OPINION:

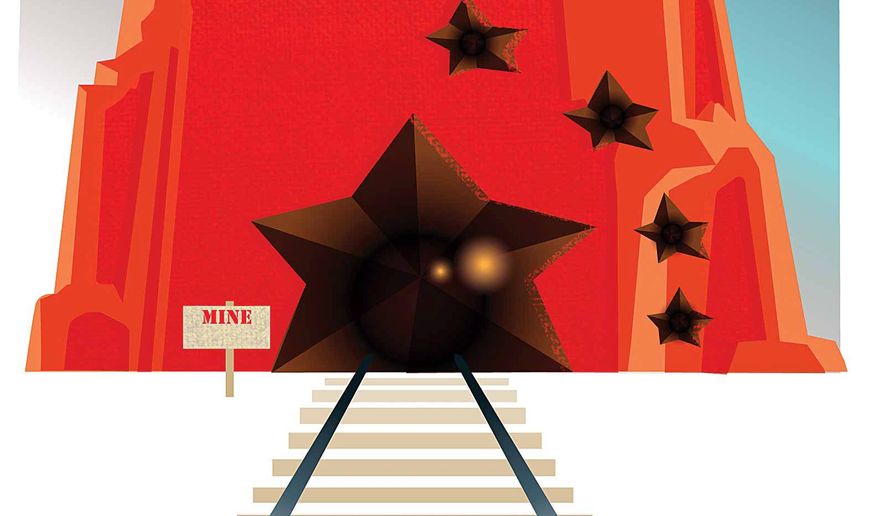

The Biden climate plan will accelerate zero emission vehicles to support a 100% clean energy economy by 2050, but currently, electric vehicles rely heavily on China’s industrial sector for high-tech metals.

American consumers are likely unfamiliar with how climate-friendly technologies like EV drive trains, batteries, solar panels and wind turbines depend on critical materials sourced or processed overseas, primarily from China.

The Biden administration will have to balance environmental concerns toward mining with the material resource demand for technology.

With five-fold growth expected for electric vehicle sales by 2025, the U.S. will increasingly need alternatives to China-mined materials for the EV supply chain. According to the U.S. Department of Energy, the U.S. imported $2.6 trillion of finished products in 2018,of which 50% contained rare earth elements, including $306 billion for the vehicle sector.

More than 90% of all battery electric vehicles and plug-in hybrids sold globally rely on permanent magnet motors. China is the world’s largest producer of these rare earth magnets.

A low carbon future will be mineral intensive and has already sparked a resource race worldwide, and even beyond the scope of this planet. In December, China successfully went to the moon and collected lunar rock samples for potential rare earth metals, the first retrieved since 1976.

The World Bank estimates the clean energy transition could increase demand for critical minerals globally, like lithium graphite and lithium, by nearly 500% by 2050 to deploy solar, wind, geothermal and energy storage.

Made in China 2025 is a state-led industrial policy to rapidly develop 10 high-tech China sectors, including energy-saving cars, new materials and electrical equipment. To support the effort, China’s “Belt and Road” initiative has monopolized new global corridors for the supply and distribution of critical minerals from Australia to Malaysia to Argentina to support its infrastructure needs.

China is also stockpiling rare earths and critical minerals for its own domestic use, as companies and governments face worldwide shortages in the supply chain. The country’s recently implemented Export Control Law is China’s latest effort to control the export of strategic commodities and to squeeze out an advantage over global technology manufacturers.

The OPEC oil embargo in the 1970s is a cautionary tale in the supply and demand of natural resources. Similarly, one nation controlling the supply of rare earth elements, from ground to gear, has exponential disruptive effects on nation economies transitioning to clean energy.

As the U.S. became energy independent from the Middle East in the oil and gas sectors, it also became resource dependent on China for advanced metals and minerals. With that comes mining, pollution and labor standards beyond our control.

China is one of the least eco-friendly countries — especially its rare earth mining industry, known for its non-sustainable and even dangerous extraction and refining techniques, as well as unsafe working conditions – causing pollution and illness both locally and globally, according to recent studies.

Our allies in the European Commission announced recent actions to make Europe’s raw material supplies more sustainable and secure for a green and digital economy. Europe will need up to 18 times more lithium by 2030 and 60 times more by 2050. The EU plans to diversify supply from other countries and develop their own capacity for the extraction, processing, and recycling of rare earths.

The U.S. took similar action this fall when President Trump issued an executive order addressing the threat and reliance on critical minerals from foreign adversaries. The president declared the “nation’s undue reliance on critical minerals in processed or unprocessed form from foreign adversaries” constitutes a national emergency.

The president directed the Department of Energy to clarify how renewable energy and advanced technology loan programs can support domestic critical minerals projects. This followed bipartisan legislation introduced in Congress to provide tax incentives to reshore a domestic supply chain for rare earths, and several rounds of grants by the Department of Defense and the Department of Energy for U.S.-based deposits and processing resources.

There are several rare earths projects currently in development and production in the U.S., Australia and Canada. These three countries have rigorous environmental and mining standards and potential for additional development of economically viable and resource-rich deposits.

However, the rest of the world lags decades and billions of dollars behind China in this race for natural resources supply and control. The Biden administration will need to address Chinese manipulation of the critical mineral supply chain across all aspects of U.S. policy, including domestic, economic, climate, trade and foreign policy.

The need is urgent. Critical minerals are the backbone of any economy reliant on manufacturing and technology, and it’s also paramount to U.S. national security and clean energy endeavors.

We must break free of our dependence on China as soon as possible. Doing so will take a broad bipartisan and industry-wide effort, featuring partnerships and innovative collaborations between governments and industry around the globe.

As President-Elect Joe Biden recommits the U.S. to the Paris agreement on his first day in office, his climate policy should be inclusive of a critical materials resilience strategy for the U.S. and its partners.

• Pini Althaus is CEO of New York City-based USA Rare Earth (www.usarareearth.com), the funder and operator of the Round Top Heavy Rare Earth and Critical Minerals Project in Hudspeth County, Texas, owner of the critical minerals processing plant in Wheat Ridge, Colo., and the neo magnet plant in North Carolina.

Please read our comment policy before commenting.