The second in a three-part series: Taiwan in the Crosshairs examines how the island and its nearly 24 million people are holding up under pressure from Beijing’s stepped-up diplomatic and military intimidation campaign. Read part one here.

HSINCHU, Taiwan — Hulking white factory buildings tower over the plush vegetation lining the road that snakes through this city, a place long known as Taiwan’s “Silicon Valley” but increasingly identified as ground zero in a widening cold war between the United States and China.

More than 400 of Taiwan’s highest-level private tech firms are located in Hsinchu, and several of America’s most iconic and influential brands — including Apple, Intel, Microsoft and Lockheed Martin — are either deeply invested in and or heavily reliant on the advanced microchips made here.

“The clients come from everywhere,” said Scott Huang, a researcher at Hsinchu Science Park, whose most prominent tenant is the Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s top producer of chips used in everything from smartphones to F-35 fighter jets.

As China intensifies its threat to absorb Taiwan and force it under the control of the Chinese Communist Party, Taiwanese officials cite the chip manufacturing sector as the linchpin of the island democracy’s strategic relevance. It is a major piece of the argument of why Americans should care about the fate of what might otherwise seem like a distant geopolitical fight for Washington to avoid.

SEE ALSO: SPECIAL REPORT: Ukraine drama has young Taiwanese rethinking the threat from China

Security analysts point to other aspects of Taiwan’s strategic value. The island has one of the more vibrant democracies in East Asia — a bastion of political free speech and U.S.-connected free market capitalism that is closer to China than any other nation in the region. Its prosperity and civil liberties offer daily rebukes to Beijing’s arguments about the superiority of the mainland’s state-guided economic model.

Taiwan’s location, halfway down China’s 9,000-mile coastline and directly between the East Sea/Sea of Japan and the South China Sea, is also vital. Chinese military control over the island could one day give Beijing naval dominance over the shipping of a massive flow of goods around the world.

In any argument about U.S. commitments to Taipei, the government of Taiwanese President Tsai Ing-wen highlights these factors, but it also emphasizes the island’s manufacturing of some 90% of the world’s most advanced microchips.

“If Taiwan’s semiconductor industry is disrupted in any sense, I think it’s going to impact upon the rest of the world,” said Taiwanese Foreign Minister Joseph Wu.

The global supply chain issues of the COVID-19 era hobbled the U.S. car industry and other major industrial sectors for months, but Mr. Wu said those would seem minor compared with the shortages a Chinese attack on Taiwan could trigger.

Chinese President Xi Jinping has been aggressively pushing Beijing’s goal of absorbing Taiwan since 2019 and has warned that China reserves the right to use force at any time to dissolve the democracy. A recent spike in Chinese military drills and China’s neutrality toward Russia’s invasion of Ukraine has sparked fresh concerns that Mr. Xi is preparing for war.

SEE ALSO: Five more years: Xi sticks to his guns as party congress opens in Beijing

The concerns dovetail with fears that China, which lacks the capability to produce microchips at the level of sophistication of Taiwanese manufacturers, wants to take over the ecosystem in Hsinchu or at least bring its most dominant companies under Communist Party control.

U.S. analysts warn about Chinese control of increasingly advanced chips, which are widely seen as the gateway to the future. Rapidly advancing processing speeds are expected to revolutionize human society and weaponry in the coming decades, thrusting the microchip industry into the center of U.S.-Chinese tensions.

The Biden administration is scrambling to block U.S. companies and their Taiwanese partners from selling the most advanced semiconductors — artificial intelligence chips — to buyers in China.

Early this month, the White House authorized the Commerce Department to impose sweeping export controls that also would prohibit sales to China-based firms of elite manufacturing equipment needed for AI chip production.

U.S. lawmakers on both sides of the aisle have pushed for diversification of chip manufacturing and supply chains beyond Taiwan. The effort galvanized in August with President Biden’s signing of the CHIPS and Science Act, which provides some $52 billion in subsidies for companies to build semiconductor manufacturing facilities in the United States.

“The only country in the world that is a source of the most advanced semiconductors is Taiwan, and I would regard that as a resilience risk and also a national security risk,” Treasury Secretary Janet Yellen told an event hosted by The Atlantic in late September. In addition to increased domestic manufacturing, she said, the U.S. is making efforts to work with other “trusted partner countries” to diversify supply chains.

Taiwanese officials say they are not threatened by these developments, but rather seek to embrace them as an opportunity to shift the island away from its trade dependence on China, whose companies purchase substantial numbers of lower-level microchips manufactured in Taiwan.

