The coronavirus crisis will reverberate for years, including hastening the depletion of Social Security’s trust fund and bringing ever closer the date when the venerable program will have to cut benefits, according to a new analysis Thursday.

The Penn Wharton Business Model, a project of the University of Pennsylvania, says COVID-19’s economic chaos will sap tax revenue, including the payroll taxes that sustain the trust fund.

At the same time, low interest rates will limit the income from money already sitting in the trust fund, the researchers said.

On the other side of the equation, the grim reality of 100,000 coronavirus deaths means fewer people collecting death benefits — but it’s nowhere near enough to make up for the lost money, the business model projects.

How bad it gets depends on how long the downturn lasts, the researchers said. A quick rebound — dubbed the V-shaped model — would be limited, while a slower recovery — the U-shaped model — would hasten the end of the trust fund faster.

“PWBM found that under their projected U-shape recession, the OASDI trust fund will run out four years earlier than anticipated, moving from 2036 to 2032. If the recovery is V-shaped, the depletion date moves two years earlier, from 2036 to 2034,” the researchers said.

The Bipartisan Policy Center has also crunched the numbers and figures that if the downturn is as bad as the Great Recession that followed the 2008 Wall Street collapse, Social Security could be even worse off.

“If we were to suffer a recession identical to the Great Recession again, Social Security’s trust fund would be gone in 2029,” BPC analyst Nicko Gladstone said. He detailed his findings on a podcast for the Concord Coalition, a venerable budget watchdog outfit.

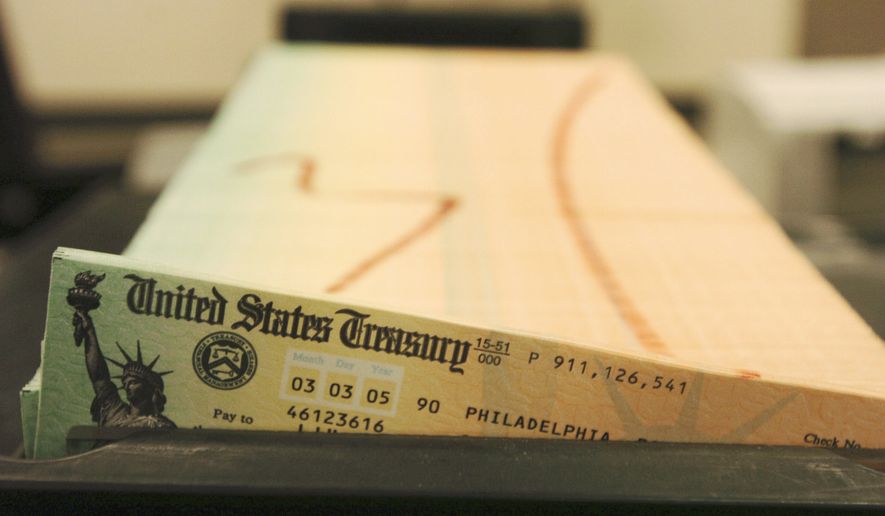

The trust fund is the pool of money built up over decades as payroll taxes outstripped yearly costs from Social Security.

But with the huge Baby Boom generation retiring, payroll taxes are no longer enough to cover those yearly costs, and Social Security has had to dip into the trust fund.

The depletion date is when the trust fund will no longer have money and Social Security will only be able to pay out benefits based on the case it has coming in through payroll taxes.

That doesn’t mean Social Security is bankrupt, exactly. But it does mean that, barring Congress stepping in and paying for the program with general revenue, the program will only be able to pay out based on what’s coming in each year.

Mr. Gladstone at the BPC said that would work out to a cut of 20% to 30% out of each check.

Social Security’s average monthly benefit right now is about $1,500.

“The biggest factor here is uncertainty,” Mr. Gladstone said. “How many people stay out of work for how long will depend on things like when we have a vaccine.”

The speculation about Social Security’s finances has yet to show up in the government’s bottom line.

The Treasury Department’s latest monthly statement showed the Federal Old-Age and Survivors Insurance Trust Fund, which is the chief Social Security trust fund, collected $85.3 billion in April. That’s slightly better than the $81.2 billion in the same month a year ago, and the steady rate contrasts with regular income tax receipts, which cratered.

Before coronavirus, Social Security’s trustees said the trust fund would run out in 2035. The Penn Wharton Business Model’s own calculations said it would probably be a year later, in 2036.

• Stephen Dinan can be reached at sdinan@washingtontimes.com.

Please read our comment policy before commenting.