The cost of diesel fuel is soaring while regular gas prices fall, putting even more pressure on higher U.S. shipping and consumer prices.

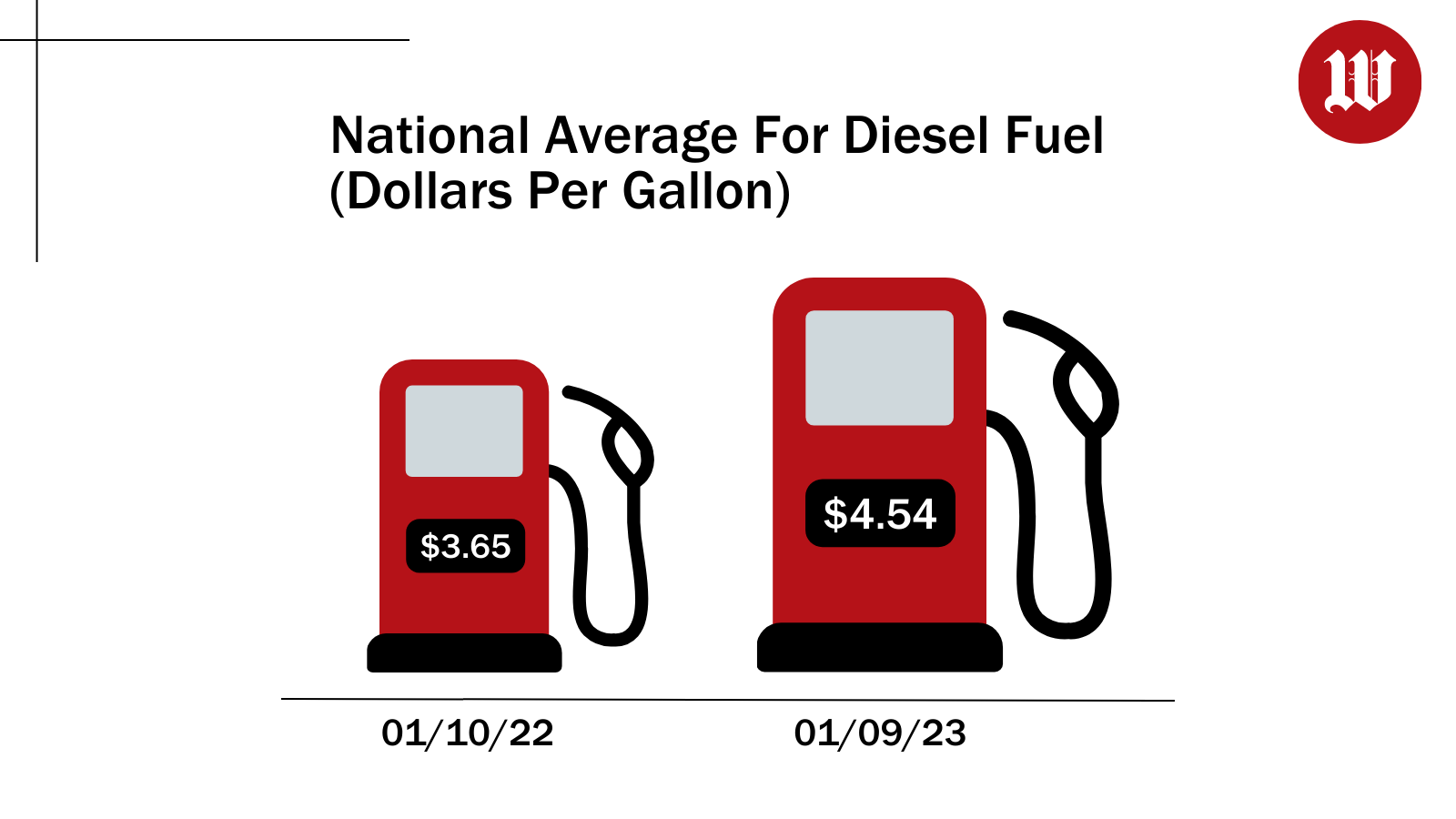

The national average for a gallon of diesel hit $4.54 this week, up nearly $1 from a year ago, according to the latest data from the Energy Information Administration. In California, where diesel averages a national high of $5.44 a gallon, the price is up about 70 cents.

