OPINION:

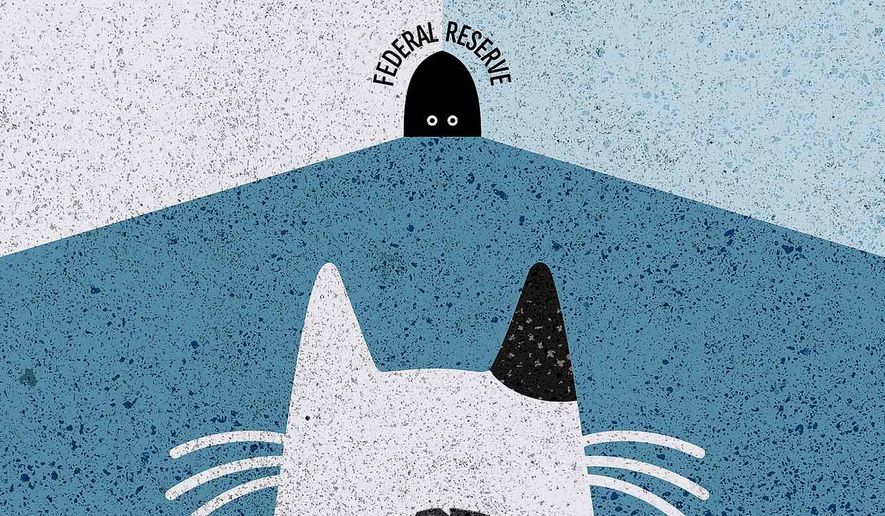

Facing surging inflation and a Democratic Congress hell-bent for leather on deficit spending, Federal Reserve Chair Jerome Powell offers the weakest possible response to pressures for action.

Headline inflation is running at 6.8% — the highest pace in four decades. Neither the recent pullback in gasoline prices nor three vaccine shots in every arm could mitigate the underlying pressures on businesses to raise prices and workers to seek higher pay.

Since November, gas prices have eased about 10%, but that’s after rising 80% from their pandemic low. And gasoline, heating fuels and other energy only account for about 7.5% of the Consumer Price Index.

Apartment rents and the imputed rent on owner-occupied homes constitute about one-third of the index. Real estate values are rising at nearly a 20% annual pace but owing to the difficulties of canvassing landlords and homeowners, those are factored into the CPI with a long lag.

The November CPI reported only a 3.8% annual jump in the cost of shelter. Look for that to rocket to the highest rate in decades and keep headline inflation elevated in 2022.

Farmers are bearing huge jumps in costs for fertilizer, machinery and other materials that will further drive up prices for bread, milk, meat and dairy. Drought conditions in California and the tropics will push up fruits, vegetables and coffee.

We have heard ad nauseam that the pandemic has global supply chains tied in knots and those forces would abate, but then we had the delta and omicron variants. The Greek alphabet has lots more letters, and betting that omicron will be the last new variant to cause havoc is simply wagering against nature.

As long as Asian nations rely too much on quarantines and the less effective Chinese CoronaVac and Sinopharm vaccines, overseas factors and transportation disruptions will interrupt supplies of consumer goods and components for U.S. and European manufacturing.

Shortages of chips won’t abate soon. An environment of uncertainty regarding pandemic-induced changes in consumer purchasing patterns has discouraged investment in new capacity elsewhere.

Even if the global factory sector emerges from the pandemic over the next year or two, the shift toward onshoring and nearshoring, owing to the geopolitical risks of relying on China, will raise costs and prices.

Dealing with climate change and other adjustments in what we consume and how we make products — from electric vehicles to switching existing homes from natural gas and heating oil to electric heat pumps — will raise the cost of just about everything as we move through the balance of this decade.

President Biden’s policies that discourage oil and gas production have empowered the social investing movement. That is pushing up the cost of capital in the petroleum sector and curtailing American production.

Higher fossil fuel prices do little good for the environment — but still drive up the cost of getting to work and heating home — because we cannot get our hands on electric vehicles or retrofit homes fast enough.

The March 2021 $1.9 trillion stimulus package was irresponsible. The money injected into the economy during the Trump presidency had hardly worked its way through and too much new money was dispersed to families who didn’t need it.

The resulting savings overhang — the money that is now chasing too few goods — will likely last into 2023. If the Democrats manage to pass some of their social spending and climate change proposals, that kind of reckless macroeconomic policy will continue to overheat demand for the rest of the decade.

Wages are rising — but not fast enough. According to the Atlanta Federal Reserve, by about 4.3% in the last year.

Surveys by the New York Federal Reserve and Conference Board indicate consumers expect prices to rise more than 6% over the next year, whereas businesses are planning to only raise wages 3.9%.

With labor markets tight, we can expect workers to continue job-hopping. We may not have the union power we did during the 1970s, but the much larger white-collar workforce of our modern era has much better information about what the boss pays and bargaining power.

All that’s a recipe for a self-sustaining, wage-price spiral.

The Fed’s decisions to taper bond purchases more quickly, but not end those until March — and perhaps raise interest rates — still add stimulus. It’s a weak, wait-and-see policy.

The Fed should stop bond purchases and raise interest rates now. Former Fed chair Paul Volcker acted decisively to break inflation, and Mr. Powell should push up the federal funds rate at least a quarter-point at each meeting.

Mr. Powell is simply too timid for the challenges the nation faces.

• Peter Morici is an economist, emeritus business professor at the University of Maryland and national columnist.

Please read our comment policy before commenting.