WASHINGTON (AP) - President Donald Trump’s efforts to reshape the Federal Reserve stumbled on Monday, with one of his potential nominees for the Fed’s board withdrawing from consideration and another being enveloped by fresh doubts.

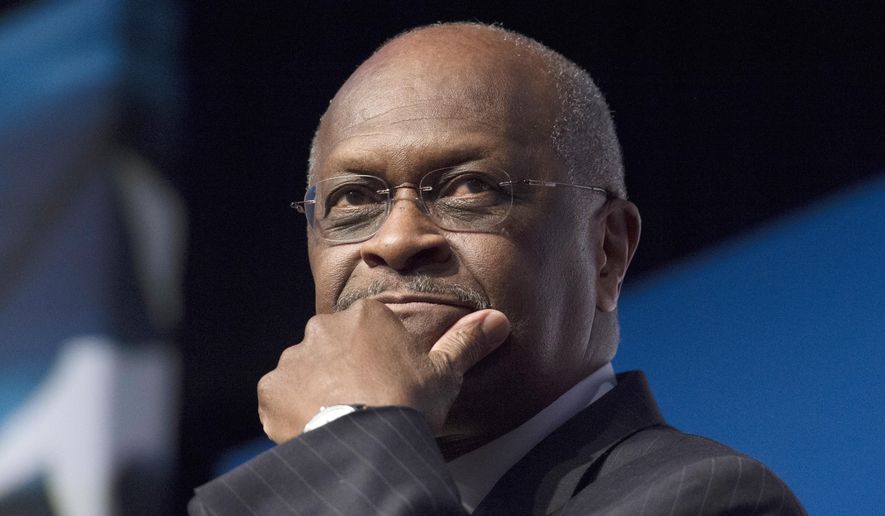

Herman Cain, a former CEO of Godfather’s Pizza, asked to be taken out of the running for an influential post at the U.S. central bank, Trump tweeted. Cain had dropped out of the 2012 presidential race after facing allegations of sexual harassment and infidelity - issues that resurfaced after Trump said earlier this month that he planned to nominate Cain for the Fed.

Trump tweeted that “My friend Herman Cain, a truly wonderful man, has asked me not to nominate him for a seat on the Federal Reserve Board. I will respect his wishes.”

Separately, CNN on Monday unearthed opinion columns that Trump’s other pick for a Fed board vacancy, conservative commentator Stephen Moore, wrote in the early 2000s. Among the opinions Moore asserted in those columns was that women should be barred from refereeing, announcing or even selling beer at men’s college basketball games. Those writings appeared on the conservative National Review website.

Moore told CNN that the articles were “a spoof.”

“I have a sense of humor,” he added.

Cain’s nomination had already appeared doomed after four Republican senators said earlier this month that they wouldn’t vote to confirm him if he were nominated. Republicans hold just a three-seat majority in the Senate, so the opposition of those senators, on top of unified Democratic opposition, made Cain’s prospects appear impossible. Senate Majority Leader Mitch McConnell declined to say two weeks ago whether the chamber would confirm Cain.

Several other controversies have also dogged Moore. A lien of more than $75,000 was filed against him in January 2018 for unpaid taxes. Reports have also indicated that he has fallen behind on alimony and child support payments to his ex-wife.

The CNN report Monday also noted that Moore once wrote, “Is there no area in life where men can take vacation from women?”

On top of that, both Cain and Moore have faced widespread criticism that they are unqualified for a critically important role on the world’s most influential central bank and that Trump chose them mainly for their allegiance to him and his priorities.

On Monday, Senate Democratic Leader Chuck Schumer warned the Republicans against using Cain’s withdrawal as a “pathway” to approval of Moore, calling him “equally unqualified and perhaps more political.”

“Mr. Moore, like Mr. Cain, poses a danger to the economic stability of our country,” Schumer, D-N.Y., said in a statement. “Mr. Cain clearly saw the writing on the wall and withdrew his name from consideration; hopefully Senate Republicans will again voice their deep concerns and force Mr. Moore to do the same.”

Carl Tannenbaum, chief economist at Northern Trust and a former Fed official, said Moore “has been overly partisan” in his comments about the Fed. Moore has lavished praise on Trump’s tax cut policies and has accused Chairman Jerome Powell of undercutting the economy with interest rate hikes.

Those criticisms “don’t sit well, certainly with people inside the Fed, and with the financial markets,” Tannenbaum said. “The Fed’s culture is consensus-driven and apolitical.”

Indeed, Trump’s picks of Cain and Moore have sparked worries about the Fed’s ability to remain politically independent. Last fall, Cain co-founded a pro-Trump super political action committee, America Fighting Back PAC. It features a photo of the president on its website and says, “We must protect Donald Trump and his agenda from impeachment.”

“There were so many things about (Cain) that were red flags,” including his lack of understanding of monetary policy, said Diane Swonk, chief economist at Grant Thornton and longtime Fed watcher. Cain has served on the board of the Federal Reserve Bank of Kansas City but didn’t participate in any interest rate decisions in that position.

The potential nominations surfaced after Trump spent months attacking Powell, his own pick to lead the Fed, and other Fed officials for raising rates four times last year. Trump has contended that those rate hikes hurt the stock market and were unnecessary because there was no inflation threat.

At a meeting in March, Fed policymakers indicated that they expected to keep rates unchanged this year, a sharp change from December, when they suggested that they would lift short-term rates twice more this year.

The Fed board, along with presidents of the Fed’s regional banks, plays a critical role in the U.S. economy, holding meetings to debate and vote on whether to raise their benchmark interest rate. That rate, in turn, affects everything from mortgage rates to the interest rate on auto loans and the interest paid on savings accounts. The Fed typically increases its benchmark rate when it worries inflation is about to accelerate, or cuts it to accelerate growth.

Like Moore and Trump himself, Cain has criticized the central bank’s policies. In a 2012 Wall Street Journal column, Cain argued that the Fed’s low rate policies had distorted the value of the dollar. He advocated a return to the gold standard as a way to control inflation, a position that most economists disagree with. Many economic historians argue that the gold standard, which fixes the dollar’s value to a specific amount of gold, worsened the Great Depression.

Before leaving the presidential race, Cain had proposed a “9-9-9” tax plan that called for replacing the current tax system with a flat 9 percent business and individual income tax, and a 9 percent sales tax.

__

AP Writers Martin Crutsinger and Marcy Gordon contributed to this report.

Please read our comment policy before commenting.