Some White House officials are floating a possible temporary payroll tax cut to help prevent the economy from slowing, as the 2020 election approaches.

While discussions are said to be at an early stage, one White House ally said Monday that officials have discussed the use of revenue collected from tariffs on China to help offset a payroll tax cut or other forms of tax relief.

“There’s some talk of using the revenues from the tariffs to offset a tax cut,” said economist Stephen Moore, an informal adviser to the White House. “That’s one of the ideas, a reduction in the payroll tax rate.”

The Washington Post first reported on the discussions.

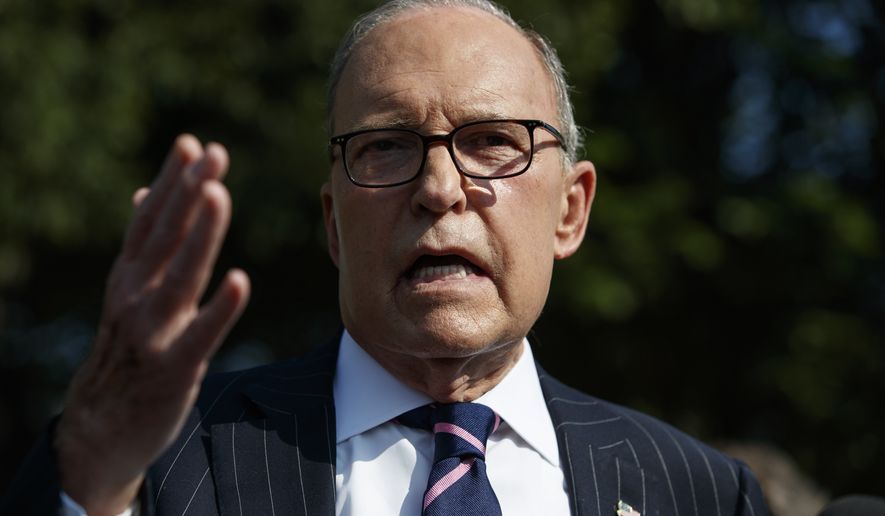

But a White House official noted that top White House economic adviser Larry Kudlow said Sunday that “more tax cuts for the American people are certainly on the table, but cutting payroll taxes is not something under consideration at this time.”

Workers pay a 6.2% payroll tax to fund Social Security programs. The tax was cut to 4.2% during the Obama administration to stimulate the economy, and returned to 6.2% in 2013.

Employees pay the tax only on income up to $132,900, making it one of the most regressive levies in the federal arsenal, hitting the less-well-off harder.

A new round of tax relief would be another boost for the economy, which has shown some signs of cooling off in the second quarter. Growth in the gross domestic product eased back to 2.1%, down from 3.1% in the first quarter.

President Trump on Monday said the U.S. economy “is very strong, despite the horrendous lack of vision by Jay Powell and the Fed.” He called on Mr. Powell, chairman of the Federal Reserve, to cut a key interest rate by 100 basis points, or a whole percentage point, “over a fairly short period of time” to boost growth.

“If that happened, our Economy would be even better, and the World Economy would be greatly and quickly enhanced-good for everyone!” Mr. Trump tweeted.

The Fed cut interest rates by one-quarter percentage point (25 basis points) last month, far short of Mr. Trump’s expectations.

The president also pointed Monday to political concerns about the economy and his reelection prospects.

“The Democrats are trying to ’will’ the Economy to be bad for purposes of the 2020 Election,” Mr. Trump said. “Very Selfish!”

Asked on Sunday whether he was prepared for a possible recession, Mr. Trump replied, “We can do a lot of things. But if it slowed down, it would be because I have to take on China and some other countries [on trade].”

The president added, “I don’t see a recession. We’re doing tremendously well. Our consumers are rich. I gave a tremendous tax cut [in 2017], and they’re loaded up with money. They’re buying.”

Government data showed that in July consumer spending, which accounts for about 70% of the overall economy, remained strong at retail stores and restaurants. The Commerce Department said retail sales rose a healthy 0.7%.

The payroll tax cuts during the Obama administration reduced tax revenue by about $100 billion annually. Mr. Moore said part of the difficulty is that “a payroll tax cut is really expensive.”

“There’s 150 million workers who pay the tax,” said Mr. Moore, who also is a columnist at The Washington Times. “If the tariffs are raising about $30 [billion] or $40 billion a year, you wouldn’t get a very big payroll tax with that kind of money. It’s just too little.”

He said the early talk of a potential payroll tax cut is “a defensive measure.”

“I don’t think anybody knows where they’re headed right now, but there is some talk of another tax cut,” he said. “I’m not so sure they need to do that. I think the economy’s pretty strong. People are a little bit worried about a slowdown because of the trade war, and it might make sense to use the tariff money from the Chinese to offset some other tax cut.”

• Dave Boyer can be reached at dboyer@washingtontimes.com.

Please read our comment policy before commenting.