A key Republican lawmaker is pressing the Treasury Department to examine the proposed acquisition of Forbes Global Media Holdings by a China-based enterprise that got its initial seed money from an arm of the Communist Party.

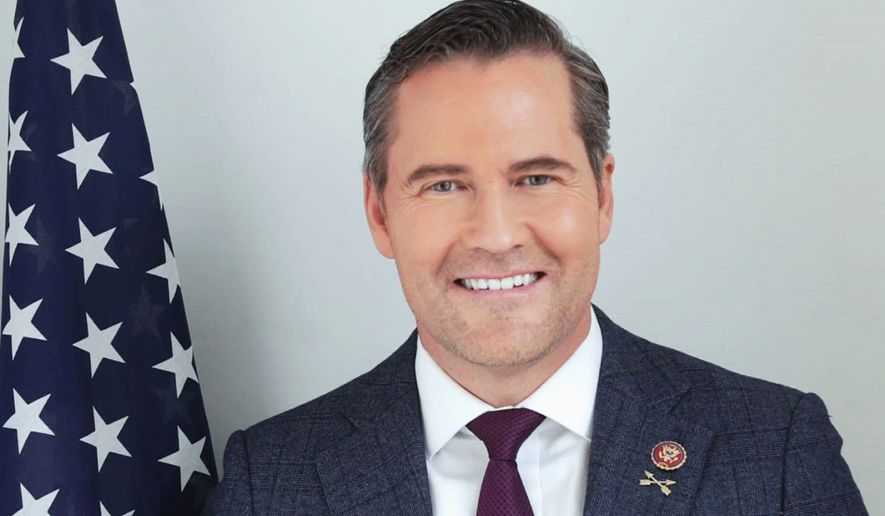

Florida Rep. Mike Waltz, a member of the House Armed Services Committee and the House GOP’s China Task Force, wrote this week to Treasury Secretary Janet Yellen asking if the “ongoing acquisition” of Forbes — long a beacon of free-market capitalism — is under review by Treasury’s Committee on Foreign Investment in the United States (CFIUS), which probes foreign entity takeovers of American companies for national security concerns.

“Forbes has served as a champion of free press in its reporting on capitalism and democracy,” wrote Mr. Waltz. “We’ve seen the [Chinese Communist Party] utilize its own media platforms to spread propaganda with the intent to weaken the United States’ standing in the world. … Should the [party] have a major footprint in a respected U.S. media entity, they will be able to spread that propaganda through a platform here at home.”

The Treasury Department did not immediately respond to a request from The Washington Times for comment about the letter, which Mr. Waltz’s office said was dated April 24.

The congressman penned the letter roughly a month after The Times first reported that Republicans on the House Permanent Select Committee on Intelligence were investigating whether the Chinese government is attempting to exert influence over Forbes Global Media Holdings.

Forbes has sharply denied being singled out by the intelligence committee, and a spokesman for the company said last month that any suggestion of Chinese government influence over Forbes’ operations is “completely unfounded.”

However, correspondence obtained by The Times shows GOP members of the committee began probing the issue late last year, as executives at the New Jersey-based publisher of Forbes magazine worked on a major deal with a China-based special acquisition firm, or SPAC, called Magnum Opus Acquisition Ltd.

Under the proposed $630 million deal, which Forbes publicly announced in August, the iconic business media brand would transition into a publicly traded company on the New York Stock Exchange as part of a merger with the Hong Kong-based Magnum Opus.

According to SEC filings, China’s sovereign wealth fund, China Investment Corp. (CIC), provided seed money for the investment company. With total assets worth more than $1 trillion, CIC is one of the world’s largest sovereign wealth funds.

Some in the national security community question whether the entity is a conduit through which Beijing seeks to wield influence over Chinese financial firms’ investment decisions in public and private companies around the globe.

SEC filings show CIC owned a roughly 5.8% stake in Magnum Opus when the deal with Forbes Global Media Holdings was announced, although the filings also show that China Investment Corp. has since disposed of its shares.

Mr. Waltz raised questions about CIC’s involvement with the Forbes deal in his letter to Ms. Yellen.

“It is my understanding that, [on] March 25, 2021, Magnus Opus received its seed funding from CIC. Two days later, on March 27, representatives of Magnus Opus met with representatives of Forbes,” the Florida Republican wrote. “In August, Forbes Global Media Holdings and Magnus Opus announced they had come to a definitive business combination agreement. Suspiciously, CIC reportedly sold its shares in the SPAC at the end of 2021.”

“As you are aware, CIC is a financial arm of the Chinese Communist Party (CCP) and the timing of Magnus Opus’ meeting with Forbes’ representatives so soon after receiving its seed money from CIC raises questions about the initial intent of investment,” the congressman added. “The potential ownership of a major American media company by an arm of the CCP raises serious national security concerns and whether the deal should be allowed to move forward.”

Mr. Waltz asked Ms. Yellen whether the proposed acquisition of Forbes has come under review, adding, “If not, why?”

• Guy Taylor can be reached at gtaylor@washingtontimes.com.

Please read our comment policy before commenting.