The average regular gasoline price on Monday hit $3.25 a gallon, down more than 3 cents from last year, the EIA said.

“Higher fuel prices absolutely mean higher costs for transportation, which increases the costs of consumer goods,” said Louis Campion, president of the Maryland Motor Truck Association.

Higher diesel prices deliver a “one-two punch” of increased expenses and less business for the 91% of companies that operate six or fewer trucks, he said in an email.

“Spikes in gasoline and diesel prices ripple through the economy, impacting consumer budgets and business investments, creating a whole host of inflationary pressures that have serious impacts on the freight economy,” Mr. Campion said. “If people have to spend more on gas, they may begin spending less on other goods and services that will disrupt normal, seasonal freight patterns.”

Commercial trucks in the U.S. consume roughly 36 billion gallons of diesel annually to deliver a variety of goods, including online shopping orders and frozen poultry for neighborhood markets.

Diesel prices have soared during the COVID-19 pandemic partly because of increased demand for shipping during the winter and farm equipment fuel, analysts say. At the same time, inventories are running short and U.S. refining capacity is down about 2 million barrels a day from pre-pandemic levels.

Although President Biden tapped the Strategic Petroleum Reserve last year to tamp down skyrocketing gas prices, the White House has not taken similar action to lower diesel costs.

“This large difference in diesel and gasoline prices is very unusual, especially for such a long period,” said Lucian Pugliaresi, president of the Washington-based Energy Policy Research Foundation Inc.

Boycotts of Russian energy stemming from the invasion of Ukraine have led to a global substitution of diesel for natural gas in much of Europe and Asia, he said in an email.

Because of the war, Europe has received many diesel imports that otherwise would have gone to the U.S.

Those conditions limit the ability of U.S. officials to manipulate diesel prices, as the White House tried to do with gasoline by releasing fuel from the strategic reserve.

“Being the fuel of work, diesel is more influenced by global demands for shipping, construction, etc. Gasoline markets are traditionally more locally determined,” said Allen Schaeffer, executive director of the nonprofit Diesel Technology Forum in Frederick, Maryland.

The surge in online shopping during the pandemic has kept shipping demand high, and it shows no signs of slowing.

Diesel prices will keep rising for several years unless the Biden administration reverses some green energy policies, said Myron Ebell, an energy specialist at the libertarian Competitive Enterprise Institute.

“The cost of every item in a store or delivered directly to your door goes up when delivery costs go up,” Mr. Ebell said in an email. “I think it’s fair to say a substantial part of the inflation we’ve seen is due to higher freight costs, and that’s mostly caused by higher diesel prices.”

Supplies of liquid fuels distilled from oil refining are at their lowest levels since the federal agency started tracking them in 1951, according to the EIA.

The agency estimates that inventories of distillate fuel oil have been below a five-year low (2017-2021) since the start of last year and more than 20% below a five-year average.

Diesel advocates blame the shortfalls on increased refinery maintenance, the pandemic, labor shortages, slowed production and “green” pressure to convert the shipping industry to renewable energy.

“Production has been slowing due to refineries either closing or being reworked into biodiesel production as part of a politically based renewable energy agenda,” said Joe Trotter of the American Legislative Exchange Council, a network of conservative private investors and state legislators. “This hurts consumers because refineries can only turn out about half as much biodiesel compared to traditional refining.”

Some cyclical factors suggest that diesel prices will cool on their own as recessionary pressures grow over the next few months.

Industry insiders point out that seasonal refinery maintenance has largely concluded, the harvest season is over and rising inflation and tightened credit access have slowed freight demand.

Diesel engines of all kinds already use renewable biodiesel fuels. About 132,000 barrels a day of biodiesel and renewable diesel fuel poured into the U.S. market in 2021, according to the Diesel Technology Forum.

“The slowing U.S. economy will drive down demand for diesel, lowering prices and easing overhyped supply concerns,” Mr. Schaeffer said.

Some businesses are acting to lower diesel costs at the pump.

On Tuesday, convenience store chain Sheetz announced that it would lower diesel prices by 50 cents a gallon at its locations nationwide for the rest of the month.

Company officials said the cut would save roughly $10 for midsize trucks, $12 for full-size trucks and $60 for semitrailers to fill an average fuel tank.

• Sean Salai can be reached at ssalai@washingtontimes.com.

Please read our comment policy before commenting.