OPINION:

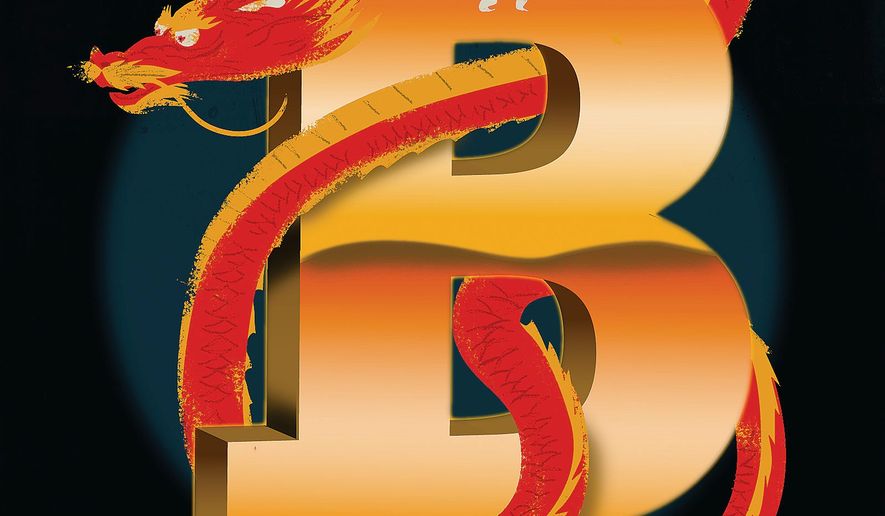

As the trade talks with China continue to develop — now with Treasury Secretary Steve Mnuchin heading to China — there is a lot on the table. One thing that won’t likely be discussed — but is important — is the head start that China has on cryptocurrencies. In fact, China has captured a majority control of the two largest cryptocurrencies in the world while the United States is still debating whether to have a real political and legislative debate on the issue at all. This despite the threat China’s dominance poses to our economic interests.

China is currently taking advantage of our inaction. The Chinese have seized a majority of cryptocurrency mining power, and used cheap electricity offered in Inner Mongolia to create mining farms and powerful mining companies such as Bitmain. These mining farms have been so successful that they have held over 50 percent of the Bitcoin mining power since 2015. From January 2015 to January 2018, Chinese control over the bitcoin hash rate grew from 42 percent to 77 percent.

The two cryptocurrencies that China seems most interested in, Bitcoin and Ether, are both mined using proof-of-work algorithms. Proof-of-work is a system in which miners are rewarded with coins for validating transactions in the blockchain. Since the validation of the network is done through a guessing-and-checking mechanism, the more mining power you have, the greater your chances are in getting the “solution” right and being rewarded in cryptocurrency.

Not only do mass amounts of mining power provide a financial motivation, but it also allows for the possibility of a 51 percent attack — where a group of miners — or sometimes just one — combine their mining resources to affect the approval of transactions, allowing them to double-spend coins. While this hasn’t happened yet, this majority ownership creates a real and potentially catastrophic vulnerability to the cryptocurrency market.

And, while the Chinese government’s hold on Bitcoin and Ether will likely go unnoticed during the trade talks, that doesn’t mean that it should be. It also doesn’t mean that politicians should continue sitting on their hands. Since we can’t tell China to stop taking advantage of our sluggishness, we need to take action — to incentivize crypto-entrepreneurs in the United States.

Congress could start by developing a framework for cryptocurrencies that defines tokens based on new asset classes. For instance, there is a debate right now whether or not utility tokens should be considered a security or not.

Unlike Bitcoin and Ether, utility tokens, a different type of digital asset, help provide services within a specific blockchain ledger — meaning that these tokens are the primary tool used by the job-creating business models leveraging block-chain technology. This newish innovation includes a variety of tokens like XRP, which helps banks and businesses make cheaper and faster transactions.

To provide greater clarity for investors and businesses thinking of adopting utility tokens, sensible regulatory guiderails should be developed to let the industry flourish. If we allow this regulatory purgatory to continue, we risk losing American companies to countries with clearer crypto frameworks; or worse, risk having U.S. businesses, such as New Jersey based “Basis,” shut down due to concerns its product would be deemed a security risk by the SEC.

The United States needs a deliberate and thoughtful framework that provides guidance for some of the more entrepreneurial startups. Many crypto startups are currently on the edge — and helping define that edge for them will allow them to make decisions now that won’t come back to hurt them. This adequate regulation will fuel entrepreneurs to develop their businesses in America — not flee to foreign shores in search of investments and regulatory clarity.

At this point in the development of crypto-markets it is hard to say that one coin, or one token, is the future. However, blockchains are here to stay, cryptocurrency markets continue to progress and tokens are being used to solve real world issues already. Add to that the fact that China has jumped out into the lead, and it is pretty clear that we should at least provide entrepreneurs enough regulatory certainty to make them comfortable when investing in the market.

Haphazard enforcement can be worse than bloated government. If we want to compete in this new market and compete with China, we need to move now.

• Charles Sauer is president of the Market Institute. He is the author of “Profit Motive: What Drives the Things We Do.”

Please read our comment policy before commenting.