OPINION:

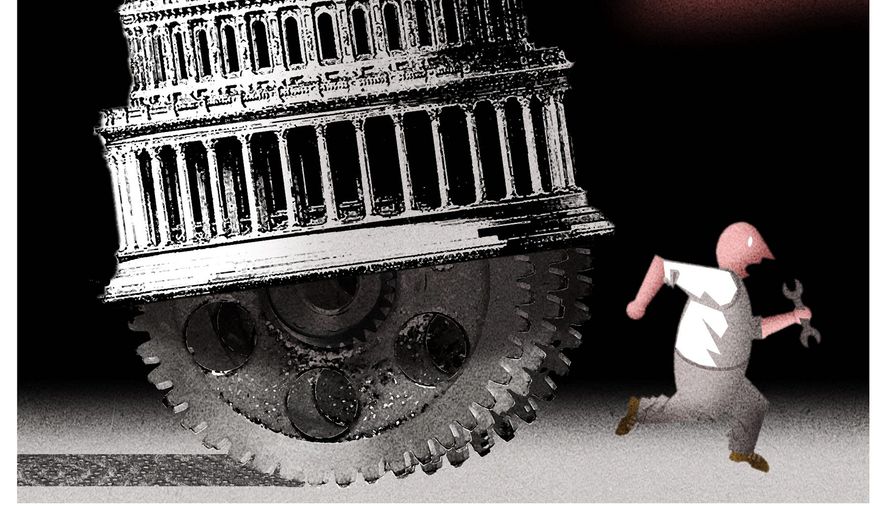

Can we stop arguing over worker classifications already?

Over the past few years, there’s been a lot of debate regarding worker classifications, particularly independent contractors — those persons and small businesses that provide goods or services under a written contract or a verbal agreement.

In 2019, California passed its Assembly Bill 5, which affected how thousands of businesses classify these workers. That law was so sweeping that voters in the state had to approve the exclusion of larger ride-share companies like Lyft and Uber from the legislation or risk losing those services.

In early 2021 the House of Representatives passed the PRO Act, which, among other things, would have forced some employers into classifying more independent contractors as employees. The law never made it past the Senate. Still, supporters in the Democratic party vow to fight on (many of the provisions are included in the Build Back Better bill, which would be up for consideration again in 2022). I know many labor attorneys expect to see changes from the Labor Department that may incorporate some of the worker classification provisions included in the bill.

New York State is considering changing its worker classification and independent contractor rules. Changes are also being considered in Massachusetts and New Jersey.

But why? Supporters say that employers — particularly ride-share and delivery platforms — take advantage of these workers by denying them benefits, rights and protections. Opponents say these changes are just a ruse to create more potential unionized workers. But a recently published comprehensive survey of 10,348 of these workers conducted by Pew Research clearly supports the position that these people don’t want to be employees at all. They want to be entrepreneurs.

The study found 78% of Americans who have ever earned money through ride-share and delivery platforms say that their own experiences with these jobs have been at least “somewhat positive,” including 24% who describe it as “very positive.” A much smaller share (17%) describe their experience in negative terms. The study found that these positive sentiments extend across demographic groups. Clear majorities of gig workers, regardless of age, gender, racial and ethnic background or household income, report having a good experience with these jobs.

Gig workers, contractors, freelancers — whatever you’d like to call them — are also happy to be considered entrepreneurs. Thirty-five percent say a major reason why they have taken on these jobs in the past year is that they “wanted to be their own boss,” 32% say they did this “for fun” or “to have something to do” in their spare time and 28% report not having many other job opportunities in their area as a key motivation for doing this work.

Are the companies that use these freelancers abusing them? Not according to the Pew study.

“By and large, current or recent gig workers are satisfied with some of the key aspects of their jobs and think companies who run these platforms are fair when it comes to pay and assignments (although there is less consensus when asked about benefits),” researchers say. The report found that a majority of people who have earned money through many of the popular ride-share, delivery and other platforms in the past 12 months say the companies that run these apps or sites have been “very or somewhat fair” when it comes to how their jobs are assigned (72%) or their pay (64%).

Independent contracting has become so popular that numerous organizations like the American Association of Independent Contractors, the Professional Association of Independent Contractors and the On Demand Independent Contractors Association, as well as the National Federation of Independent Businesses, have grown to provide benefits for hundreds of thousands of their members who enjoy the pros of entrepreneurship but also want representation to look after their interests.

Many small businesses, like my own, don’t want changes to the current worker classification rules either. My company uses a dozen or so freelancers for specific tasks, many of whom have worked for me for over a decade. They enjoy their freedom and flexibility. They can pick and choose their jobs and independently determine the rates they charge me. They get their health insurance through health exchanges or through a spouse. They’re happy.

“If enough of my clients can no longer work with me as a freelancer as a result of this new law, I’ll most likely have to get a full-time job, take a pay cut, work longer hours than my current 25 hours a week, lose my flexible schedule and autonomy, and miss out on being a primary caregiver to my child,” says Mary Kearl, a professional freelance writer and marketing consultant.

I’m sure there are freelancers out there who are being treated unwell by some companies. But, being freelancers, they have the option to choose to provide their services elsewhere. Would the PRO Act — or the worker classification provisions in the Build Back Better bill or now being considered by the Labor Department — help by allowing them to be part of an employee union? Perhaps. But, as mentioned above, there are already many organizations that can represent their interests.

And c’mon folks: Aren’t there plenty of bigger issues that the Biden administration and Congress should be addressing in 2022? Thanks to recent research, and given what we now know about American gig workers, independent contractors and freelancers, maybe it’s time to end this debate and move on.

• Gene Marks is a CPA and owner of The Marks Group, a technology and financial management consulting firm specializing in small- and medium-sized companies.

Please read our comment policy before commenting.