The Congressional Budget Office revised its projections Tuesday, saying it now expects the federal government to run a $1.7 trillion deficit this year as inflation hits Uncle Sam hard.

Just a few months ago, CBO said the deficit would be $1.5 trillion this year. But the government is still struggling to collect anticipated revenue even as spending rages unchecked, splashing even more red ink across the budget for fiscal year 2023.

The grim new projection comes even though the government got a windfall with the Supreme Court’s ruling in June invalidating President Biden’s broad student loan forgiveness scheme. That will add hundreds of billions of dollars back onto the government’s balance sheet.

But spending is surging so fast that it will quickly eat up all the savings on paper, CBO said.

The biggest single spending increase is the 34% jump — $146 billion more — that the government is spending on interest payments for the public debt. That tracks with the higher interest rates that have plagued the economy under Mr. Biden.

Add a striking shortfall in revenue, and it’s a recipe for the third-worst deficit in U.S. history.

“On the basis of its estimate of the deficit through July and preliminary estimates of revenues and outlays in August and September, CBO now expects that the total deficit for 2023 will be $1.7 trillion, or about $200 billion larger than the estimate it published in May,” CBO’s analysts said. “Revenues and outlays alike are now anticipated to be below amounts CBO projected in May, but the reduction in revenues is larger.”

Through the first 10 months of the fiscal year, Uncle Sam has spent nearly $500 billion more compared to the same period last year.

Revenue, meanwhile, is down more than $400 billion so far this year.

The result is a $1.62 trillion deficit so far, which is already worse than last year’s $1.38 trillion shortfall.

CBO has been warning for months that taxes were running lower than anticipated, with both corporate and individual tax revenue down. But analysts have struggled for explanations.

“The reasons for the difference will be better understood as additional information becomes available; one factor may be smaller collections of taxes on capital gains and other types of income,” the analysts said Tuesday.

Whatever the reasons, the results are bad: CBO now says it figures revenue will come in $400 billion below what it was guessing just months ago.

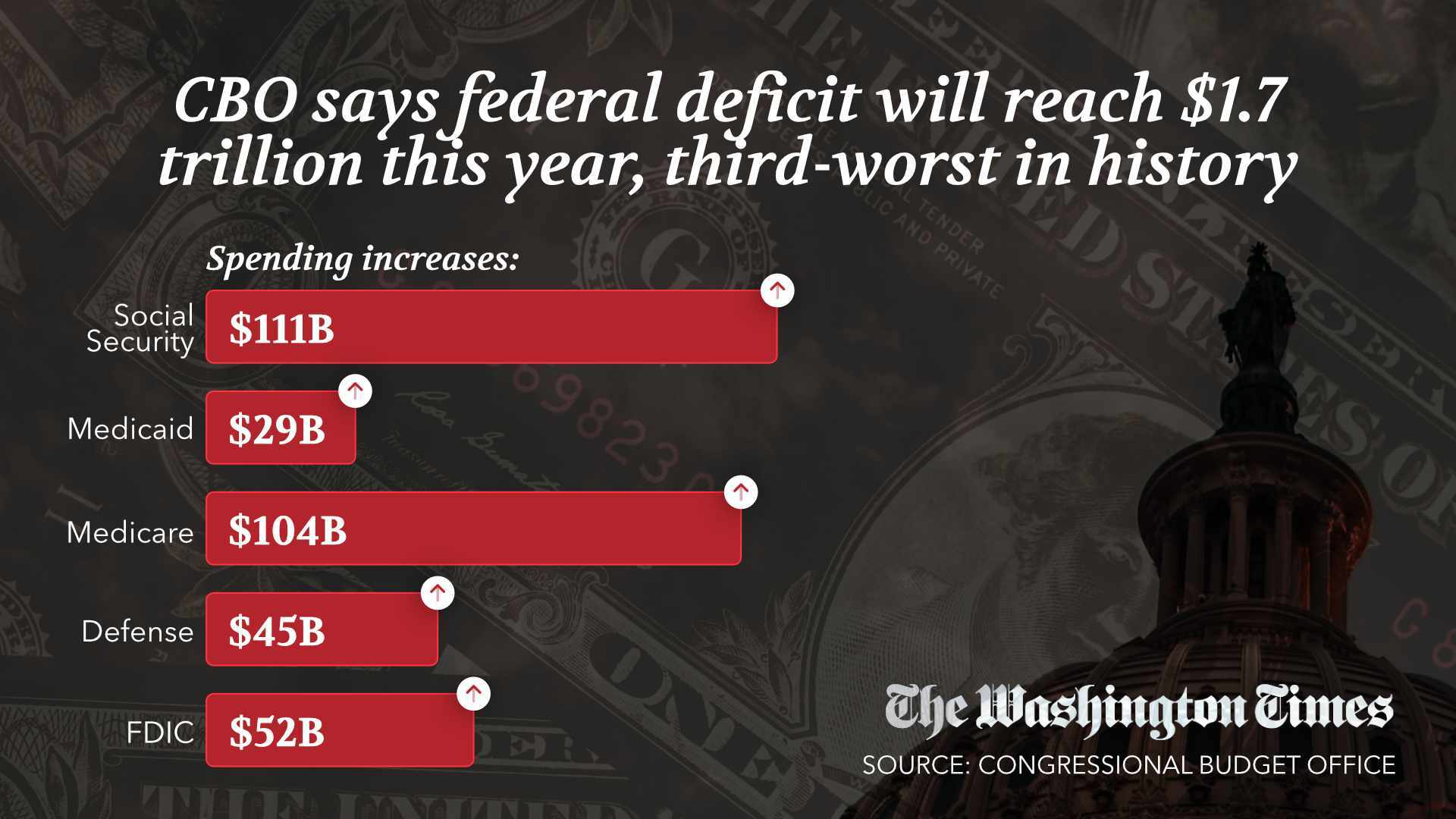

On the spending side, all the big programs are costing more.

Social Security spending this year is up 11%, or $111 billion. There are more people getting checks, and inflation drove up the size of each check, too.

Medicare spending is up $104 billion, or 18%, and Medicaid spending is up $29 billion, or 5%.

Veterans spending is also up, with more people seeking medical care and the cost of treatment rising. Defense spending is up $45 billion this year, with operation and maintenance costs rising.

This year’s bank failures have also cost Uncle Sam, with the Federal Deposit Insurance Corporation seeing a $52 billion increase in its spending. Officials do expect to recover much of that money over the next few years.

CBO’s monthly numbers are estimates. The Treasury Department will announce final figures from April later this week.

• Stephen Dinan can be reached at sdinan@washingtontimes.com.

Please read our comment policy before commenting.