Republicans in Congress are proposing an expansion of the Child Tax Credit that would boost refunds and include credits for unborn children.

Rep. Ashley Hinson, Iowa Republican, proposed the package of legislation, known as the Providing For Life Act. Ms. Hinson’s measure includes nine other bills aimed at bolstering federal benefits for families.

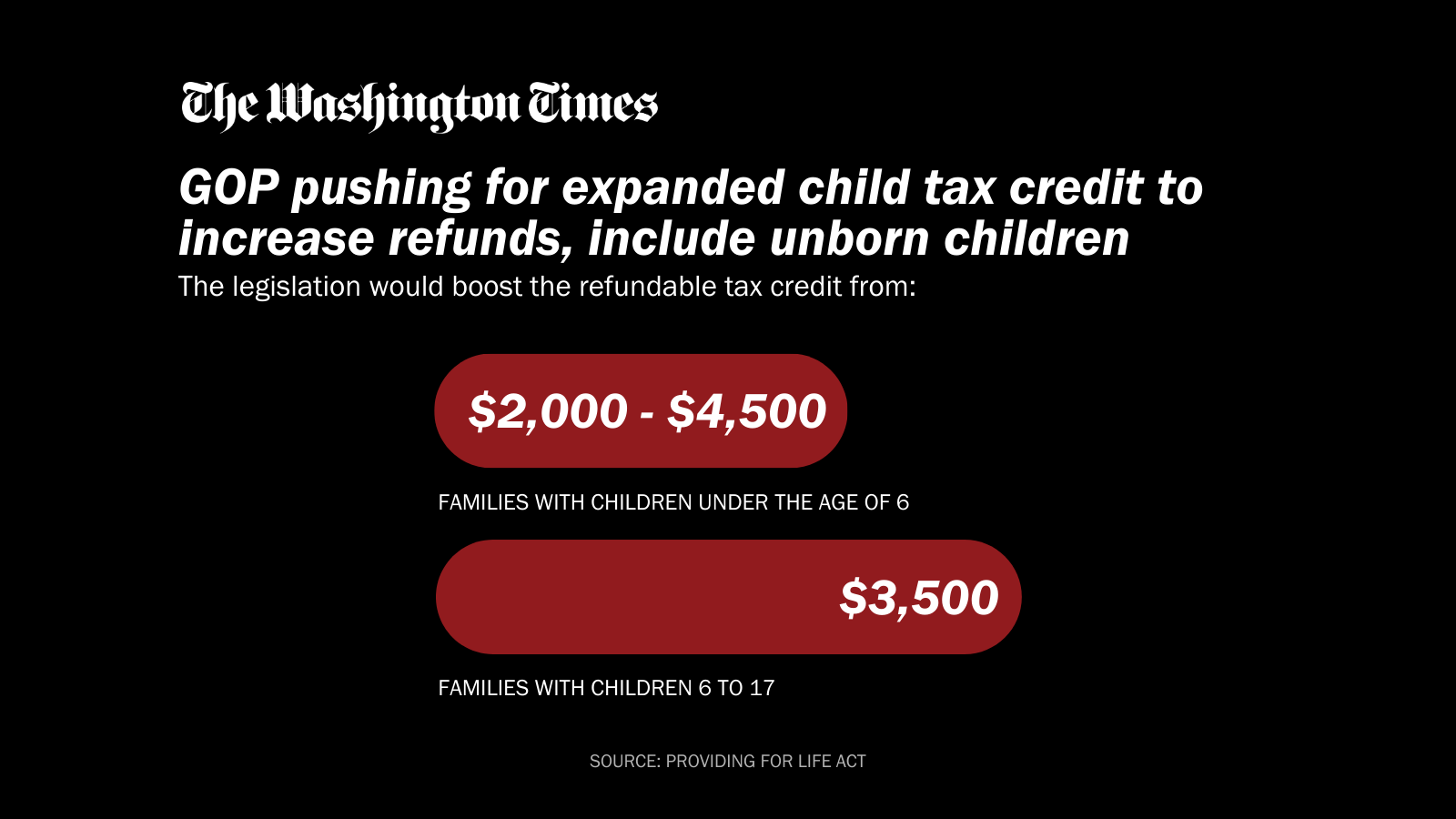

The legislation would boost the refundable tax credit from $2,000 to $4,500 for families with children under the age of 6, and $3,500 for families with children 6 to 17. Unlike the COVID-19 pandemic version of the credit, parents would have to be employed to be eligible for the refunds.

Another provision would retroactively expand the Child Tax Credit to unborn children. Parents would be able to claim the credit from the prior year when they were pregnant. They would also be eligible for the credit for the current year after their child is born.

The bill would also make the Adoption Tax Credit fully refundable. That credit was worth $14,890 in the current tax year for adoptions finalized in 2022.

Ms. Hinson said in a statement that her bill “charts the policy course for a culture of life in America.”

“By expanding the Child Tax Credit to include the unborn and provide additional relief to working families, empowering women to care for their babies and families regardless of socioeconomic status or ZIP code, and expanding access to community resources, we can protect the most vulnerable, make a meaningful difference for those in need, and strengthen all families,” Ms. Hinson said.

Other provisions tucked away in the expansive legislation include allowing families to access up to three months of Social Security benefits for paid parental leave.

The bill also would set up incentives for states to build guidelines that require fathers to pay for half of an expecting mother’s pregnancy costs, would mandate cooperation with child support requirements for SNAP benefits and would reroute $100 million in federal funding for “work activities” to help fathers make child support payments.

Ms. Hinson’s legislation follows the popular pandemic-era version of the Child Tax Credit, which saw families with children under 6 eligible for refunds up to $3,600. The now-defunct version of the credit also allowed for refunds of $3,000 for children between the ages of 6 and 17. Democrats pushed to make the previous version of the Child Tax Credit permanent but failed.

Sen. Marco Rubio, Florida Republican, introduced the Providing for Life Act in the Senate earlier this year.

“Supporting pregnant mothers and their unborn children is essential, not just because it’s the right thing to do, but because America’s continued strength depends on the next generation,” Mr. Rubio said in a statement. “This comprehensive legislation will provide real assistance for American parents and children in need. We need policies like these to show America that conservatives are pro-life across the board.”

Correction: An earlier version of this story misspelled Rep. Ashley Hinson’s name.

• Alex Miller can be reached at amiller@washingtontimes.com.

Please read our comment policy before commenting.