Secretary of Commerce Gina Raimondo on Tuesday promised to impose strict guardrails on the $52 billion payout to semiconductor manufacturers that President Biden signed into law last month.

She said the government would “look after every nickel of taxpayer money.”

The Commerce Department is starting to dole out the funds that include $28 billion in “leading-edge” semiconductor manufacturing, $10 billion in new manufacturing capacity and $11 billion to strengthen U.S. leadership in semiconductor research.

Ms. Raimondo sought to tamp down criticism that the funding amounted to corporate welfare for already profitable companies.

“This is not a blank check for companies,” Ms. Raimondo told reporters. “There are clear guardrails on this money and the Department of Commerce intends to be vigilant and aggressive in protecting taxpayers.”

She added that the money could not be used for stock buybacks and that the government dollars are meant to enhance rather than replace private investment, and the U.S. taxpayer dollars cannot go to develop leading-edge semiconductor technologies in China.

“These are some of the most stringent taxpayer protections and guardrails we’ve ever had,” Ms. Raimondo said. “We’re going to look after every nickel of taxpayer money.”

The government also can claw back funds from companies if they are misspent or if companies fail to put them to use, according to Ms. Raimondo.

“Make no mistake about it, we will use that clawback authority if, after giving the money to a company, they fail to start their project on time, fail to complete their project on time, or fail to see the commitments that they’ve made,” she said.

Ms. Raimondo led classified briefings on Capitol Hill during the administration’s final push to move the stalled chip funding bill across the finish line. She warned lawmakers that the U.S. is running out of time to woo chip manufacturers to its shores as other countries offer similar incentives.

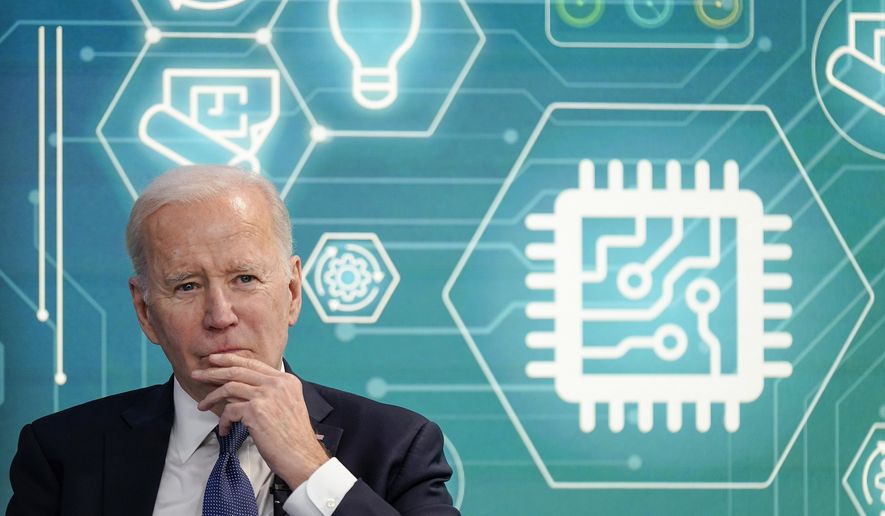

The funding was approved by Congress as part of a $280 billion technology spending bill that Mr. Biden lauded as a “once-in-a-generation investment in America itself.”

“America invented the semiconductor,” Mr. Biden said when signing the bill into law. “And this law brings it back home.”

Passage of the bill in the narrowly divided Congress marked a legislative win for the White House and for Democrats hungry for a policy victory ahead of the Nov. 8 midterm elections.

Proponents of the bill, which includes more than $50 billion in the next five years for chip manufacturing and a 25% tax credit through 2026 for new chip production, say it will reduce America’s dependence on China and resolve a major supply chain issue that has contributed to high inflation.

Without a steady flow of semiconductors, which are used to manufacture a variety of goods such as smartphones, automobiles, washing machines and advanced weapons, proponents warn that the U.S. will be severely hobbled in maintaining economic stability.

Opponents, including some Republicans and self-described democratic socialist Sen. Bernard Sanders of Vermont, labeled it “corporate welfare.”

Several semiconductor heavyweights have linked further investment in the U.S. to the federal subsidies included in the bill.

Micron announced after funding was approved by Congress that it would spend $40 billion in domestic semiconductor manufacturing, creating 5,000 new high-tech jobs, the Boise, Idaho, firm said. Micron says its investment will boost the U.S. share of chip production from 2% to 10% over the next decade.

Qualcomm has also agreed to buy $4.2 billion in chips produced from GlobalFoundries’ upstate New York factory. GlobalFoundries is expected to expand its domestic chip manufacturing footprint to benefit from the federal subsidies under the legislation.

Later this week, Mr. Biden will attend a groundbreaking ceremony in Ohio for Intel’s planned $20 billion semiconductor complex. The groundbreaking was initially scheduled for July, but Intel delayed the start of construction on the new facility until Congress’ final passage of the semiconductor funds.

“These investments have been made by these companies, because the CHIPS Act passed, and they have confidence now that the money will be put out the door,” Ms. Raimondo said.

• Joseph Clark can be reached at jclark@washingtontimes.com.

Please read our comment policy before commenting.