OPINION:

A few days ago, the Congressional Budget Office was rude enough to release its assessment of the actual cost of the infrastructure legislation being considered by the Senate. It turns out that the legislation is not, in fact, paid for by new revenues. CBO estimates that the legislation will add $400 billion to the deficit over the 10-year budget window.

How can that be? The senators who drafted and negotiated the legislation made a huge deal pointing out that all of its spending was offset by “new” revenues without requiring new taxes.

You can think what you like about that – the senators and the Biden administration were lying about the offsetting revenues, or they were simply mistaken, or they don’t really have a good grasp of how the government they lead actually works. Or maybe all three.

In a larger sense, of course, the government has only one source of revenue – taxpayers. Consequently, anything that increases spending necessarily increases taxes over the long run. That should be clear to pretty much everyone over the age of consent.

Is there anything else worth knowing about the legislation?

Well, we’ve learned that it would require ignition interlocks – devices that require you to pass a breathalyzer test each time you start your car – on all new cars In a surprise plot twist, it turns out that a company that manufactures breathalyzers has spent a bunch of money in the past five years lobbying folks to be ready to get this provision into law.

The legislation also pours the foundation for the federal government to impose a new tax based on how much you drive. Forget about the cost – which will be substantial — for a moment. Think about the encroachments on your privacy by the federal and state governments that such a tax would require.

The legislation gives the federal government new and extensive authority to site and approve electric transmission lines, even over the objections of states and localities. Similarly, the legislation shifts authority from the states to the federal government for determining where and how and how much should be spent on building roads and bridges.

These are just some of the bad and poorly developed ideas that have been found in the five days that most people have had to read the 2,700 pages of the bill’s text. There is no telling what other landmines might be hidden in there.

Finally, this legislation tees up an energy tax – one that would cost $4,000 per household — that awaits in the reconciliation.

One more time and louder for the folks in the back: Infrastructure and reconciliation are linked. President Biden has said so. House Speaker Nancy Pelosi has said so. Senate Majority Leader Charles E. Schumer has said so. Sen. Joe Manchin III, West Virginia Democrat, has said so.

We should believe them.

Understandably, Senate Minority Leader Mitch McConnell wants to play nice. He wants to give Mr. Manchin and Sen. Kyrsten Sinema, Arizona Democrat, as much political room as possible so they can pare down the $3.5 trillion reconciliation to something slightly less gargantuan.

But what if he and the other Republicans prepared to vote for this deeply flawed legislation have misread the field? What if humoring Mr. Manchin and Ms. Sinema winds up costing taxpayers $1.2 trillion and the Democrats turn around and only shrink the reconciliation a measly few hundred billion dollars?

What then?

The Republican negotiators of this legislation have already been wrong about whether new revenues offset the new spending. They were careless enough to announce a deal before text had even been drafted, let alone shared with other senators. They were indifferent enough to the Senate process and regular order to allow the legislation to proceed without committee hearings, without mark-ups, without meaningful debate.

They managed to leave the Keystone XL pipeline by the wayside. They failed to get construction of the border wall included, despite the current crisis at our southern border.

It is also understandable that the Republican negotiators are eager to prove that the Senate can still “do something.” Unfortunately, the “something” they are contemplating is a gateway to higher taxes (including energy taxes and taxes on how many miles you drive), higher spending, and a dramatic and substantial transfer of power and authority from states and localities to the federal government.

For the senators who vote for the legislation, the risk is minimal; in most instances, they are insulated by wealth and power from the consequences of this mistake. The rest of us have to live with them.

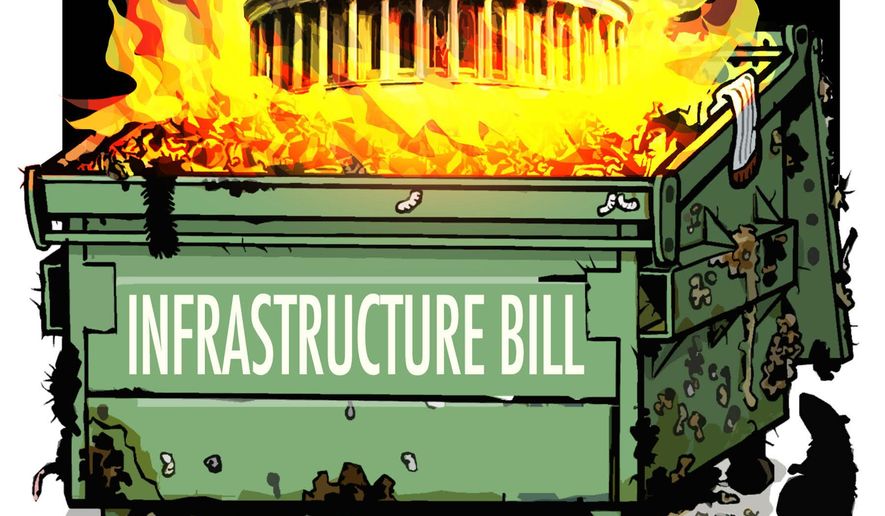

Once again, and hopefully for the last time, no one should vote for this dumpster fire.

• Michael McKenna, a columnist for The Washington Times, is the president of MWR Strategies. He was most recently a deputy assistant to President Trump and deputy director of the Office of Legislative Affairs at the White House.

Please read our comment policy before commenting.