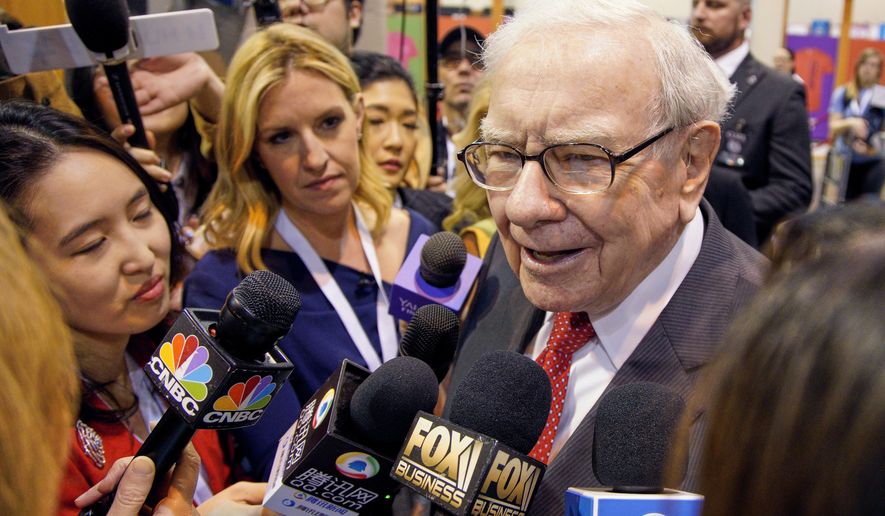

OMAHA, Neb. (AP) - The Latest on Berkshire Hathaway’s annual shareholders meeting where CEO Warren Buffett and Vice Chairman Charlie Munger answer questions for hours (all times local):

3:15 p.m.

Billionaire Warren Buffett says investors should all stick to areas they know when they are deciding what companies to invest in.

Buffett calls that concept your “circle of competence.”

Buffett says that over time he has expanded his circle a bit, but he has also found areas where he’s incompetent and shouldn’t be investing.

Buffett has famously avoided investing in most high-tech stocks over the years because he felt that he couldn’t reliably predict which firms would dominate in the future. But in recent years, Buffett’s Berkshire Hathaway has become a major shareholder in Apple.

He was speaking at the conglomerate’s annual meeting.

___

2:40 p.m.

Billionaire Warren Buffett says he doesn’t think people should worry about the jobs that will be lost to automation in the years ahead.

Buffett made his comments during Berkshire Hathaway’s annual shareholders meeting on Saturday.

He says the market system finds ways to create new jobs to replace ones that are lost. He compared it to the way technology like tractors and combines eliminated most jobs in agriculture over the past 200 years.

Buffett said: “This economy works. It continues to work.”

___

12:35 p.m.

Investor Warren Buffett says he’s happy with Berkshire Hathaway’s partnership with the Brazilian firm of 3G Capital.

The companies worked together to buy Kraft and Heinz, but recently the combined food giant had to write down the value of its brands by $15 billion.

Buffett said during Berkshire Hathaway’s annual meeting on Saturday that he would be open to working with 3G on additional deals in the future.

Buffett says the main problem with the Kraft investment is that Berkshire and 3G overpaid for it. And Buffett says he and 3G underestimated the challenges branded foods face from retailers and the growth of private label products.

___

11:50 a.m.

Berkshire Hathaway is holding more than $114 billion in cash and short-term investments, so shareholders are wondering even more than usual what Warren Buffett might buy for the conglomerate.

The company’s annual meeting is being held Saturday in Omaha. Buffett has said that he has had a hard time finding acquisitions selling for reasonable prices in recent years because the market has soared.

Shareholder Kim Sautter of Bellevue, Nebraska says she’ll be watching to see what Berkshire will invest in next.

___

11:30 a.m.

Berkshire Hathaway set up a booth in the exhibit hall at its annual meeting this year where shareholders can buy campaign buttons urging people to vote for either Chairman Warren Buffett or Vice Chairman Charlie Munger.

Buffett joked that the campaign was his answer to all the people who ask about his successor because he is 88 years old. But Munger at 95 would bring his own health concerns.

Buffett joked said he feels confident he’ll retain the chairman job because he appointed the people who will count the button sales.

___

9 a.m.

Thousands of Berkshire Hathaway shareholders return to Omaha every year to learn from Warren Buffett and celebrate the company he built through acquisitions and investments.

But with the 88-year-old Buffett and 95-year-old Charlie Munger leading the company it’s hard for shareholders not to wonder how much longer the revered investors will be in place. Neither has any plans to retire. The shareholder meeting is Saturday.

Shareholder Stephen Teenois made the trip to Omaha this year after owning the stock for several years because he wanted to experience the event with Buffett and Munger spending hours asking questions.

Teenois said he wants to “soak in everything I can and learn from him.”

Buffett has said that Berkshire has a succession plan in place for whenever it is needed.

Please read our comment policy before commenting.