Taiwanese companies have been scrambling in recent years to increase investments in other countries, including the United States. TSMC began constructing a $12 billion microchip manufacturing plant in Arizona in 2020.

The ‘First Island Chain’

Debate in Washington over Taiwan’s strategic relevance has intensified since August, when China expanded the scope of its military drills and missile tests near the island to protest House Speaker Nancy Pelosi’s visit. The United States has backed Taiwan militarily since the 1950s, but Mrs. Pelosi’s visit was the highest-level official U.S. visit in a quarter century.

The Biden administration responded to the increased Chinese activity by sending U.S. warships through the 110-mile-wide Taiwan Strait between China and Taiwan.

The move underscored Taiwan’s geographic significance to the security of major maritime shipping routes. A Chinese disruption could endanger the free flow of goods to international markets and badly damage the economies of the U.S. and its allies.

“The waters surrounding Taiwan are home to the busiest shipping lane in the world,” Wang Mei-hua, Taiwan’s minister for economic affairs, said at a recent event hosted by the Center for Strategic and International Studies.

“China, Japan, South Korea and many other countries all depend on the shipping lanes to deliver their goods to the world and vice versa,” said Ms. Wang.

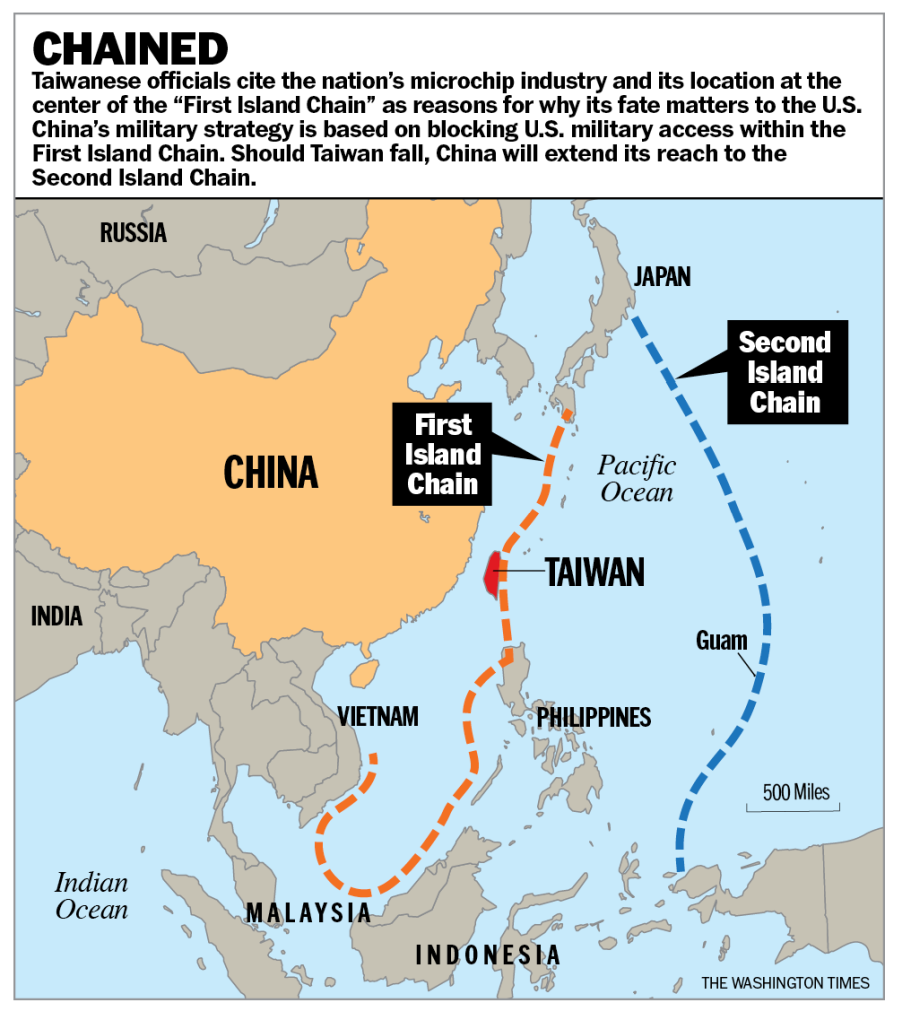

She noted that Taiwan’s location “at the center of the ‘First Island Chain’ of the West Pacific … serves several strategic purposes both offensive and defensive.”

“If Taiwan were to become under threat or be in crisis, it would not only have a severe impact on global shipping and logistics, but it would also have an impact on the political and economic order of the Indo-Pacific.”

