OPINION:

Montanans call their state “The Last Best Place,” and for gun owners, it may be just that. Their political leaders actively defend the constitutional rights of Montanans and the rest of us as well. Greg Gianforte, Montana’s Republican governor, is a gun guy who suspended his campaign for a day or so in 2020 to go bear hunting, bought himself a rifle to celebrate winning his primary, and gave his wife a shotgun to celebrate their wedding anniversary.

Few Americans even knew that until a week ago, credit card companies were planning to identify gun and ammunition purchasers via a special code in one more sinister attempt by the government and international anti-gun activists to create a federal gun registry. Progressives have been attempting to circumvent the prohibition against such a registry for decades.

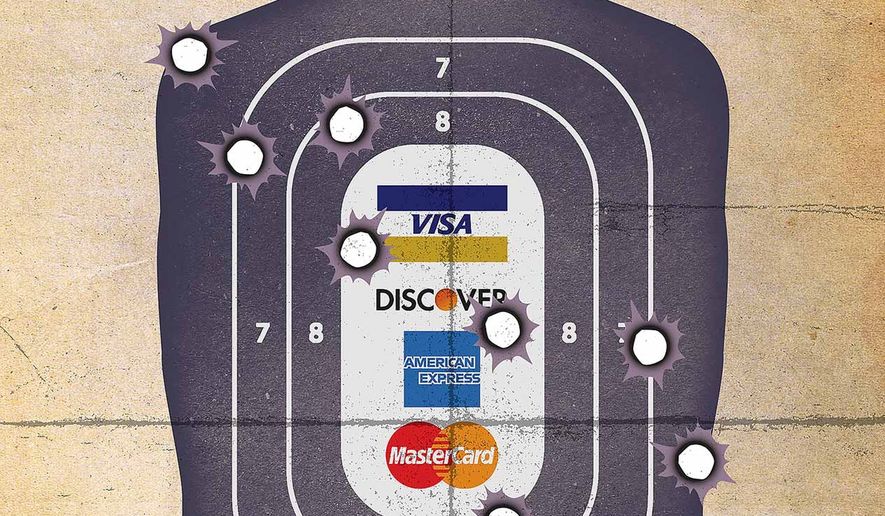

Those plans were scrapped last week, thanks to an effort led by Montana Attorney General Austin Knudsen, who has emerged as a hero to gun owners around the country. Last week, Visa, Mastercard, Discover and American Express announced that the companies are “pausing” their announced plan to track gun store customers via the code developed for that purpose.

Few Americans even knew this was brewing, but gun owners viewed it as just the latest and perhaps most insidious attempt by the government in partnership with international anti-firearms activists to get banking institutions to create a federal gun registry, something that they see as an existential threat to gun ownership.

In the wake of 9/11, the National Security Agency amassed “mega data” from phone records to track or identify “terrorists.” The American Civil Liberties Union went to court to challenge the NSA’s spying on Americans. This unearthed an internal FBI memorandum on how to use metadata to track and identify American gun owners. The National Rifle Association joined the suit, and the courts eventually reined in the NSA. Like the censorship efforts with Twitter, the Biden administration continues to work with private and international groups to further policies it cannot implement directly.

Originally proposed by a New York Times reporter and advocated by Sen. Elizabeth Warren, Massachusetts Democrat, the idea of tracking gun sales through credit card companies floated around for several years until Amalgamated Bank of New York began pressing for the code in 2021. The New York Times describes Amalgamated as “the left’s private banker.”

The New York Post reported that Amalgamated Bank’s “deep ties to the Democratic Party and its support for liberal and leftist political causes may make it a new model for how progressive corporations, politicians and activists can work together to push favored causes outside the political process.”

Amalgamated and friends went to the innocuous-sounding International Organization for Standardization, a multinational organization that operates under the radar to develop “merchant category codes (MCCs)” used by credit card companies to categorize customer purchases and preferences.

The standards-setting group initially resisted but eventually rolled over, bought into the plan and began pressuring major credit card companies to use the new code. Discovery was the first to sign on, followed by Visa and Mastercard. A major victory for the anti-Second Amendment lobby was on the horizon.

Mr. Knudsen got wind of the change and quickly recruited other state attorneys general to hold credit card companies accountable. Several states began debating legislation to ban the practice. Last week, the companies cried uncle and at least temporarily got off this progressive bandwagon, but Mr. Knudsen and others say a “pause” is not enough.

“They shouldn’t just ‘pause’ their implementation of this plan — they should end it,” he said.

But the left will not give up. The Obama administration, through the Department of Justice and federal banking regulators, developed “Operation Choke Point” to pressure banks to refuse services to gun manufacturers and retailers that represented what the government referred to as “reputational risk.” That program was ended after a public furor in 2017. Still, two years later, American Banker magazine reported, “efforts to use banks as a lever for broader social change are just getting underway.”

The prediction is chilling as libraries, parents, pharmacies, and other century-old institutions feel the pressure to conform. Progressives, politicians and their allies within the business community are banding together to enact what could never pass congressional or constitutional muster.

Mr. Knudsen was right to insist that a pause isn’t enough. Regulators and credit card executives have admitted that they will go further if they get their way. Algorithms will allow the reporting of individual gun purchases to law enforcement so the buyers can be monitored.

The war for freedom and law rages, but today, we can all thank the commonsense dedication of Montana officials who have shed light on this battle for all of us.

• David Keene is editor at large at The Washington Times.

Please read our comment policy before commenting.