The Democratic-controlled House Ways and Means Committee on Tuesday voted to make public former President Donald Trump’s tax returns, taking the unprecedented step of using congressional power to expose an American’s private financial information.

The move, executed in a party-line vote, will satisfy Democrats’ longtime yearning to see Mr. Trump’s taxes that he refused to release during the 2016 presidential campaign, breaking with the tradition of presidential candidates presenting their tax information to voters.

However, The Washington Times learned exclusively, the information being released included identifiable information about the former president’s 16-year-old son Barron, including his Social Security number.

A source familiar with the closed-door debate said the final hour led to a shouting match between lawmakers, and no GOP amendments were accepted by Democrats.

The committee’s Republicans said the Democratic members had set a precedent for politically motivated use of Congress’ authority over the IRS and Americans’ tax returns.

“If they make private information public today, it will be a regrettable stain on this committee and on Congress that will make American politics even more divisive,” Rep. Kevin Brady of Texas, the top Republican on the committee, said.

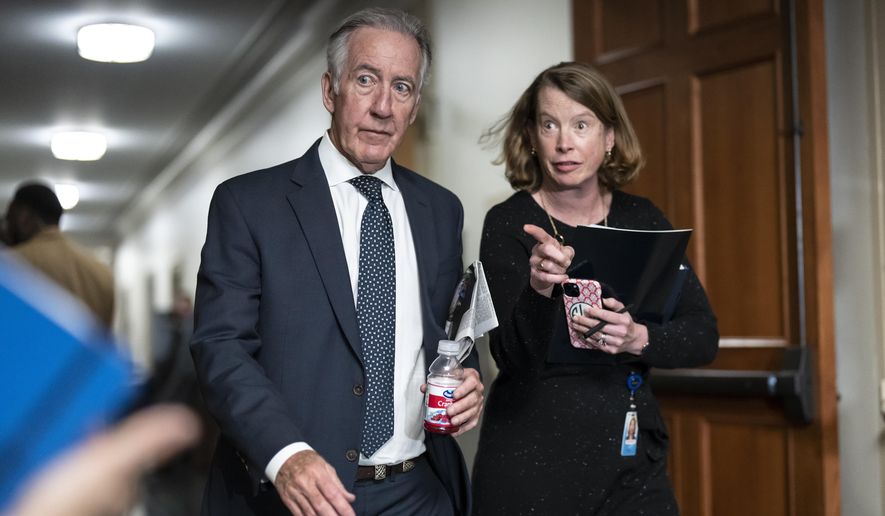

Committee Chairman Richard Neal, Massachusetts Democrat, said everything the committee did was above board.

“This was not about being punitive. This was not about being malicious and there were no leaks from the committee. We adhered carefully to the law,” he said after the vote.

The committee, which oversees the Internal Revenue Service, debated the issue behind closed doors for more than four hours before taking a vote in an open meeting. It was one of the final partisan battles of the Democratic-controlled 117th Congress.

Mr. Neal said the documents, roughly six years of Mr. Trump’s tax returns, would be redacted of personal information such as Social Security numbers.

Democrats have long sought Mr. Trump’s financial records, citing public accountability for their requests to obtain them.

Rep. Dan Kildee, Michigan Democrat, dismissed Republican claims that the move was politically motivated, because his party will only remain in power for less than two weeks.

“I don’t swear an oath to be a member of Congress until a month before the end of elections or the end of the year,” Mr. Kildee said. “We do our job right until the very end and the only reason this timing is what it is, is not because of us. We moved in the spring of 2019. In fact, some were critical of Mr. Neal for not moving more quickly. We moved pretty quickly.”

The committee’s wrangling over the tax returns came a day after the House Jan. 6 committee sent the Justice Department criminal referrals accusing Mr. Trump of inciting or assisting an insurrection against the U.S. government, obstructing an official proceeding of Congress and conspiracy to defraud the government.

The Justice Department, which was already investigating Mr. Trump, is not compelled to follow Congress’ recommendation for criminal charges.

The Ways and Means Committee has had access to Mr. Trump’s taxes for weeks since the Supreme Court rejected the former president’s bid to prevent Congress from obtaining the records. The ruling arrived without a dissenting opinion and put an end to a three-year court battle over Congress’ access to Mr. Trump’s tax records.

Mr. Neal first wrote to the IRS in the spring of 2019 asking to inspect parts of Mr. Trump’s various business dealings. He called it a duty for his committee to ensure all Americans are abiding by the nation’s voluntary federal tax system, which includes extending that oversight to the White House.

Mr. Neal’s request was granted because of a 1924 law that gives the head of the Ways and Means Committee and the Senate Finance Committee the power to request and receive the tax returns of any American.

“Nearly four years ago, the Ways and Means Committee set out to fulfill our legislative and oversight responsibilities, and evaluate the Internal Revenue Service’s mandatory audit program,” Mr. Neal told The New York Times in a statement. “As affirmed by the Supreme Court, the law was on our side, and on Tuesday, I will update the members of the committee.”

Mr. Trump broke with tradition when he refused to voluntarily release his tax returns as a presidential candidate. The former president justified it by saying he was being audited at the time.

The intrigue surrounding Mr. Trump’s tax returns intensified after a 2020 New York Times report that found he only paid $750 in federal income tax in 2016 and no income taxes at all in 10 of the last 15 years because of personal financial losses.

At the time of the report, Mr. Trump accused the paper of illegally obtaining the records, calling it a “politically motivated hit piece full of inaccurate smears.”

• Mica Soellner can be reached at msoellner@washingtontimes.com.

Please read our comment policy before commenting.