The lucrative $50,000-per-year journalist tax break that Democrats have tucked within President Biden’s multitrillion-dollar social welfare bill is estimated to cost taxpayers more than $1.6 billion over the next decade.

A new analysis of the legislation by the Joint Committee on Taxation, a special congressional panel made up of 10 senior lawmakers from both chambers of Congress, found that taxpayers would be on the hook for more than $1.6 billion if the tax credit becomes law.

The credit would allow “local news” outlets to receive a quarterly tax credit, “equal to 50%” of a journalist’s wages up to a cap of $12,500-per-quarter.

Overall, eligible outlets could receive as much as $50,000 annually per journalist in tax breaks through the program in its first year. In subsequent years, the credit would drop to 30% of a journalist’s wages per quarter. Democrats propose to let the tax credit expire after five years unless Congress votes to renew.

Republicans say that it amounts to a giveaway to the “mainstream news media.” They also argue it would create an improper relationship between the federal government and the nation’s leading media outlets, which could be exploited for propaganda purposes.

“Not only is this proposal a grotesque waste of taxpayer money,” said Mr. Johnson, “it would be a dangerous precedent of government collusion with the media. Biden’s collusion with the press has already caused enough damage to freedom of speech and freedom of the press.”

As written any “local newspaper publisher” that serves “the needs of a regional or local community and who employs no more than 750 employees” would be eligible. The criteria are broad enough to cover major newspapers with a national reach.

Democrats dispute such claims, saying the bill is meant to benefit local news outlets, especially those that have seen ad revenues fall because of the coronavirus pandemic.

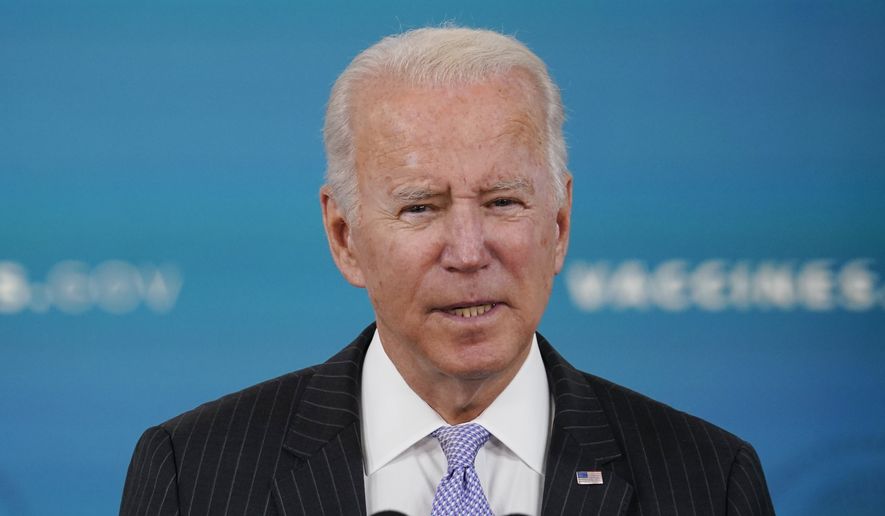

Mr. Biden plans to force the massive spending bill through Congress without support from a single Republican. Democrats will use a special procedure known as budget reconciliation that allows some tax and spending measures to avert the 60-vote filibuster threshold and pass by a simple majority of 51 votes.

• Haris Alic can be reached at halic@washingtontimes.com.

Please read our comment policy before commenting.