OPINION:

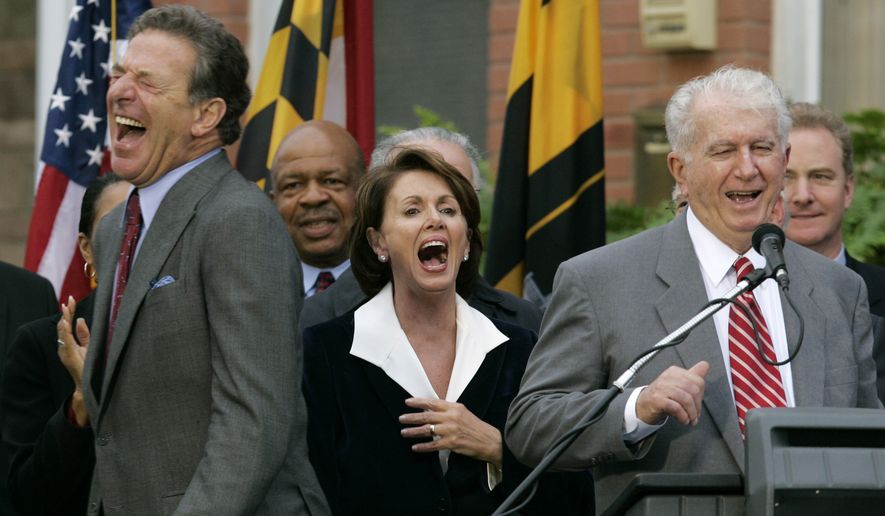

Paul Pelosi, House Speaker Nancy Pelosi’s husband, is one heck of a trader!

He purchased about $10 million in Microsoft shares through call options on March 19th when the stock was trading at $230.35. Days later, Microsoft was awarded a contract by the U.S. Army valued at $22 billion and inked a deal to buy an artificial intelligence firm. Its stock has soared about 12% since Mr. Pelosi’s initial investment.

Now, it could be Mr. Pelosi is just a skilled investor — he owns and operates Financial Leasing Services Inc., a San Francisco-based real estate and venture capital firm, where he and his wife have amassed a personal fortune of about $114 million.

It also probably doesn’t hurt Mrs. Pelosi is the most powerful woman in the U.S. House, tasked with overseeing, regulating and appropriating monies to the executive branch that go to the very firms Mr. Pelosi invests in.

The timing of the Microsoft investment is very suspicious. Mr. Pelosi bought the Microsoft options last year, when the Army was testing Microsoft’s AI headset technology. It was unclear if the Army would have the money to award the contract — after all, the $730 billion defense policy bill that Congress passed in January called for cuts to the initiative.

In February, Microsoft Chief Executive Officer Brad Smith was called to the Hill to testify before Congress. In his testimony, he praised his company’s headset technology, saying it could provide soldiers with “real-time analytics” on remote battlefields and could help in planning hostage rescue operations.

A month later, the Pentagon awarded Microsoft with the $22 billion contract. Who knew what when? It’s not unreasonable to suspect Mrs. Pelosi had some insider insight as to if and when the contract would be awarded. She’s was minority leader last year and is now the Speaker of the House.

But Mr. Pelosi’s good fortunes don’t stop there. Weeks before President Biden signed an executive order to replace the entire federal automobile fleet with electric cars, Mr. Pelosi bought up to $1 million in Tesla stock. Mr. Pelosi has so far seen a 21% return on his investment.

In January of last year, before the coronavirus shut down the economy, Mr. Pelosi purchased Amazon and Facebook stock, which have netted him more than $1 million in paper profit as the companies have thrived during the pandemic.

In late February, after Mrs. Pelosi received a private coronavirus briefing, Mr. Pelosi paid up to $3.3 million to buy technology stocks, including Slack Technologies, which makes messaging software that exploded as people started to work from home.

Mr. Pelosi’s savvy investing is the reason why the Stock Act was signed into law in 2012 to help combat congressional insider trading. A year prior, CBS’ “60 Minutes” exposed how Mrs. Pelosi stalled legislation that would harm credit card company Visa, as her husband bought into its initial public offering, garnering the couple a handsome profit.

Over the years, the Stock Act has been weakened. There was supposed to be a searchable online database to track Congress’ financial disclosures to make insider trading and conflicts of interest easier to detect. It was scrapped by Congress in a subsequent bill a year later without debate. Disclosures of large stock trades are still required within 45 days and insider trading is still illegal — it’s just harder to find the data.

Websites like “Unusual whales” have popped up, which aggregate the disclosures and break news of potential congressional insider trading. It was Unusual Whales that first reported Mr. Pelosi’s Microsoft purchase last month, not traditional news outlets, because the information is difficult to obtain, and let’s face it, our news media isn’t very enterprising.

It was by design.

This year, Mrs. Pelosi has blocked several bills aimed at prohibiting lawmakers and their spouses from trading in corporate stocks from coming to the House floor for a vote.

Several House members tried to get an amendment from Reps. Abigail Spanberger, Virginia Democrat, and Chip Roy, Texas Republican, that required senators and representatives, their spouses and their dependent children to put stocks and other covered investments into blind trusts until after they are out of office attached to H.R. 1. It was denied.

As Sludge reports, “The Spanberger-Roy TRUST in Congress Act could still be considered as a stand-alone piece of legislation, but it has been referred to the House Administration Committee, which is the only other committee whose members are appointed directly by Pelosi.”

How convenient.

Mrs. Pelosi is not alone. Several members of Congress — both Republican and Democrat — were revealed to have bought or sold stock last February and March after receiving private briefings on the looming threat of coronavirus.

But Congress plays only by the rules they create — or chose to avoid. It’s unlikely, if ever, they’ll pass a bill limiting the fortunes they can amass while serving in public office.

• Kelly Sadler is commentary editor at The Washington Times.

Please read our comment policy before commenting.