OPINION:

The Biden administration is deciding whether to restrict or even eliminate a central component of stock trading. This unnecessary big government overreach threatens to make investing prohibitive for individual investors because it could terminate zero-commission trading, which has made buying and selling stocks more affordable than ever.

The deregulation of stock trading commissions opened the door for individual investors to actively participate in the stock market. Opportunities for discount brokerages to competitively set commission rates lowered transaction costs, improved price discovery, and refined services in such a way that it began to bridge the divide between individual and institutional investors.

The transition from fixed-rate commissions to zero commission trading began during the Nixon administration. In September 1973, the Securities and Exchange Commission announced that starting in 1975, fixed-rate commissions on stock trading would be eliminated. This allowed brokers to charge different rates for each trade. Instead of a flat fee for buying 10 or 10,000 shares, market competition would set commission rates.

The SEC’s action significantly lowered the cost of trading for individual investors. According to The Wall Street Journal, brokers immediately cut commissions by at least 50%. This was a watershed moment for individual investors. In 1975, Charles Schwab admitted as much by saying that “deregulation provided the window for people to being to innovate” and that it “turned the whole industry upside down and led to this great mass flourishing of services and pricing and technology.”

When commissions were reduced, the volume of trading increased. In July 1985, The Washington Post reported that trading volume “soared five-fold.”

Another watershed moment occurred when brokers decided to eliminate commissions. In 2013, Robinhood launched and offered zero commission trading. In 2019, Interactive Brokers offered its first zero commission product, IBKR Lite. Soon after, a wave of major retail brokers such as Charles Schwab, Fidelity, TD Ameritrade and E-Trade cut commissions to zero.

Many brokerages have earned revenue by accepting payment for order flow (PFOF), which has allowed them to maintain zero commission regimes. Brokers send trade orders to firms that connect buyers with sellers (e.g., wholesale market makers) such as Virtu, Citadel Securities, Two Sigma and Susquehanna. These firms earn revenue from the difference between the bid and offer price on a trade and pay brokerages a fee for routing the orders for execution.

The market makers compete to provide the best possible execution of each trade. This private competition is lowering costs for individual investors. According to Coalition Greenwich, in 2018, “market makers provided an average of $6.18 in savings per order.” These individual savings amounted to aggregate savings of more than $1.3 billion for individual investors. Additionally, from July 2018 to June 2019, 87% of retail market order shares showed price improvement, and almost 95% of retail market order shares experienced best execution.

A study by Samuel Adams and Connor Kasten also found that zero-commission trading, which is made possible by PFOF, improves order execution quality. Zero commissions reduced the bid-offer spread for market makers, and adverse selection significantly decreased, or in other words, information gaps between buyers and sellers narrowed.

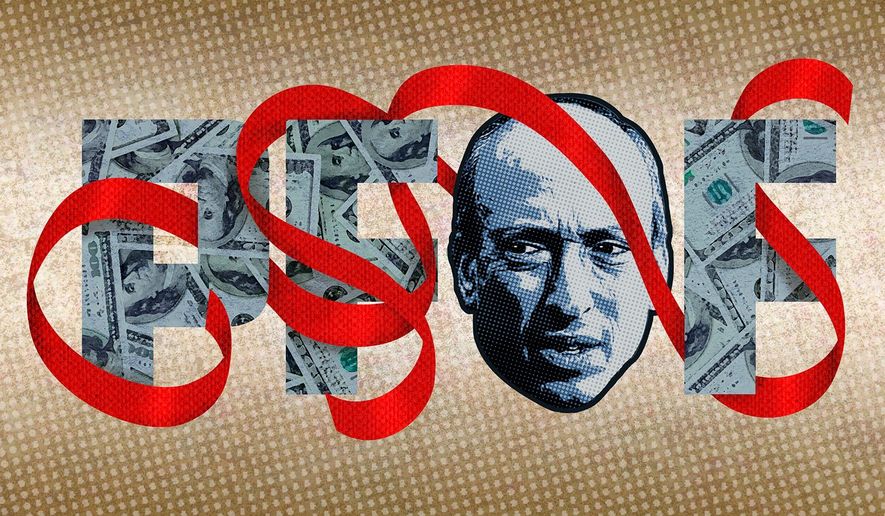

Unfortunately, SEC Chairman Gary Gensler is prepared to increase transaction costs and limit trading options for individual investors.

Earlier this year, Mr. Gensler took a sledgehammer to the discount brokerage industry when he told Barron’s that he was amenable to banning PFOF. It seems that every chance Mr. Gensler gets, he is willing to have his agency wedge its way into free-market competition. First, Mr. Gensler claims private cryptocurrencies are too unwieldy and need more regulation. Now the entirety of the zero-commission revolution is at risk of collapsing if he follows through with his assault on PFOF.

Not to mention, Mr. Gensler’s concerns are unfounded. PFOF results in lower costs for retail investors, market makers and brokers. According to data analyzed by the nonpartisan Congressional Research Service, PFOF has also “indirectly helped generate a surge in retail securities investing.” From December 2019 to December 2020, retail securities investing increased to 23% from 13% of the total trading volume.

Fortunately, some lawmakers in Congress understand the benefits of PFOF and how it has revolutionized stock trading for individual investors. Republican Sen. Pat Toomey of Pennsylvania, ranking member of the Senate Banking Committee, recently introduced the Investor Freedom Act of 2021 (S. 3102). The bill ensures that federal regulators will not punish brokers for accepting PFOF. It also prohibits the SEC or “any national securities exchange or registered securities association” from publishing regulations that would curtail or eliminate PFOF.

The Biden administration’s threats are not to be taken lightly. Taking a proactive stance in the protection of PFOF is taking a position to defend the free-market innovation that has drastically shifted the financial landscape in favor of individual investors.

Less government interference and more deregulatory actions in the equity trading ecosystem will continue to enable individual investors to be active participants in the United States’ capital markets.

• Bryan Bashur is a federal affairs manager at Americans for Tax Reform and executive director of the Shareholder Advocacy Forum.

Please read our comment policy before commenting.