NEW YORK — A former U.S. congressman from Indiana, technology company executives and an investment banker were among nine people charged in four separate and unrelated insider trading schemes revealed on Monday with the unsealing of indictments in New York City.

It was one of the most significant attacks by law enforcement on insider trading in a decade and a prosecutor and other federal officials planned a news conference to elaborate on the cases that they said resulted in millions of dollars of illegal profits for the defendants, who were situated on both coasts and in middle America.

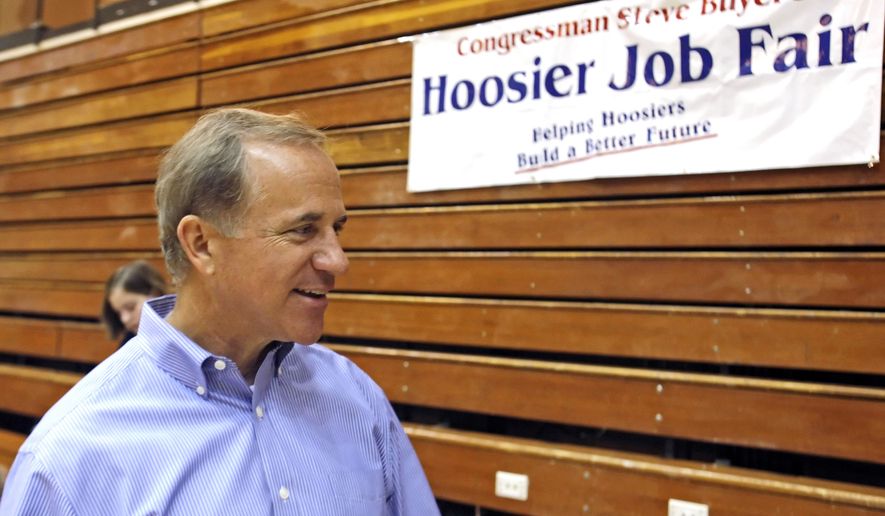

One indictment identified Stephen Buyer as someone who misappropriated secrets he learned as a consultant to make about $350,000 illegally. Buyer, a Republican congressman from 1993 through 2011, served on committees with oversight over the telecommunications industry, the indictment said.

Buyer was accused in court papers of engaging in insider trading during a merger of T-Mobile and Sprint, among other deals. Documents said he leveraged his work as a consultant and lobbyist to make illegal profits.

In a civil case brought by the Securities and Exchange Commission in Manhattan federal court against Buyer, he was described as making purchases of Sprint securities in March 2018 just a day after attending a golf outing with a T-Mobile executive who told him about the company’s then nonpublic plan to acquire Sprint.

“When insiders like Buyer - an attorney, a former prosecutor, and a retired Congressman - monetize their access to material, nonpublic information, as alleged in this case, they not only violate the federal securities laws, but also undermine public trust and confidence in the fairness of our markets,” Gurbir S. Grewal, director of the SEC Enforcement Division, said in a release.

SEE ALSO: Uber admits to hiding 2016 data breach exposing riders and drivers, avoids prosecution

In a second prosecution, three executives at Silicon Valley technology companies were charged with trading on inside information about corporate mergers that one of them learned about from his employer.

In a third case, a man who was training to be an FBI agent allegedly stole inside information from his then-girlfriend who was working at a major Washington D.C. law firm. According to court papers, he and a friend made more than $1.4 million in illegal profits after he learned that Merck & Co. was going to acquire Pandion Therapeutics.

In a fourth indictment, an investment banker based in New York was charged with sharing secrets about potential mergers with another with an understanding that the pair would share illegal profits of about $280,000.

Please read our comment policy before commenting.