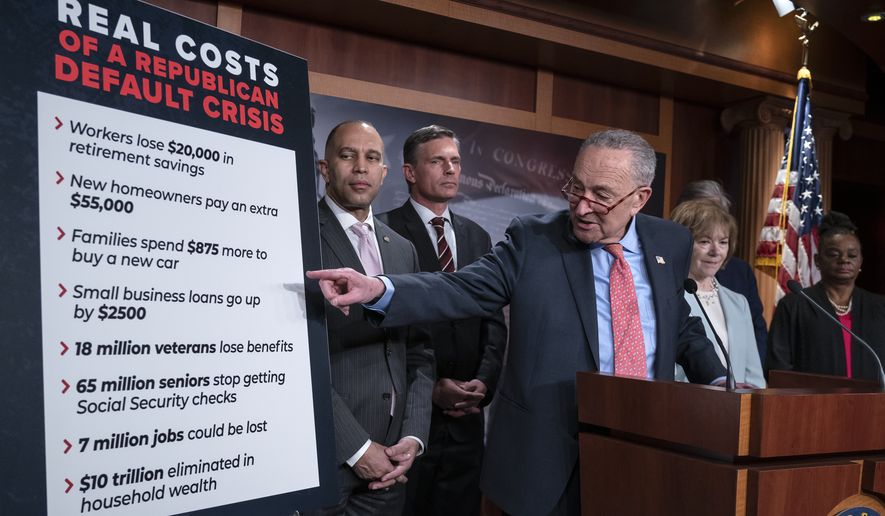

“An American working their whole life and finally approaching retirement could lose $20,000 in retirement savings,” said Senate Majority Leader Charles E. Schumer, New York Democrat. “Homeowners would pay $55,000 more for a home, families $875 [more] to buy a car.”

Democrats say a default could send the stock market plunging and force banks to raise interest rates. The analysis is premised on how the private sector responded to previous debt-limit showdowns in 2011 and 2013.

Sen. Mike Lee of Utah, top Republican on the JEC, said earlier this week that it wasn’t unusual for Republicans to expect Mr. Biden to negotiate over spending cuts in return for increasing the borrowing limit.

“It’s wrong for [Democrats] to say that [Republicans are] flirting with the default, they’re trying to cause a default because [Mr. Biden’s] the one saying he won’t accept any conditions,” Mr. Lee said at an event with members of the House Freedom Caucus.

SEE ALSO: House Freedom Caucus urges Biden to start debt limit negotiations: ‘We’re ready’

This isn’t just any ordinary debt ceiling increase, it’s a debt ceiling increase that’s come after more than two years of heavy inflation — inflation that we were told at first, was just short term.”

Authored by the JEC’s Democratic members, the report warns that “debt-limit brinkmanship” alone could be costly. The panel notes that in 2011, when the nation was recovering from a recession, a fight over raising the debt limit saw the S&P 500 decline by 17% and interest rates jump nearly three-quarters of a percent.

If the same result were to happen today, the centrist-leaning Third Way think tank estimates that 401(k) retirement savings accounts could lose $20,000. JEC Democrats say the impact could be worse for individuals trying to buy new homes, cars, or those trying to start a small business.

Overall, the committee Democrats estimate that if interest rates climb then individuals would pay:

— $800 more on a car loan.

— $2,500 more over the life of a small business loan.

SEE ALSO: Speaker McCarthy readies GOP demands for debt ceiling battle with Biden

— $54,000 more over the span of a 30-year mortgage, or about $150 more per month.

— $4,200 on the life of a private student loan.

Sen. Martin Heinrich, New Mexico Democrat who chairs the JEC, said the report should serve as a wakeup call for voters.

“If it costs you $54,000 more to buy a home and to get a mortgage, is that any different than having your taxes raised by $54,000, over the same period?” Mr. Heinrich said.

The analysis comes as House Republicans have ruled out raising the debt limit without getting Senate Democrats and President Biden to agree to spending cuts.

“Why are we having a banking crisis? Because government spent too much and created inflation,” said House Speaker Kevin McCarthy, California Republican. “Should we do exactly what the president is saying, just lift the debt ceiling and create more inflation and more banking problems?”

GOP leaders and Mr. Biden have not shown any signs of moving to resolve their impasse.

Treasury Secretary Janet Yellen, who has warned that the U.S. will run out of money to pay its bills by early summer, said this week that failing to raise the debt limit would invite an economic “catastrophe.”

White House officials have dismissed the idea of negotiating, saying that both parties piled onto the national debt and the federal government has a constitutional requirement to make good on its fiscal obligations.

“Like the president has said many times, raising the debt ceiling is not a negotiation; it is an obligation of this country and its leaders to avoid economic chaos,” said White House Press Secretary Karine Jean-Pierre.

Some Republican and Democratic lawmakers agree that the Constitution requires the federal government to honor its debt, which currently stands above $32 trillion. The requirement means that even if Congress refuses to raise the debt ceiling, incoming tax revenue will be used to pay the roughly $500 billion in annual interest owed to the nation’s creditors.

“There’s a reason why everyone says the debt ceiling is a bad hostage to take in budget negotiations,” said a centrist Republican lawmaker, who privately expressed reservations about the party’s stance on the debt ceiling. “If you’re taking a hostage, everyone needs to believe you’ll shoot the hostage if you don’t get what you want. We can’t really shoot the debt ceiling because the Constitution says you have to honor the debt.”

During this fiscal year, which started on Oct. 1, the federal government has borrowed nearly 30 cents of every dollar spent. If it can’t borrow, it can spend only what it takes in, which means it will stop paying — or default — on some of its obligations.

At that point, the government would enter uncharted territory.

“Without raising the debt ceiling, the federal government would be obligated to keep paying interest on its debt and funding mandatory spending programs like Social Security and Medicare,” said David Ditch, a federal budget analyst at The Heritage Foundation. “But that leaves little money for other programs, including food stamps, unemployment benefits, tax credits, homeland security, among others.”

Other analysts say there is no way the Treasury Department could pick and choose which bills to pay. For one thing, the department says it doesn’t have the technical capabilities. Ms. Yellen has criticized a House GOP proposal for Treasury to prioritize which bills to pay.

When Treasury faced a debt showdown in 2011, the department considered options such as selling assets, imposing across-the-board trims or prioritizing programs. Treasury officials concluded that the “least harmful” option was to delay all payments.

How that squares with the Constitution remains to be seen. The 14th Amendment says “the validity of the public debt of the United States … shall not be questioned.”

• Haris Alic can be reached at halic@washingtontimes.com.

Please read our comment policy before commenting.