OPINION:

The IRS is supposed to keep a sharp eye on nonprofit organizations that enjoy preferred tax status. And yet, it was recently discovered that 76 phony charities hiding in plain sight (all registered with the same New York City post office address) earned the IRS’ stamp of approval.

The scam wasn’t even good. The fake charities adopted names similar to trusted organizations and filed paperwork with the IRS. The IRS had received warnings from real nonprofits with similar names, including the American Cancer Society, that these copycat scam organizations were fraudulent. The IRS rubber-stamped each one. And it’s no surprise. The agency rejects only one out of every 2,400 applications for new nonprofit groups.

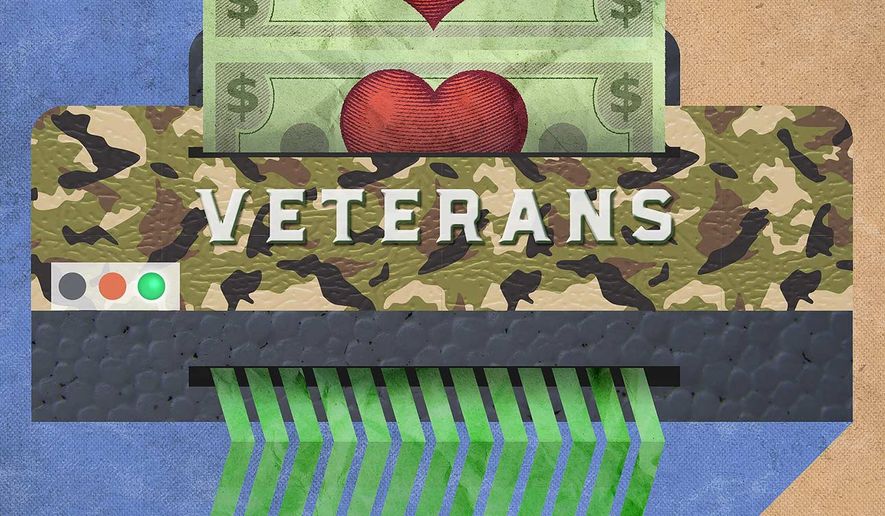

Aside from the intentional abuse of donor intent, many legitimate charities are poorly managed by people with little experience handling large sums of money or delivering program services. Veterans charities are among the worst offenders in this category.

In an average year, Americans donate more than $1.2 billion to groups that support vets and their families. Too many of these charities over-promise and under-deliver at the expense of their donors and of those they claim to support.

Consider three well-known veteran charities: Tunnels to Towers, the Wounded Warrior Project and the Disabled Veterans National Foundation. You have probably seen their ads on TV or been solicited at home by one or more of them. Over the last two years, these three organizations collected hundreds of millions of dollars from donors who expect their money to be spent wisely.

According to recent tax filings, one of the three organizations has overhead costs of just 6%. Another spends five times as much on overhead. The third spends more than 70% of the money they receive in overhead expenses before a dollar reaches veterans in need. But, short of inspecting their tax filings, how would you know which is which?

There are others that squander more than half of their donations on overhead expenses for rents, salaries, etc. Some groups maintain a relatively low overhead but keep too much of their donations in the bank or investments. Some have held back enough donations to run themselves for a decade. Donors are deceived when their gift is stashed in an overly funded rainy-day reserve. For veterans and families in need, every day is a rainy day.

Despite these different financial profiles, all veteran charities appear similar from the outside. They promise a range of benefits from housing support to scholarships to providing service dogs and more. Doing the research to decide where you want to donate without having your money mismanaged can be time-consuming and sometimes requires a paid subscription.

The IRS isn’t doing enough to protect patriotic donors. It recently became apparent to myself and others that America needs a no-cost internet research service like a Consumer Reports targeted at veteran charities. So, we made one.

The Robert Alexander Mercer Veterans Foundation reviews dozens of veterans charities and recommends which are worthy of your investment.

Our recommended charities, which can be found at CharitiesForVets.com, have each proven to be efficient, effective stewards of their donations. They keep overhead spending to a minimum and pass other financial tests while fulfilling their mission. And you can quickly check — if you are curious — which of the three named charities mentioned above runs the more efficient organization.

Nearly a billion dollars are donated annually to charities we do not recommend. We encourage donors to seek out the best ones who are making a difference. The RAM Veterans Foundation will help.

• Rebekah Mercer is president of the RAM Veterans Foundation.

Please read our comment policy before commenting.