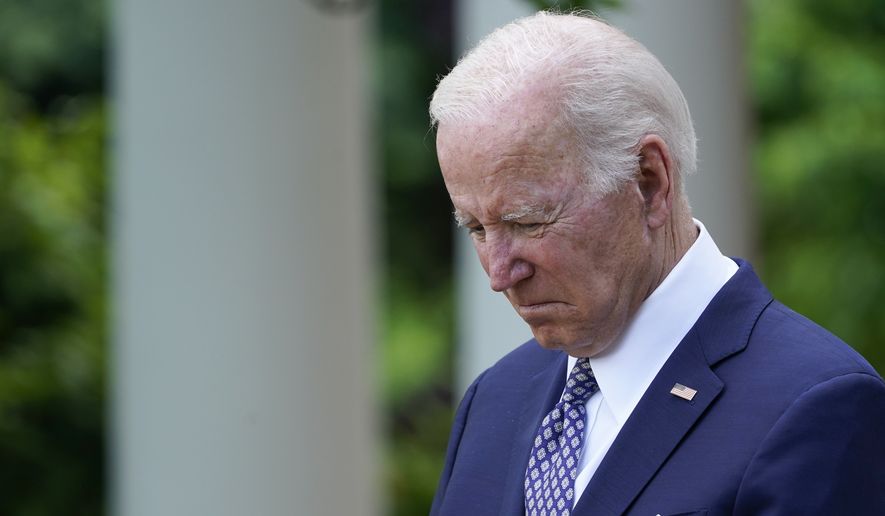

OPINION:

The more President Biden talks about inflation the less we want to hear from him. Real wages are down. Prices are up considerably since he entered the White House. The latest jobs report, while meeting expectations, contains some clues the job market may be softening.

None of this seems to bother the president. Americans may be hurting, but, according to the first of what he says “will not be my only speech” on the subject, inflation is a problem that, while never that bad to begin with, is already on its way to being solved.

Mr. Biden’s policies, and those of progressives like him, are directly connected to the price spikes we’re all seeing. Suppliers have been put in a position where they can’t respond to increases in demand by increasing production. Instead, they and we must do more with less, a costly solution to say the least. Americans born during or after the Reagan administration have never experienced inflation like this. Those of us who remember the 1970s also probably remember how the trio of rising interest rates, inflation and unemployment kept us or our parents up at night, giving us something to fear besides “fear itself.”

The president seems to have missed this. He’s blamed the current crisis on almost everyone and everything other than his own economic and regulatory initiatives. His war on energy is driving up the price of gasoline. His war on competition is pushing the cost of food and other essential goods higher. His war on markets is stopping producers from increasing production to meet rising demand, leading to shortages. A new analysis from the San Francisco Fed found core inflation higher here than in other nations, which the president seemed to dispute in his May 10 speech, and attributable in part to the president’s decision to continue unemployment bonuses and government stimulus as the lockdowns ended.

Rather than recognizing his policies are inflationary, the president wants to double down. Instead of pro-growth initiatives that will increase our purchasing power, he wants subsidies and caps that will make it appear things cost less than they do, something that ironically enough is also inflationary.

The core problem is the Fed, which has dramatically expanded the money supply by ballooning its balance sheet and maintaining zero interest rates for too long. The president doesn’t set monetary policy directly but his picks for the board aren’t exactly inflation fighters in the mode of Paul Volcker either.

The fix is simple but painful. Mr. Biden and his fellow progressives need to stop spending so much of our money on us. Milton Friedman called it years ago when he said, “The only cure for inflation is to reduce the rate at which total spending is growing.” If that happens then Mr. Biden and his congressional party colleagues will have next to nothing to offer their voters come the next election — which is why they won’t go there.

Mr. Biden and company can continue to ignore reality for as long as they like. They’re wealthy enough and insulated enough from the problems of everyday life that they can hold out longer than the rest of us. That doesn’t mean the bad news won’t get worse — it most assuredly will — but they can reassure themselves they won’t hear or feel the ruckus they’ve caused.

The rest of us will. Getting out of the mess we’re in will not be easy. As Mr. Friedman explained, you can’t slow inflation down without unemployment rising and outputs slowing. There is a recession in our future, a Biden recession, that, as awful as it might be is still better than what will happen if inflation continues unchecked.

Please read our comment policy before commenting.