Regional analysts emphasize Taiwan’s democracy and free market connectivity as counterpoints in the face of rising Chinese economic and military power.

“Taiwan is the first authentic Chinese democracy and a rival political enterprise to the Chinese Communist Party,” said Andrew Scobell, a distinguished fellow with the China program at the U.S. Institute of Peace. “Taiwan shows up Beijing’s lie that without the Communist Party there is no new China and that China isn’t ready for the kind of democracy that the rest of the world has.

“Taiwan is living proof that Chinese people want democracy and it works quite well,” said Mr. Scobell.

He said Taiwan’s vibrant democracy “influences the calculus in Washington” as Americans view the cross-strait tension as a confrontation between an “oppressive dictatorship and a little democracy.”

Although the Taiwanese population is less than 24 million, the island ranked 16th among the world’s economies in terms of merchandise trade in 2021. What remains to be seen is whether the ranking will improve or decline as Taiwan diversifies its economy by investing in semiconductor operations in other democratic countries.

‘Democratic supply chain’

More than 1 million people of Taiwanese descent are living in the U.S., and even a brief visit illustrates how Taiwan embraces aspects of American culture in nuanced ways.

One of the signature labels of Taiwan’s vaunted Kavalan Whiskey distillery uses American white oak casks imported from Kentucky.

Taiwanese officials say the island’s status as a democracy ties directly to its prowess on the global semiconductor manufacturing landscape and its relevance to the future of a U.S.-aligned global economy.

Mr. Wu told a group of international journalists visiting Taiwan through a program sponsored by the Taiwanese Ministry of Foreign Affairs that other countries “understand the value of having a semiconductor industry or ecosystem, so they would like to have Taiwan make investments.”

“So far, we have been receiving requests to make investments in Japan, in the United States, in Germany, in India, or in Central and Eastern European countries,” the foreign minister said.

“The U.S. demands more and more serious discussions with us, not only with Taiwan but also with Korea and Japan — the so-called ‘Fab Four’ — to form an alliance to make sure that the democracies have [their] own supply chain and it’s not conditioned by the authoritarian country — which is China — and that we are not providing computer chips for China to use in its weapons systems.”

Despite Taiwan’s technological and geographical advantages, some U.S. analysts say Washington should avoid a confrontation with Beijing, the world’s second-biggest economy and the third-largest U.S. trading partner after Canada and Mexico.

Christopher McCallion, a fellow at Defense Priorities, wrote in a recent analysis that fears that China could “seize Taiwan’s chip-manufacturing capacity and leapfrog the U.S. technologically are overblown.”

If China invades Taiwan, Chinese companies will be cut off from vital U.S. and other inputs to the chip manufacturing industry and would be “unable to resume chip production under new management,” he said.

The U.S. should “avoid provoking” China and “seek to dial down the temperature with Beijing,” Mr. McCallion said.

He said U.S. efforts to deter China might encourage Beijing to use force, resulting in a military clash Washington hopes to prevent.

“A war between the U.S. and China would be exponentially costlier than any potential semiconductor supply shock resulting from a cross-strait invasion [by China],” he wrote.

It’s hard to predict how an invasion would impact Taiwan’s high-tech hub. Mr. Huang went to great lengths to credit robust U.S. investment in building up the island’s microchip industry.

“We thank the Americans a lot,” he said.

Mr. Wu echoed the foreign ministry’s sentiment. The “supply chain for Taiwan’s semiconductor ecosystem cannot get away from the United States,” he said.

The foreign minister described Taiwan as part of a “democratic supply chain” and said the “source of our technology is coming from the United States.”

“The United States,” he said, “has supported Taiwan to build this whole ecosystem.”

Hear Guy Taylor on the rising tensions between China, Taiwan and the U.S. on this episode of History As It Happens with Martin Di Caro.

Long a source of contention between China and the U.S., the vibrant island democracy of Taiwan finds itself once more in the geopolitical crosshairs as Beijing has stepped up its diplomatic and military intimidation campaign in recent months. In a three-part series, Washington Times National Security Team Leader Guy Taylor traveled to Taiwan to examine how the island and its nearly 24 million people are holding up under the pressure. The series of exclusive articles looks at how the Taiwanese, especially the young, are reacting to China’s intimidation campaign, how Taiwan’s world-class semiconductor chip industry plays into the crisis and how the diplomatic understandings of the “One China” policy are facing unprecedented strains on both sides of the Pacific. Read the full series HERE.

• Guy Taylor can be reached at gtaylor@washingtontimes.com.

Please read our comment policy before commenting.