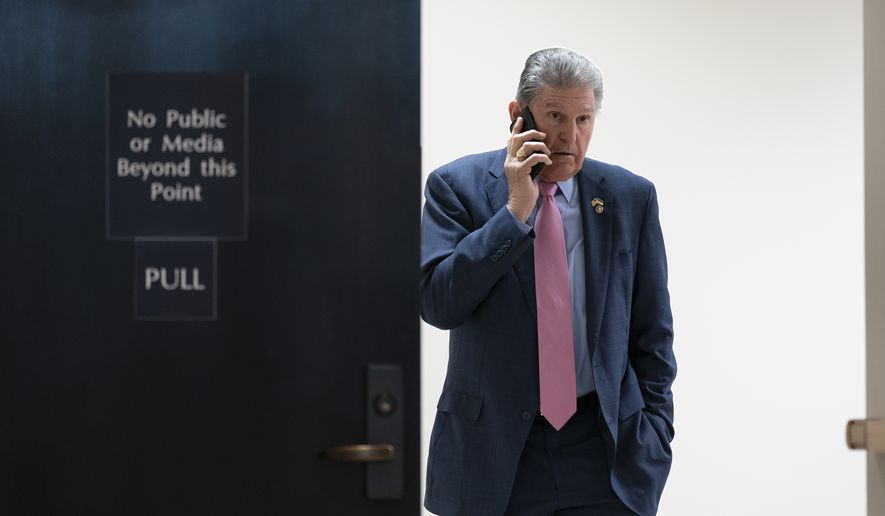

Sen. Joe Manchin III is offering a word of caution for enthusiasts of environmental, social and governance investing, or ESG, saying that the practice of considering climate change and other political matters in investments could threaten energy security amid geopolitical risks from Russia.

The Russia-Ukraine war, the conservative West Virginia Democrat said, underscores the need to have a balance between investing in both clean energy and fossil fuels, rather than leaning on ESG, which conservatives call a form of “woke capitalism.”

“Colleges, universities, you have different investment firms — they’re looking only at ESG and not geopolitical risks. They’re not being reasonable [or] practical,” Mr. Manchin told The Washington Times. “If you hang your hat on one thing, without the geopolitical risks — just ask Europe what they’ve gone through.”

He emphasized that he is “not criticizing ESG and the overall consideration of ESG and [our] responsibilities” to address climate change.

Rather, Mr. Manchin said both ESG and geopolitical risks “should be considered when we’re making decisions on the energy of our country and energy that our allies need [and] how we’re going to produce that.”

Mr. Manchin’s remarks came as the Senate Energy and Natural Resources Committee, which he chairs, examined the state of global energy security roughly one year after Russia invaded Ukraine. His concerns also came amid a multibillion-dollar campaign by Republican-led states to divest public funds from investment firms such as BlackRock that practice ESG.

He questioned European Commission Director-General for Energy Ditte Juul Jorgensen during a hearing held by his panel Thursday whether she felt Europe has put too many of its eggs in the ESG basket by being heavily reliant on Russian oil and natural gas.

She responded that while ESG will remain prevalent, the war has forced them to refocus more financing on overall energy security, regardless of its climate impact.

“ESG remains an important factor to guide our taxonomy, as an element to guide investors to the extent they want to have a green portfolio or green funds. That does not mean that investments into security of supply are non-relevant. It’s an important selling point, if you will, from a sector perspective,” Ms. Jorgensen testified. “The way we have looked at it in terms of our public financing or European financing is that we will be financing more into the energy transition, but financing into security of supply has been a high priority.”

Mr. Manchin has waded into the hot-button ESG debate in recent weeks.

Earlier this month, he sided with all 49 Senate Republicans in a bid to scuttle new rules from the Labor Department that allow retirement-plan fiduciaries to engage in ESG investing, which critics say jeopardizes the 401(k) accounts of roughly 150 million Americans.

• Ramsey Touchberry can be reached at rtouchberry@washingtontimes.com.

Please read our comment policy before commenting.