OPINION:

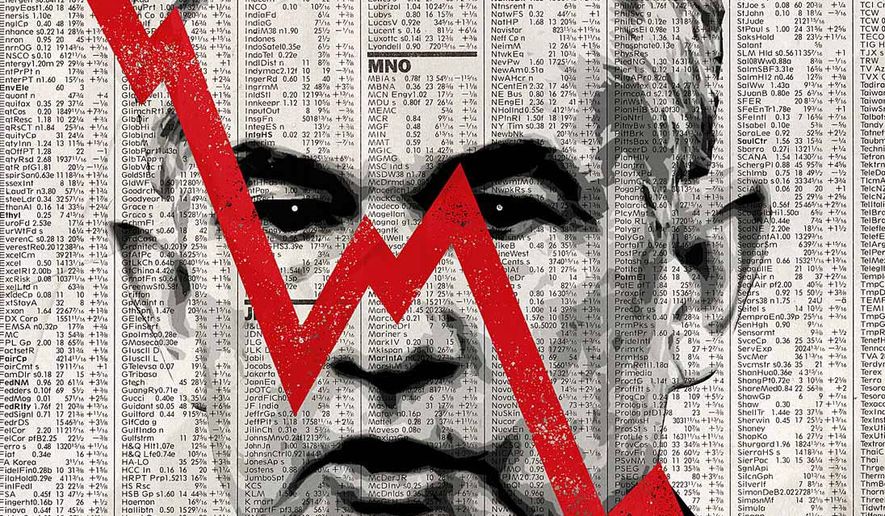

Nowadays recessions occur when policymakers do or say dumb things — the economy no longer has an internal clock akin to the changing of the seasons. Sadly, Fed Chairman Jerome Powell’s mishandling of monetary policy and the president’s tweets and other fits may be enough to send the economy tumbling.

Though I now support the construction of a border wall — it’s the only way to keep unauthorized visitors from setting foot on U.S. soil, applying for asylum and then slipping into the general population — President Trump doesn’t have the votes in Congress. His tweets and pointless government shutdowns offer financial markets the picture of an unstable and fitful leader.

All presidents have issues with the Federal Reserve — higher interest rates make wage gains and votes tougher to get — but other presidents made the most of their concerns known through private meetings. If anything, Mr. Trump’s public pressure compelled Mr. Powell to dig in his heels and deliver a December interest rate increase that financial markets made clear was badly conceived.

Similarly, the president’s inability to thoughtfully counter the liberal media’s constant drum beat that the tax cuts have the economy on a sugar high and his tariffs are harmful create the worst possible karma.

Sadly, all of this takes the spotlight off the incompetence at the Fed.

The economy can’t sustain the nearly 4 percent growth accomplished during the middle two quarters of last year. To do so would require annual labor productivity advances greater than 3 percent per year, and I have a better chance of playing shortstop for the Yankees.

With most of the unemployment in labor markets mopped up, growth is slowing to about 2.5 percent to 3 percent. This requires the right business spending — more aggressive application of artificial intelligence and increased spending on training for less-skilled workers and those with redundant skills or frivolous degrees in Peace Studies and Etruscan Art. So far, businesses have been doing those things.

It’s happening in places like Amazon warehouses and at Square Inc. — the folks who make those white gadgets that plug into smartphones to swipe credit cards — to deliver socks and small business loans more effectively and with fewer workers than Target and J.P. Morgan.

Still, the Fed economist remains fixated on the Phillips Curve, which says inflation should be rising now when it’s not, and the Fed must continue to push up interest rates into next year and other measures to tighten credit.

On the morning of Dec. 19, stocks were rallying. Then the Fed statement announced a quarter-point increase in the federal funds rate, it would likely raise that rate two more times this year and ultimately take it still higher. Stock prices immediately gave back the gains of the first few hours.

Later that day, Mr. Powell appeared not to know his own mind or much about economics. He indicated that the federal funds rate was already near its desired level, yet he let the policymaking committee issue the above noted statement.

Moreover, the Fed is selling off its portfolio of mortgage-backed securities, accumulated in the wake of the financial crisis to suppress mortgage rates and add liquidity to markets. At his afternoon press conference, Mr. Powell indicated that now relinquishing that portfolio had no consequences for financial market turbulence.

That’s the reasoning of sophomores —— the appellation derives from Greek words for wise and fool. How can adding liquidity affect financial markets positively when the Fed is buying mortgage-backed securities but not affect markets negatively when it is selling those?

I must have missed something during my education in economics that is taught at law school, where Mr. Powell got his training.

On his utterances, stocks tanked the afternoon of Dec. 19. If the market ever issued a vote of no-confidence to a Fed chairman that was it.

Most economists do not predict a recession anytime soon but observing this specter, nearly 50 percent of corporate finance chiefs see one beginning by the end of this year. CFOs are the folks — not my learned colleagues plying chalk to blackboard — who will evaluate the efficacy of pursuing new investment projects versus scaling back on business spending and hiring.

Tax cuts and deregulation have worked wonders for the Trump economy so far, but blunderbuss and incompetence are often more powerful than all the good intentions of mankind.

• Peter Morici is an economist and business professor at the University of Maryland, and a national columnist.

Please read our comment policy before commenting.