OPINION:

The Biden administration is not making it easy on American seniors on Medicare to enjoy the holiday season this year with the possibility of high prescription drug prices under the Christmas tree. The poorly named “Inflation Reduction Act” has a provision that imposes an escalating excise tax on the sale of medicines. The tax kicks in if drug companies do not agree to government price controls. This tax could be called “The Seniors Drug Tax” if it comes to fruition and it will be as welcomed by the elderly as a lump of coal in the Christmas stocking.

One would think that an unpopular new tax on seniors on Medicare within a year of an election would be electoral madness, yet this administration seems convinced that they can spin low poll numbers, a bad economy, high inflation and rising drug prices into victory. Like the fiction that people like a holiday fruit cake, seniors will not be fooled by this administration’s empty rhetoric.

Under the fiction of a negotiation, the government has been empowered to target certain drugs covered by Medicare. Once the drug is on a list, as my friend Ryan Ellis explained in National Review on Sept.20, 2023, “if a company does not accept the price control imposed on the drug, it will be forced to charge a 95% excise tax on the sale of that medicine (on everyone who buys it, not just seniors).” Mr. Ellis makes the case that if the drug company says yes to the mandated drug price, then seniors can expect drug scarcity and less research. If they say no, then the drug is sold with a “95% excise tax on top of the sales price.” Neither of these options are good for seniors.

This is not a typical negotiation between equal parties. Two of the most intimidating government agencies negotiate separately on each drug. The Centers for Medicare & Medicaid Services (CMS) has started the process by issuing a list of the first ten drugs subject to price fixing. The next step is that a price cap is proposed by CMS to the drug manufacturer. As time passes, the Internal Revenue Service (IRS) is empowered to drop the hammer and to rachet up pressure on drug manufacturers by increasing the excise tax on these listed drugs if no agreement is reached.

The IRS describes it as hitting 65% for the first 90 days then escalates to 95% if no agreement after 270 days. This is not a negotiation in any sense of the word. If a company does not agree to the mandated price, another punishment that is imposed is the drug being declared not eligible under Medicare Part D plans.

Seniors are being promised cheap drugs, yet this promise is empty if the government comes in and attempts to price fix a drug far below the level that is acceptable to the drug manufacturer. The irony is that the government has accused these companies of price gouging, yet it is the government that would be gouging consumers by doubling the price of a drug. Only a government Grinch would support this type of plan that both taxes the drugs then removes them from coverage from Medicare.

The problem is that government is doing it all wrong. Government is not creating more competition and a freer market to get prices down; they are trying to use government price controls to artificially push down prices. Free markets work and government does not. Just look at our annual deficits hitting $2 trillion a year to see a great example of government not working for the taxpayer. Why would we think that same government bureaucrats who can’t balance a budget can competently negotiate fair drug prices?

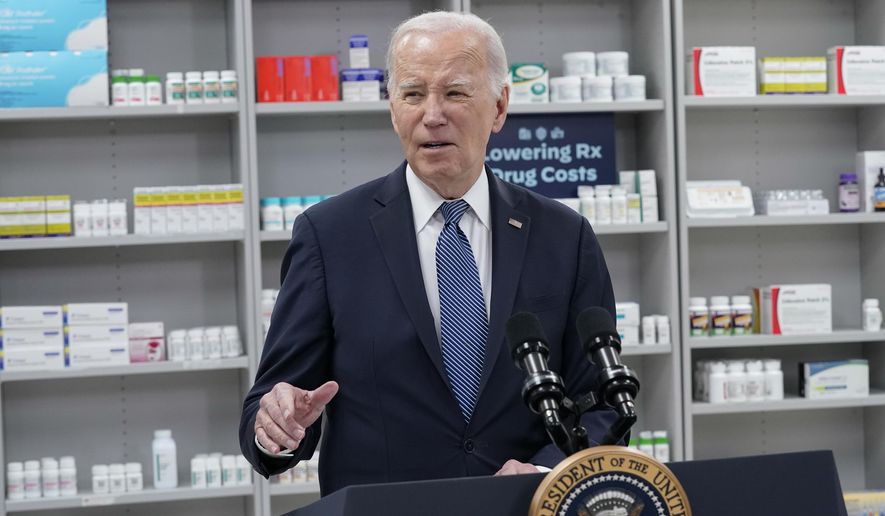

President Biden is proving to be the Grinch that stole Christmas from seniors. While the President falsely claims that the “Inflation Reduction Act” lowered inflation, within that law there was a promise to get drug prices down. To do so, President Grinch is threatening a massive tax on drugs that don’t go along with whatever his bureaucrats set as a fair price.

• Christian Josi is a veteran political strategist and Managing Director of C Josi & Company, a media relations and public affairs consultancy.

Please read our comment policy before commenting.