OPINION:

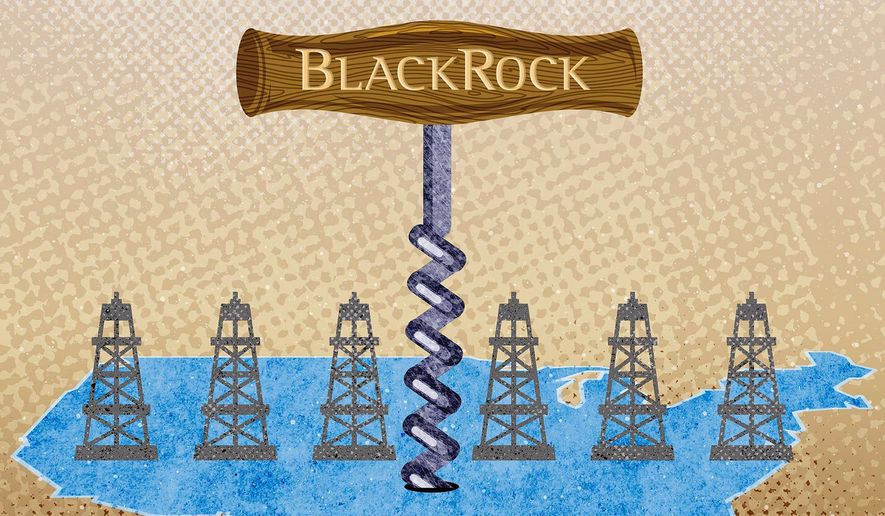

BlackRock, an investment company mostly famous for deciding that oil and natural gas are morally bad investments and, at the same time, being the only American company to sponsor an investment fund in communist China, has decided to hedge its bets a bit.

Reuters has reported that BlackRock and its CEO Larry Fink are trying to convince the world that even though the company announced that it wouldn’t invest in oil and gas companies in the future because it is “committed to supporting the goal of net zero,” that in reality BlackRock “wants to see these companies succeed and prosper.”

This happy talk is too little and too late. Riley Moore, Treasurer of West Virginia, recently announced that his state would not be doing any more business with BlackRock specifically because of the company is hostile to a significant portion of West Virginia’s citizens and how they make a living.

It’s about time.

It’s also about time for Texas and other states to follow West Virginia’s lead and divest from BlackRock for the simplest of all reasons: Blackrock does not have America’s best interests at heart.

The world is starved for energy in large measure because BlackRock and other major financiers refuse to invest in companies that provide the essential, affordable and reliable energy all of us need. Part of the reason we are seeing inflation is because the lack of sufficient investment in energy projects is driving up energy and food prices.

For years, institutional investors and investment banks have rejected investments in fossil fuels. Now the results of those decisions are showing up in high energy prices. Oil is at $100 a barrel. Natural gas prices are high. Coal prices are high. These high prices are starting to hit people in their pocketbooks.

Let’s look at California. Gasoline prices in San Diego are at a record high with the average price of regular at $4.726 a gallon (the average in the rest of the country is $3.52). California’s average residential electricity rates are 23.76 cents/kWh — that’s 87% higher than Nevada’s rates, 93% higher than Arizona’s rates, and 108% higher than Oregon’s rates.

California wants to lead America and the world to a net-zero future, but what they don’t like to talk about is how their plans are resulting in crushing “greenflation” for middle and low-income families.

This greenflation isn’t just crushing just families in California. This year, Europeans will see their energy bills rise by 54% compared to 2020. If you believe in the futures markets, next year will be worse.

Much of this is driven by high natural gas prices. What has Europe done to have a secure, affordable supply of natural gas? The U.K. has shale resources, for example, but instead of accessing to those resources, it imposed a moratorium on hydraulic fracturing and spent lavishly on renewables.

Germany has relied on alternative sources for electricity, but this summer, the wind didn’t blow and the sun didn’t shine quite as much as expected. Germany had to turn to natural gas-fired generation to make up the difference. Obviously, the natural gas that was burned this summer to make electricity was not available this winter to heat homes. Consequently, the price of both natural gas for heating and electricity are at record highs in Germany, routinely running five times as much as prices in the United States.

Who knew that natural gas helps keep the lights on and people warm during the winter? Who knew that Russia might not be the most trustworthy trading partner? It is worth contemplating how much more difficult the situation in Europe would be without American liquified natural gas.

Which brings us back to BlackRock and Mr. Fink. Mr. Fink’s 2021 letter to CEOs stated, “It’s important to recognize that net-zero demands a transformation of the entire economy.” We are already seeing the transformation Mr. Fink would like to see in California and Europe — starting with the sky-high energy prices they are experiencing just one year after he wrote that statement.

It’s time for Texas and other states to work to protect their citizens by withdrawing business from BlackRock and others financiers who think that California and European-style policies are helpful. The company and its boss are no friends of the United States.

• Tom Pyle is the president of the American Energy Alliance.

Please read our comment policy before commenting.