OPINION:

Misery loves company, and so does mediocrity. President Biden is on the scout for other nations willing to share some of the tax pain he plans to inflict upon the American economy. Believing the hoary progressive myth that government can tax its way to prosperity, he is determined to prove it valid. But rather than going it alone, he wants the world’s peoples to lock arms and suffer in unison. They shouldn’t, and Americans ought to be embarrassed that the world’s most prosperous place would champion a competitive surrender.

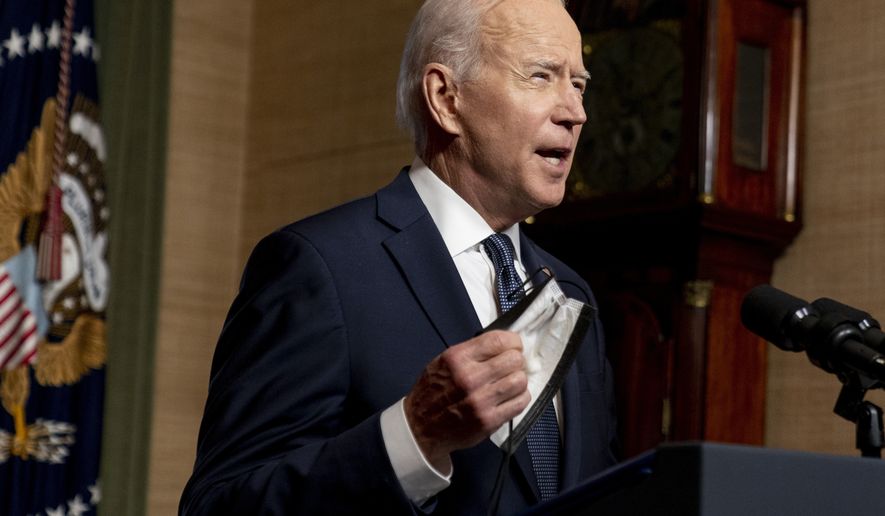

Mr. Biden needs mountains of cash to fund his $2.25 trillion infrastructure plan, and he proposes raising the corporate tax rate from the low, Trump-era level of 21% to a nearly world-record 28%. Facing stiff resistance from Republicans and even some Democrats, he signaled on Wednesday a willingness to negotiate a gentler increase.

The U.S. is already an also-ran among tax-friendly nations, ranking an unexceptional 21st on the Tax Foundation’s 2020 international index, behind such former members of the repressive Soviet bloc as Estonia and Latvia. Even Turkey, not exactly a paragon of economic liberty, ranks 10 spots ahead of the “land of the free.”

Hence, the Biden strategy to slow down the aggressive contenders. Treasury Secretary Janet Yellen launched an appeal on Monday for adoption of a 21% global minimum corporate tax. “Competitiveness is about more than how U.S.-headquartered companies fare against other companies in global merger and acquisition bids,” Ms. Yellen said. “It is about making sure that governments have stable tax systems that raise sufficient revenue to invest in essential public goods and respond to crises, and that all citizens fairly share the burden of financing government.”

In essence, Ms. Yellen urges a doubling of the existing tax rate on U.S. corporations that locate offshore from 10.5% to 21%. Through coordination with member nations of the G20 and European Union, the levy could effectively serve as a minimum tax around the globe. Calling a truce in the competition for economic dominance, goes the rationale, would mean nations need not fear that heavy tax burdens would result in the loss of businesses — and coveted tax revenue — because low-tax havens would disappear. Who says there is no honor among thieves, and revenuers?

Restraining tax competition is akin to trying not to lose by ensuring no one wins. It is hard to see how U.S. taxpayers would come out ahead when their government, which Republican Sen. Rand Paul of Kentucky writes in his annual “Festivus Report” wasted $54.7 billion in 2020 alone, is free to tax and spend shamelessly.

Until Mr. Biden proves to be a careful steward of the U.S. Treasury, Americans should rebuff his pleas for more money, and the world should refuse his invitation to join in economic mediocrity. It is not smart to synchronize with surrender.

Please read our comment policy before commenting.