OPINION:

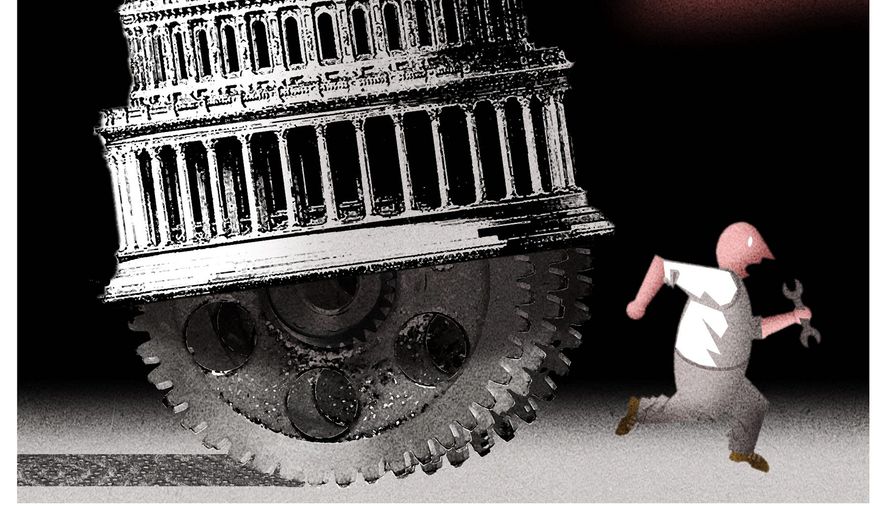

Polls show most Americans would like to be their own boss. The upcoming reconciliation bill could dash those dreams. One provision would make it almost impossible for many Americans to work independently.

The reconciliation bill will include the “PRO Act.” Among other changes, the PRO Act writes California’s AB 5 into federal law. AB 5 famously – or infamously – changed how California defines self-employment. AB 5 made classifying workers as independent contractors hard, converting many into employees.

AB 5 was targeted at gig economy jobs, like ridesharing with Uber and Lyft. Gig workers set their own schedules and decide who to work with. Gig workers cherish this flexibility. Many have family obligations that make a “traditional” 9-to-5 job impossible. Federal law generally treats them as independent contractors.

Labor unions dislike that; they cannot unionize the self-employed. Unions would much rather that the companies gig workers contract with formally employ them. That gives them an employer to bargain against. Unions wrote AB 5 and lobbied the California legislature to pass it.

The bill turned most gig workers and freelancers into employees, along with many other independent contractors. This made firms legally responsible for their newly-designated employees’ actions. They also had to comply with California’s extensive employment regulations.

However, many companies could not afford to bear those costs. So they simply stopped hiring contractors. This hurt self-employed Californians up and down the state. Community theaters closed. They could not operate under the new rules. Youth athletic programs were cut. They could not use contractors as coaches and referees. Music festivals were canceled. Their bands had been contractors too. Freelance writers. Golf caddies. Wedding photographers. AB 5 took away their livelihoods.

AB 5 particularly hurt Californians with disabilities. Being able to work from home and set their own schedule is often essential for them. Many cannot work a traditional job. But AB 5 sharply restricted these opportunities. Similarly, their caregivers often need to work from home or control their schedules. AB 5 made this impossible. One Californian mother explained: “AB5 is why I had to pack up my very ill husband with stage 4 cancer and autistic son and leave the state. There is no way I can take care of our family and work a ‘traditional’ type job. I have always worked for myself and paid my taxes. I was terrified of becoming homeless.”

California’s legislature quickly recognized AB 5 was hurting people. Less than a year after passing it, they exempted dozens of occupations. Two months later, California voters overwhelmingly approved a ballot initiative exempting rideshare drivers too.

The PRO Act would import AB 5’s self-employment test into the federal National Labor Relations Act – with no exceptions. Everyone that California’s overwhelmingly Democratic legislature recognized needed out would become an employee under federal law.

Now Democratic leaders in Congress plan to include the PRO Act in the upcoming $3.5 trillion reconciliation bill. There are rumors they may similarly change the tax code’s definition of an independent contractor too. What is not yet clear is if these changes could bypass a Senate filibuster. If the Senate parliamentarian rules the AB 5 language can pass on a party-line vote, AB 5 could become law nationwide.

If that happens, many Americans will never become their own boss. And many currently self-employed Americans will share the pain of the California woman who lamented: “I lost my job of 12 years as a medical transcriptionist because of #AB5. Many in this profession value the flexibility in hours and working from home more than employee status. Now I have no money at all.”

• James Sherk is the director of the Center for American Freedom at the America First Policy Institute. He previously served as a special assistant to the president in the Domestic Policy Council at the White House during the Trump administration.

Please read our comment policy before commenting.